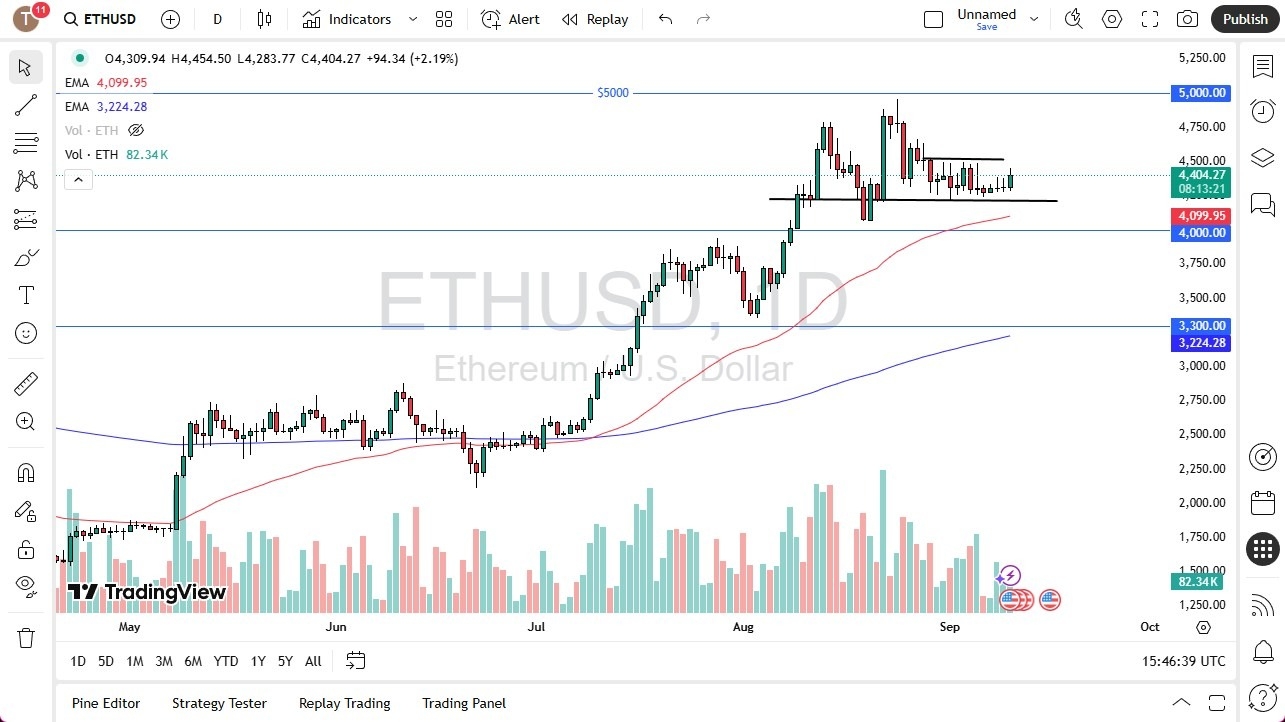

Potential signal:

- On a move above $4500, I will be buying Ethereum with a stop loss at $4300, and a target of $4900.

Ethereum has rallied quite nicely during the trading session on Wednesday, as we continue to see a lot of noisy behavior. The $4200 level below is significant support, and at this point in time I think that the $4500 level offer significant resistance. Ultimately, Ethereum has to see bullish pressure and crypto in general, most notably Bitcoin, in order to continue going higher. Ultimately, this is a market that probably continues to see a lot of volatility, but if Bitcoin can take off to the upside, it’s worth noting that the Wednesday session was rather strong, so therefore we might see a little bit of momentum if this keeps up.

Top Regulated Brokers

A Couple of Ranges

We actually have a couple of different ranges that we will be watching, with the initial one being the one previously mentioned between $4200 and $4500. However, we also have a bigger range, perhaps something that could be thought of as a “outer range” with the $4000 level offering support, and the $5000 level offering significant resistance. Ultimately, this is a market that continues to see a lot of volatility and external pressures, but in general, I think this is a market that is a longer-term bullish, and therefore I think short-term pullbacks will continue to attract a certain amount of attention. Ultimately, I think that we go looking to the $5000 level, then if we can break above there, things really get aggressive.

That being said, I think the inner range probably holds for the time being, with perhaps a little bit of a more bullish bias than negative. This being said, the market is likely to continue to see a lot of choppy and volatile movement, but I also recognize that the longer-term trend still is very positive, and we are nowhere near trying to break through a significant support level that would have me concerned.

Ready to trade Ethereum? Here are the best MT4 crypto brokers to choose from.