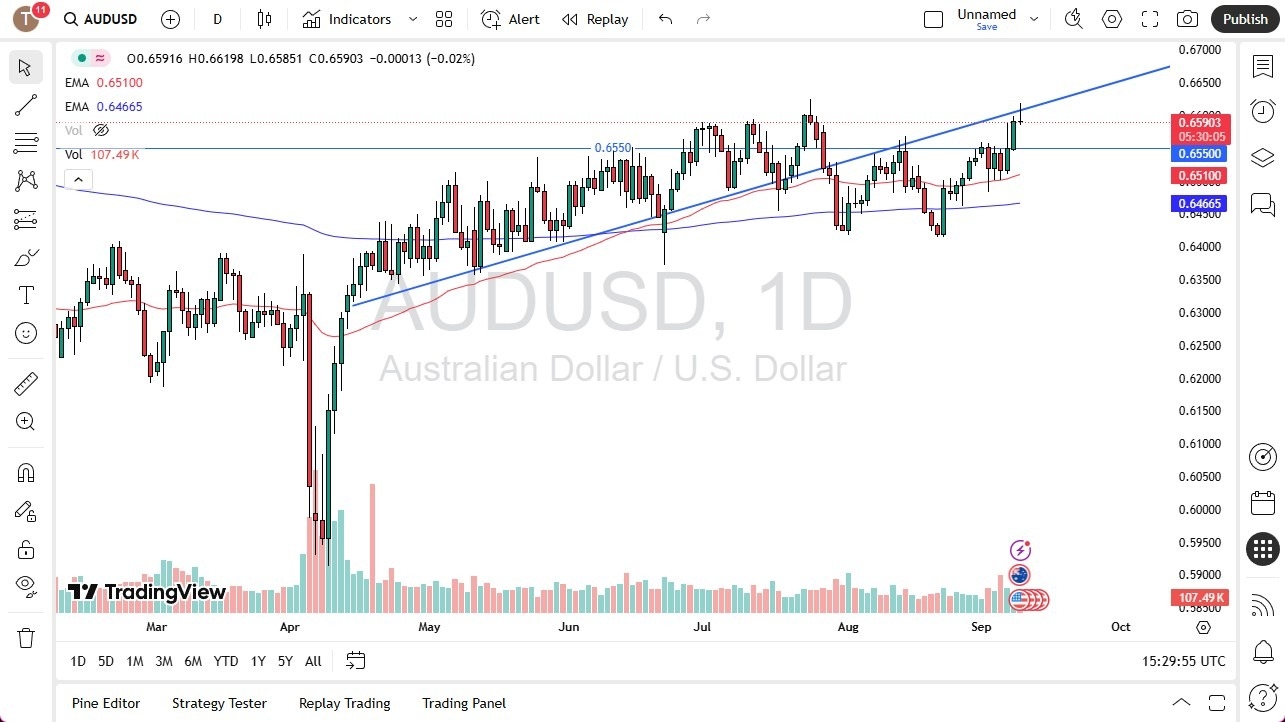

- The Aussie dollar did in fact rally a bit during the early hours here on Tuesday, but it is giving back those gains right at the previous trend line, showing a little bit of market memory.

- Another thing to pay close attention to is that the area right around 0.6630 had been a swing high previously, and now it looks like we might be failing.

Aussie Underperforms

Top Regulated Brokers

The Australian dollar has been quite a bit softer than many of its other contemporaries against the U.S. dollar. Even when the U.S. dollar was being absolutely obliterated a few months back. It is because of this and the fact that the U.S. dollar is pushing back against multiple currencies that I look at this chart as one that is definitely worth watching. This is because if the U.S. dollar suddenly becomes strong again, the Australian dollar is going to get hammered.

This is a currency that basically benefited at the cost and at the loss of the US dollar but not doing so on its own account. Remember, New Zealand just cut rates and that has a little bit of a knock on effect in Australia. It shows that perhaps that part of the world isn't as strong as it once was. Ultimately, it looks like the US economy is going to slow down, as we have seen weak jobs numbers, it makes a lot of sense that the global economy slows down with it.

China? Global Trade?

Australia is essentially a proxy for China for most Forex traders. You were talking about a country that supplies China with a lot of its raw goods. If trade slows down even further, and let's face it, we've had a tariff war for some time or tariff spat, if you will, that certainly hurts China. It certainly hurts the demand for some of the exports that Australia is so known for.

Because of this and the fact that we reached resistance anyways, I’m not surprised to see if this market drops from here. I don't necessarily think that the Australian dollar is going to collapse, I just think it's going to have a hard time going higher. Quite frankly, if it does break out above the 0.6650 level on a daily close, I suspect you'll probably do better shorting the dollar against other currencies anyway, but that's the only scenario which I see me buying the Australian dollar. The 50 day EMA sits at the 0.6510 level as support. And of course, we have the 0.6550 level, which has been like a magnet for price going back a couple of months now. It wouldn't surprise me at all to see the Aussie revisit that level yet again.

Ready to trade our daily Forex analysis? Here's a list of the best licenced forex brokers in Australia to choose from.