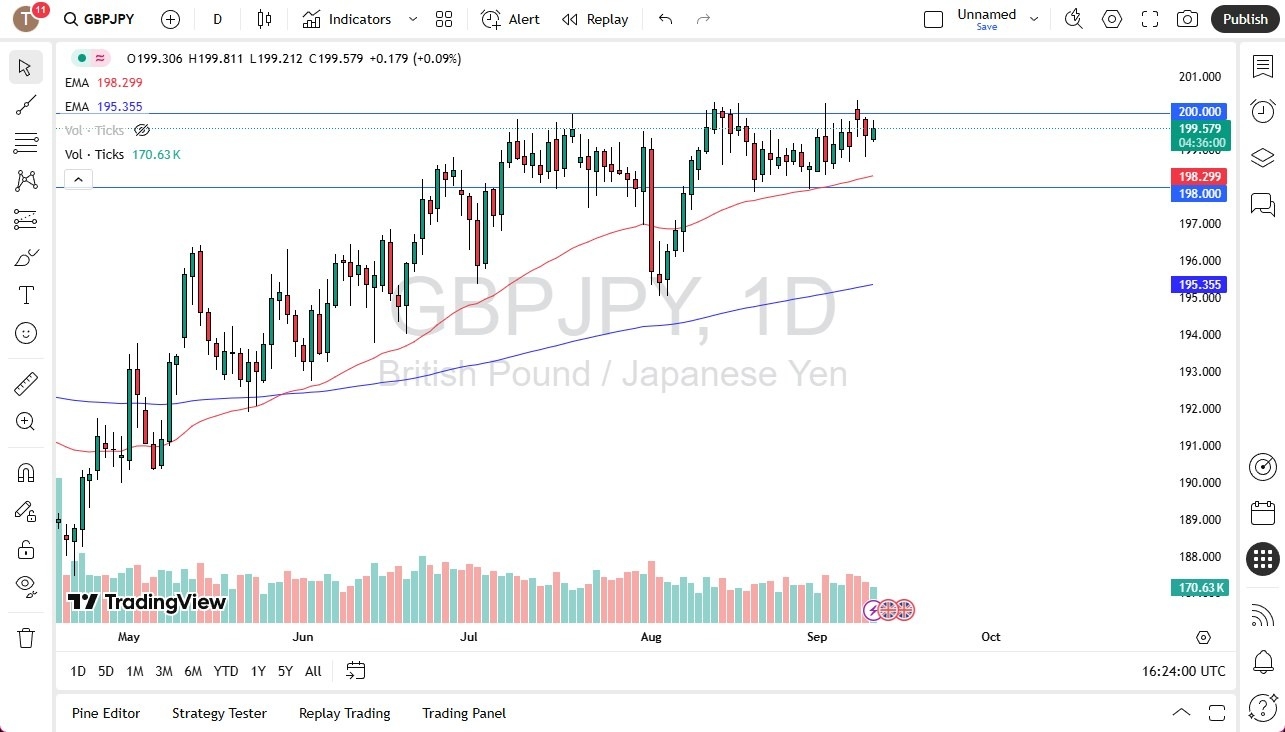

- The British pound has rallied a bit against the Japanese yen during the trading session here on Wednesday, but we still see the same massive barrier above causing headaches.

- That of course would be the area right around the 200 yen level.

- And really at this point, it seems like it's going to be a bit of a brick wall.

Nonetheless, this is a market where you can trade through the prism of buying dips, at least at this point. It looks as if the 198 yen level underneath will continue to be support, especially now that the 50 day EMA sits there. If we can break above the 200 yen level on a daily close at least significantly, maybe by 50 pips or so, then I think that would be an extraordinarily bullish sign.

Top Forex Brokers

However, there are lot of concerns out there about risk appetite, and that ends up being the case this pair might suffer. A breakdown below the 198 yen level in that environment would be very bearish because when you zoom out on the chart from a longer term standpoint, you can see that the 200 yen level has been very important, going back roughly a year and a half. And if you really zoom out, then you can see that it's been that way a couple of times in the past.

At the Moment, I Still Like Longs

All things being equal, this is a market that I do like buying though, because the interest rate differential does favor the British pound over the Japanese yen, pretty much anything will pay you more interest than the Japanese yen. And you do get paid to wait. But again, if we were to break down below the 198 yen level, then I think we've got a problem.

I think at the very least you'd be looking at a move down to the 200 day EMA, which is sitting right around the 195.35 level. Watch risk appetite. Watch stock markets around the world. They'll give you a heads up as to how this pair may behave.

Begin trading our daily forecasts and analysis. Here is a list of Forex brokers in Japan to work with.