Long Trade Idea

Enter your long position between $121.33 (the upper band of its horizontal support zone) and $123.45 (Friday’s intra-day high).

Market Index Analysis

- Duke Energy (DUK) is a member of the S&P 100 and the S&P 500 indices.

- Both indices remain near record highs, but breakdown signals have risen.

- The Bull Bear Power Indicator for the S&P 500 shows a negative divergence and does not confirm the uptrend.

Market Sentiment Analysis

Equity futures suggest a positive opening following Friday’s positive close but bearish week. Investors await the outcome of a looming government shutdown, which has become part of the political drama over the past decade. It usually ends in a last-second deal or a short shutdown. As AI appears to form a bubble with a projected near-trillion-dollar revenue shortfall, some analysts suggest high valuation could represent the new norm. Still, with over 95% of AI projects failing, and most companies accruing AI debt, markets swim in dangerous waters.

Duke Energy Fundamental Analysis

Duke Energy (DUK) operates seven nuclear facilities, amid a diverse mix of other power plants. Its service territory covers 104,000 square miles with 250,200 miles of distribution lines, serving over seven million customers. Its nuclear power generation remains concentrated in North and South Carolina, and DUK maintains 58,200 megawatts of base load and peak generation.

So, why am I bullish on DUK following its breakout?

Reasonable valuations and the promising outlook for data center energy demand make this nuclear power play an appealing long-term addition with a decent dividend yield. Duke Energy has excellent gross margins, and the board reshuffling promises to result in revenue-positive decision making. I also like the modernization of its nuclear power plants by integrating advanced monitoring systems to enhance operational efficiency and safety.

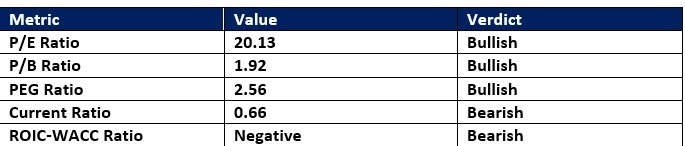

Duke Energy Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 20.13 makes DUK an inexpensive stock. By comparison, the P/E ratio for the S&P 500 is 29.53.

The average analyst price target for DUK is $131.25. It suggests moderate upside potential, with decreasing downside risks.

Duke Energy Technical Analysis

Today’s DUK Signal

Duke Energy Price Chart

- The DUK D1 chart shows price action breaking out above its horizontal support zone.

- It also shows price action below its ascending Fibonacci Retracement Fan.

- The Bull Bear Power Indicator turned bullish with an ascending support level.

- The average bullish trading volumes are higher than the average bearish trading volumes during the breakout week.

- DUK failed to match the record highs of the S&P 500, a bearish signal, but its recent breakout could lead to more upside.

My Call on Duke Energy

I am taking a long position in DUK between $121.33 and $123.45. I am buying the defensive capabilities of Duke Energy during a downturn, and into the latest board reshuffling, which I believe can unlock value as the data center boom accelerates.

- DUK Entry Level: Between $121.33 and $123.45

- DUK Take Profit: Between $131.25 and $133.88

- DUK Stop Loss: Between $117.45 and $118.90

- Risk/Reward Ratio: 2.56

Ready to trade our daily stock signals? Here is our list of the best stock brokers worth reviewing.