EUR/USD Analysis Summary Today

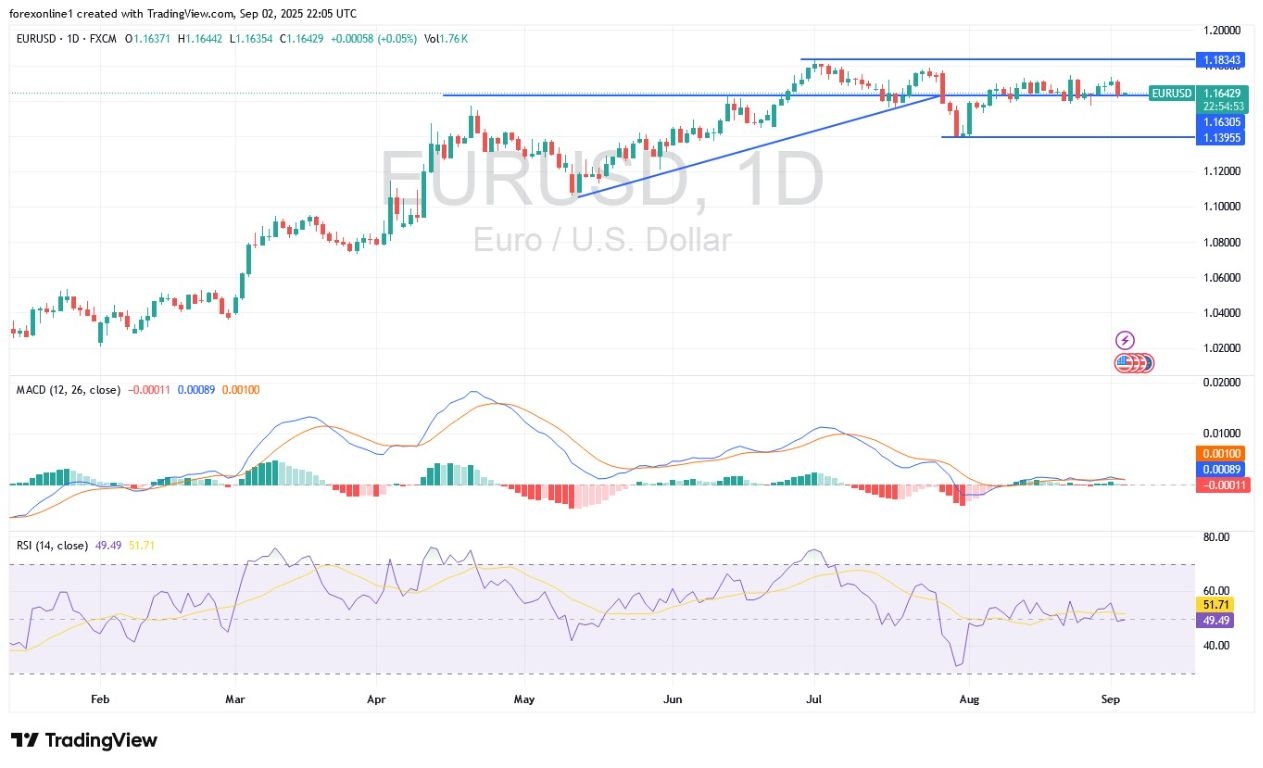

- Overall Trend: Neutral with a downward bias.

- Today's Support Levels: 1.1600 – 1.1550 – 1.1470.

- Today's Resistance Levels: 1.1700 – 1.1770 -1.1830.

EUR/USD Trading Signals:

- Buy EUR/USD from the 1.1540 support level, with a target of 1.1800 and a stop-loss at 1.1500.

- Sell EUR/USD from the 1.1770 resistance level, with a target of 1.1600 and a stop-loss at 1.1820.

Technical Analysis of EUR/USD Today:

For two consecutive days, the EUR/USD pair has resumed its downward correction after failing to maintain its recent upward bounce, which had reached the 1.1736 resistance level. The selling pressure on EUR/USD has brought it close to the psychological support of 1.1600. According to trading platforms, the euro's decline has coincided with a downturn in global bonds, as European bond yields are rising sharply, which is weighing on the euro.

Top Regulated Brokers

What's Happening in the Global Bond Market?

Global bond and stock markets are declining as investors express concern over the buildup of global government debt and slowing economic growth dynamics. The US dollar is rising amid this risk-off sentiment, performing its role as a safe-haven asset amid growing global concerns. According to market experts, traders are de-risking, and global interest rates are rising sharply as investors sell long-term financial instruments this morning, which suggests that a relatively quiet summer in the financial markets is about to end.

In general, the focus is on long-term bonds, specifically 30-year bonds. Clearly, these bonds are not supported by the central bank's interest rate cuts in the same way that 2-year bonds are. This makes them particularly sensitive to investor sentiment regarding inflation and debt sustainability.

Will the EUR/USD break its bullish outlook?

Based on the EUR/USD's performance at the 1.1600 support threshold, the RSI on the daily chart has moved below a reading of 50, which gives the bears an opportunity to push the price lower. At the same time, the MACD is steadily trending downward. Increased European political concern and stronger-than-expected US jobs data could give the bears an opportunity to move toward the next key support levels of 1.1570 and 1.1490.

Conversely, a stable EUR/USD bullish scenario would see bulls move towards the resistance levels of 1.1720 and 1.1800, respectively. Today's EUR/USD trading will be affected by new statements from European Central Bank Governor Christine Lagarde at 10:30 AM Cairo time, followed by the German services PMI at 11:00 AM Cairo time, along with the same reading for the eurozone as a whole. On the US dollar side, the US jobs report will be released at 5:00 PM Cairo time.

This negatively impacted investor sentiment toward the euro, as French and German 30-year bond yields reached levels not seen since 2011, during the eurozone sovereign debt crisis. Germany's medium-term financing plan forecasts net new borrowing of approximately €500 billion through 2029 to finance increased spending on infrastructure and defense. In France, concerns about the country's debt burden are a major factor behind the confidence vote in the prime minister scheduled for next week.

Meanwhile, euro area inflation accelerated to 2.1% in August, slightly surpassing both market expectations and the ECB's 2% target. This strengthens the expectation that the central bank will keep interest rates unchanged at next week's meeting.

Trading Tips:

Traders are advised to wait for a potential renewal of EUR/USD gains to consider selling again, but without taking on risk, and to monitor the factors affecting currency prices.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex trading platforms for beginners worth trading with.