Long Trade Idea

Enter long short position between 74.21 (the lower band of its horizontal resistance zone) and 75.94 (the upper band of its horizontal resistance zone).

Market Index Analysis

- DexCom (DXCM) is a member of the NASDAQ 100 and the S&P 500.

- Both indices trade near records, with mounting concerns about the health of this bull cycle.

- The Bull Bear Power Indicator of the NASDAQ 100 is bearish with a descending trendline.

Market Sentiment Analysis

Legal drama over President Trump’s tariffs and concerns over the independence of the Federal Reserve will weigh on this week’s sentiment, as investors await Friday’s NFP report. After four months of gains, equity markets enter September, historically the weakest month for bulls. US manufacturing data is due for release today, expected to show contraction and rising prices. Volatility could accelerate amid lower trading volumes as investors rethink portfolios.

DexCom Fundamental Analysis

DexCom is a leader in continuous glucose monitoring (CGM). Its G7 device is the most accurate CGM approved in the US, and DexCom is at the core of the MAHA (Make America Healthy Again) movement.

So, why am I bullish on DXCM after its correction?

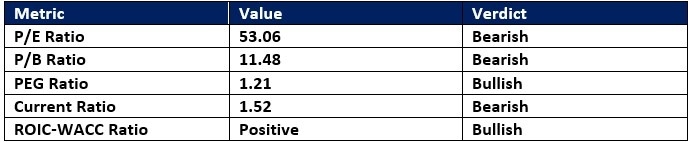

The correction eliminated some of the excessive bullishness. It also created a scenario where DXCM has over 30% upside potential. The returns on assets, equity, and invested capital rank among the best in its sector, and DexCom has healthy profit margins. Risks remain to the affordability of G7 to potentially millions of customers amid planned cuts to Medicare, which the sell-off reflected. Finally, the PEG ratio suggests more value ahead.

DexCom Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 53.06 makes DXCM an expensive stock. By comparison, the P/E ratio for the NASDAQ 100 is 33.88.

The average analyst price target for DXCM is 102.08. It suggests 30%+ upside potential with manageable downside risks.

DexCom Technical Analysis

Today’s DXCM Signal

- The DXCM D1 chart shows a price action inside its horizontal support zone.

- It also shows price action between its descending 0.0% and 38.2% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator is bearish with an ascending trendline.

- The average bearish trading volumes show signs of a capitulation sell-off, which often precedes a price action reversal.

- DXCM corrected as the NASDAQ 100 moved higher, a bearish trading signal, but bullish factors are rising.

Top Regulated Brokers

My Call on DexCom

I am taking a long position in DXCM between 74.21 and 75.94. The PEG confirms more upside potential, DexCom has a profit potential of over 30% from current levels, and excellent returns on assets, equity, and invested capital. I am buying the support zone.

- DXCM Entry Level: Between 74.21 and 75.94

- DXCM Take Profit: Between 87.00 and 89.96

- DXCM Stop Loss: Between 69.70 and 71.71

- Risk/Reward Ratio: 2.84

Ready to trade our free daily signals? Here is our list of the best brokers for trading worth checking out.