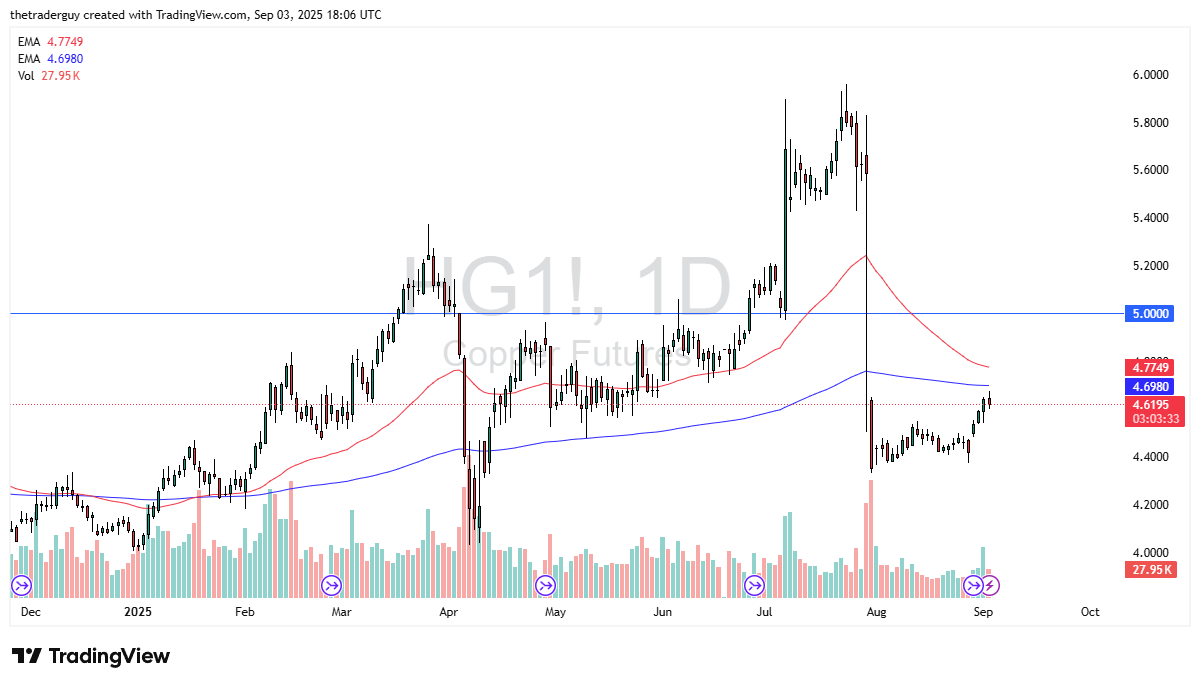

- Copper initially tried to rally a bit during the trading session here on Wednesday, but it did give back some of the gains.

- Now it's interesting to see how this has played out because copper is a very important market for people to watch as far as risk appetite and global growth is concerned.

- We have this massive gap from the end of July where Trump had come out and said that he was putting tariffs on finished copper products and that caused chaos and in fact we had copper shut down a couple of times during that session. I remember that very well.

We have since gone sideways and then started to rally with a little bit of volume here in the last couple of days as Chinese economic numbers have gotten a little bit better.

Top Forex Brokers

Interest Rate Cuts?

There are interest rate cuts out there that people will be paying close attention to. The interest rates being cut does, at least in theory, suggest that we could see a bit of explosion in construction. The Chinese growth situation also lends itself to be a scenario where it is a play on the overall global growth as Chinese companies will demand more copper to make hard assets. Furthermore, construction in China typically gets boosted as well. And we could see copper really take off to the upside.

The 200 day EMA sits just above and if we can break above that level, then the $5 level could be targeted eventually. This would be a big move in copper. And I do think that we are in the process of trying to form some type of bottoming pattern. If the market falls from here, then you're looking at a move to possibly the $4.40 level where support could come back into the picture. Even if you don't trade copper, this is a great market to watch to get an idea as to how things are going to go from a risk appetite perspective in general.

Ready to trade our Forex daily forecast? We’ve shortlisted the best forex broker list for you to check out.