Long Trade Idea

Enter your long position between $46.14 (the lower band of its horizontal support zone) and $47.38 (the upper band of its horizontal support zone).

Market Index Analysis

- Copart (CPRT) is a member of the NASDAQ 100 and S&P 500.

- Both indices hover near all-time highs with contracting trading volumes.

- The Bull Bear Power Indicator for the NASDAQ 100 shows a negative divergence and does not confirm the uptrend.

Market Sentiment Analysis

Equity futures traded in and out of positive territory ahead of today’s FOMC announcement, where expectations call for a 25-basis point interest rate cut. Equity markets move higher based on that assumption, but the bigger question is what will follow. June’s Dot-Plot Chart showed consensus for two interest rate reductions in the second half of 2025, but will the Fed stick to it amid inflation concerns, or will it cave to pressure from the White House? Volatility is likely to surge if the Fed statement disappoints investors.

Top Regulated Brokers

Copart Fundamental Analysis

Copart is an online auction platform for the automobile sector. It holds weekly and bi-weekly auctions for consumers and automotive companies. It is active in eleven countries, enabling buyers to purchase clean-title vehicles through its patented virtual auction technology (VB3).

So, why am I bullish on CPRT following its sell-off?

Tariffs on the automotive sector were less than feared, and the pending interest rate cut will benefit the customer base of Copart, one of the biggest beneficiaries of lower interest rates. Copart also has an ideal business model during this tariff uncertainty, as consumers may focus on used cars already in the country, unaffected by the tariffs. I am buying the free cash flow generation of CPRT, and bank on its sound operational statistics.

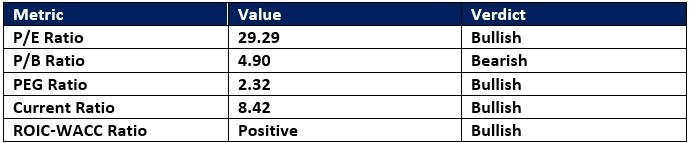

Copart Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 29.29 makes CPRT an inexpensive stock. By comparison, the P/E ratio for the NASDAQ 100 is 38.56.

The average analyst price target for CPRT is 56.62. It suggests reasonable upside potential with limited downside risks.

Copart Technical Analysis

Today’s CPRT Signal

Copart Price Chart

- The CPRT D1 chart shows price action inside its horizontal support zone.

- It also shows price action breaking down below its ascending Fibonacci Retracement Fan.

- The Bull Bear Power Indicator is bearish, but close to its ascending trendline.

- The average bullish trading volumes during positive sessions are higher than the average bearish trading volumes.

- CPRT corrected as the NASDAQ 100 pushed higher, a bearish trading signal, but bullish catalysts have accumulated.

My Call on Copart

I am taking a long position in CPRT between $46.14 and $47.38. Valuations are low, CPRT is a free cash flow machine, and the pending interest rate cut will boost its business outlook. I am buying the dip, as I foresee a price action reversal.

- CPRT Entry Level: Between $46.14 and $47.38

- CPRT Take Profit: Between $58.07 and $60.69

- CPRT Stop Loss: Between $42.82 and $44.15

- Risk/Reward Ratio: 3.59

Ready to trade our daily signals on stocks? Here is our list of the best brokers for trading worth reviewing.