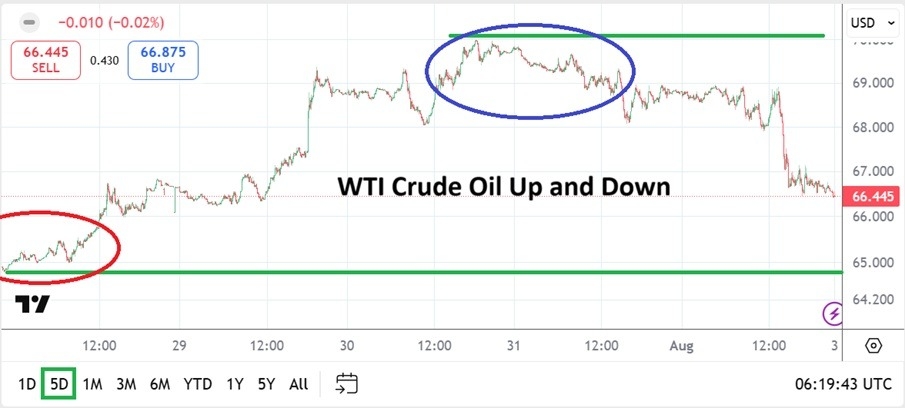

- A fractionally higher mark above 70.000 was seen on Wednesday in WTI Crude Oil. The week started off near the 64.750 ratio and achieved a solid run higher early.

- But after hitting high water marks not seen since mid-June when WTI Crude Oil spiked towards the 76.000 and faltered, the commodity started to run into selling again.

- WTI Crude Oil was trading near the 68.800 ratio when price velocity lower struck. WTI Crude Oil went into this weekend near the 66.450 ratio.

- This is a higher price than the commodity started with last Monday, but the inability to sustain highs near 69.000 is a sign speculative bulls did not get the results they may have been counting on via the U.S jobs reports numbers. However, this might be a bad interpretation of WTI Crude Oil results seen last week, because there is a chance profit taking also played its role.

Foreign Affairs and WTI Crude Oil Speculative Insights

And for those interested in ‘foreign’ affairs, the attention India received late last week due to tariff rhetoric and the U.S White House pointing out that India buys most of its oil from Russia could be built into the story regarding price. Is it possible that some speculators thought India could be pressured into buying WTI Crude Oil, or at lease limit its Russia buying and looking towards other suppliers. However, India has balked at this loud suggestion.

Top Regulated Brokers

One thing is certain, WTI Crude Oil did see bullish activity early last week only to falter. The price the commodity has gone into the weekend with allows day traders an opportunity to pursue bets based on their technical perspectives. The beginning of trading this coming week should be watched to see where immediate pressure builds – downside and upside. The price of WTI Crude Oil comfortably above 66.000 shows what could be considered a rather good equilibrium, this considering one, three and six month charts. In other words WTI Crude Oil is essentially in the middle of its price range over the mid-term.

Summer and Economic Outlooks as a Factor

We are in the middle of summer in the northern hemisphere. Driving and travel considerations are certainly factoring into the need for WTI Crude Oil.

- Yet the price remains within the middle of its range and speculators have to consider where price is being influenced. Supply and demand remain healthy.

- Economic data certainly got a negative headline news treatment from many media sources on Friday via the U.S jobs numbers. Manufacturing reports were also negative.

- However, the interpretation of this data will now be fought over by politicians and economists. And businesspeople will have to decide what to think regarding outlook.

- Choppy conditions are likely to prevail and WTI Crude Oil is likely to remain muddled within a speculative give and take.

- Support levels near 66.000 could prove important since the price of WTI Crude Oil hasn’t seen value beneath this mark since last Monday the 28th of July. If it falters, the 65.000 will come into mind for some.

WTI Crude Oil Weekly Outlook:

Speculative price range for WTI Crude Oil is 64.600 to 69.500

Speculators may have gotten more than they bargained for last week in WTI Crude Oil. The ability of the commodity to produce a solid move higher was good for day traders pursuing the trend. However, the price velocity lower this past Friday was significant and may have caught traders unprepared. Risk management is crucial as always in WTI Crude Oil.

Commodities trading needs solid risk taking tactics. The potential of WTI Crude Oil to dance around its current realm should be taken seriously. The move higher last week which brought 70.000 USD into view was perhaps surprising, but it was met by a wave of selling. This week’s trading will prove interesting early, and momentum while it should be treated suspiciously could also allow for pursuit of quick hitting technical wagers. Based on last week’s wider price range, speculators should anticipate the potential of swift technical realms being seen again.

Ready to trade our weekly forecast? Here are the best Oil trading brokers to choose from.