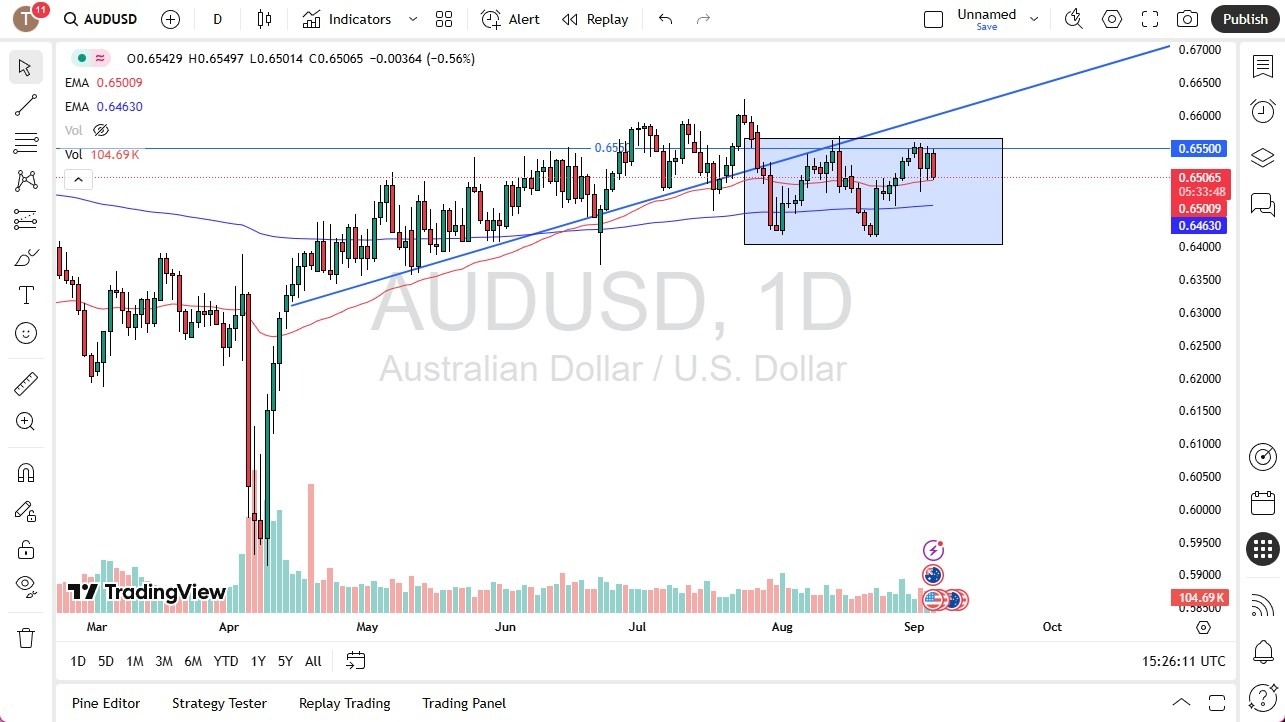

- The Australian dollar fell rather significantly during the Thursday trading session as we continue to see a lot of noisy trading overall.

- We are at the top of a larger consolidation area that has been important for several weeks, and now that we have pulled back from the high part of the consolidation area, I think it suggests that the market just simply isn’t ready to make a big move yet.

Australian Dollar Remains Suspect

Top Regulated Brokers

The Australian dollar has remains suspect for some time, because over the last several months, we had seen the US dollar fall rather precipitously against multiple currencies, and although the Australian dollar did rally a bit against the US dollar, it was very muted in comparison to other currency such as the Euro or the British pound. In other words, even when it was gaining against the US dollar, the Australian dollar was weaker than many of his contemporaries.

It’s through that prism that I look at any potential US dollar strength as a potential anchor around the neck of the Australian dollar. If the market were to break down below the 50 Day EMA, then we could drop to the 200 Day EMA. After that, then you would be looking at the 0.64 level, which happens to be the bottom of the consolidation area that we have been in. If the market were to break down below there, the Aussie will more likely than not collapse. I would also expect to see other currencies fall, but you might get more momentum here.

As far as the upside, a break above 0.6550 seems very difficult at the moment. Any move there would have traders looking at 0.66, which leaping above there then opens a bigger move, albeit somewhat unlikely if the action over the last few months is any indication. Quite frankly, in that environment you probably get more traction going long EUR/USD or another pair like it.

Ready to trade our Forex AUD/USD analysis and predictions? Check out the best forex trading platform Australia worth using.