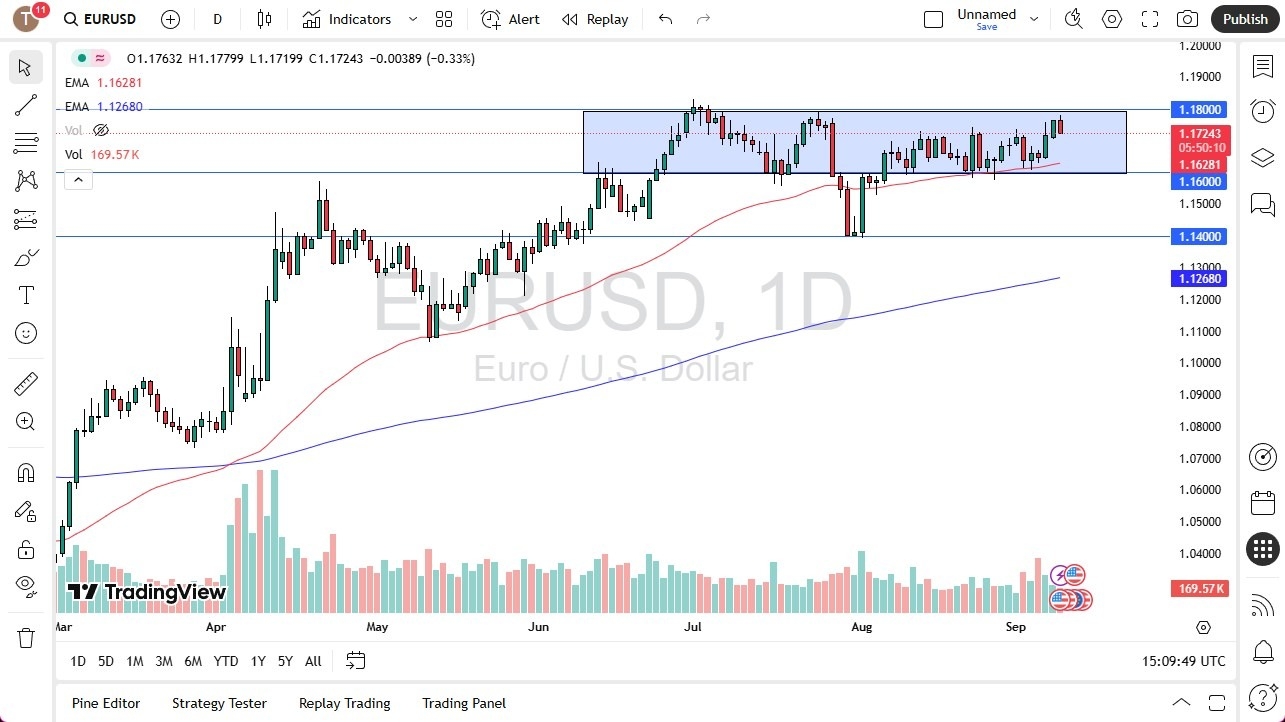

- The euro initially did try to rally during the trading session on Tuesday, but the 1.18 level continues to be a major barrier.

- This is an area where we've seen a couple of attempts at a breakout, and we have failed for the third time. That's not a huge surprise.

- The ECB has a meeting on Thursday and then next week we have the Federal Reserve, so there's a lot of news coming in the next handful of sessions.

Knock On Effects

Top Regulated Brokers

The reality is though, that there is an old expression “When the US sneezes, the rest of the world catches a cold.” With the jobs number in the United States falling to really minimal numbers and in fact, almost negative, then you've got a situation where you have to ask questions about the rest of the global economy. After all, if one quarter of the world's economy isn't going to be buying the rest of the world's things, then clearly there is a contagion effect that plays out. Every time we get one of these economic cycles, I start to hear about the death of the US dollar, the death of the US dollar as the world's reserve currency, and the fall of the American empire. It's happened multiple times in the last 20 years that I can think of right away.

However, an example would be the great financial crisis when most of it was based in the United States. It turns out everybody else got hammered. Initially, you saw the US dollar sell off and then you saw the US dollar rally. Why is that? That's because of the US treasury market. You have to have US dollars to hide your money there.

Most retail traders make the mistake of thinking “Why would I want the US dollar?” Because the economy is weak. But what they're not paying attention to is those who move the market, which are not retail traders, have to move billions of dollars. There's very few places where you can shove billions of dollars at the click of a button and not worry about imploding the market against you. One of those few places, perhaps the only place, is the US treasury market. So that will drive up demand for dollars.

Demand for Dollars

I do think this happens. Now, I don't know that it is happening right now, but we might be seeing the first signs of a top in the Euro. The next week or so will be crucial, but as things stand right now, the technical analysis suggests that the 1.18 level will be very difficult to overcome, and the 50-day EMA, as well as the 1.16 level underneath, could be supported. I think at this point, we're still range bound. This chart tells us that the euro isn't quite ready to break out. The press conference and the statement on Thursday from the European Central Bank could very well dictate where this currency goes next, mainly due to the fact that we already know that the Federal Reserve is going to cut rates. It'll be interesting to see how the Fed looks at things and whether or not they're going to start a rate cutting cycle. But historically speaking, when that happens, the dollar gets stronger.

After an initial sell-off, we may have already seen the sell-off because the euro in February was at 1.02 and here we are 16 handles higher. Once people start to worry about the global economy, suddenly the US dollar gets attractive. So do be aware of that. If we were to break out of this range, it's a 200 point move just waiting to happen. So, 200 pips from the break of the top has a measured move of about 1.20. If we break down below 1.16, then 1.14 might be revisited, something that we saw at the beginning of August anyways, and an area that's already proven itself to be important.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex demo accounts worth trading with.