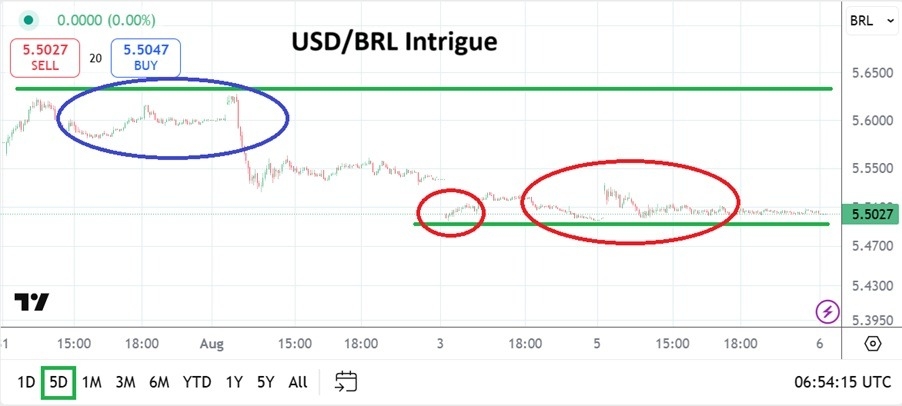

The USD/BRL as expected moved out of its tight price range late last week as tariff and political noise hit the currency pair and as of yesterday’s close mid-term lows are being traversed.

The USD/BRL closed yesterday’s trading near the 5.5025 mark. As the U.S White House talks about a 50% tariff on some Brazilian goods and Jair Bolsonaro is under house arrest, the Brazilian Real has actually gotten stronger. After moving to a high of nearly 5.6325 early on Friday, the USD/BRL has turned lower and broken through some interesting near-term support.

Even in the wake of noise that has been created by President Trump’s tariff penalty on Brazil, financial institutions have turned their attention elsewhere. After the lackluster U.S jobs numbers the USD/BRL correlated to the broad Forex market and traded lower. And the lower values have been sustained early this week which indicates some type of confidence via large traders active in the USD/BRL.

Top Forex Brokers

Contrarian Reaction and False Narratives.

Perhaps financial institutions had braced for the tariff drama between the U.S and Brazil prior to the additional threats from the U.S White House. And Brazilian financial institutions may have also foreseen the political events involving Jair Bolsonaro and the court decision to put him under house arrest. There is a chance that these two points are false narrative and influence in the USD/BRL is coming from elsewhere, but there is no denying the Brazilian Real has shown strength the past few days.

The ability of the USD/BRL to move lower and hover over the 5.5000 level is intriguing. From the last week in June until the 9th of July, the USD/BRL was able to trade within a range between 5.5000 and 5.4000. The correlation to the broad Forex markets and the volatility seen throughout the FX landscape is captivating and perhaps attractive to USD/BRL speculators.

Financial Houses and USD/BRL Speculating

A move lower by the USD/BRL in the coming days may appear contrarian to concerns shadowing Brazil, but if USD weaker centric momentum remains then pursuing additional moves lower may prove attractive.

- Caution will be needed by day traders, there is a risk that an unexpected hurdle could be demonstrated at any moment.

- However, if financial houses continue to show relative calm, then it makes sense to try and ride the coattails of larger players for smaller speculators.

- As always, day traders in the USD/BRL should be mindful of today’s opening. The currency pair has a habit of gapping on openings due to its lack of huge volume.

Brazilian Real Short Term Outlook:

Current Resistance: 5.5110

Current Support: 5.5000

High Target: 5.5390

Low Target: 5.4820

Want to trade our daily forex analysis and predictions? Here are the best brokers in Brazil to check out.