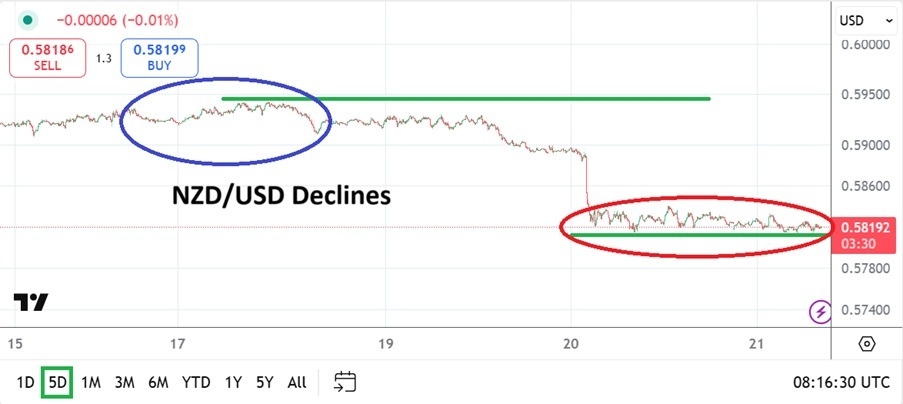

Price velocity downwards was sparked in the NZD on late Tuesday, and lows have been demonstrated the past day as the 0.58190 vicinity continues to be tested.

The NZD/USD has shown a tendency to display bearish behavior the past couple of months. The selling action has not been a stable one way avenue for day traders. The NZD/USD has provided its typical volatility filled with strong reversals, enough to test the willpower of speculators trying to pursue the currency pair who want to wager on its trend. The currency pair is proving to be complex for traders.

As of this moment the NZD/USD is near the 0.58190 mark. The NZD/USD was trading above the 0.59200 most of Tuesday, but selling started to develop late in the day and the 0.59000 ratio started to see flirtations abruptly. Yesterday’s trading in the NZD/USD saw additional selling, this time stronger and when the 0.58800 level was proven vulnerable, the currency pair sank fast.

Top Forex Brokers

0.58200 Focal Point and Looking Ahead

It can be argued the NZD/USD is correlating to the broad Forex market as other major currencies struggle against the USD in the near-term. However, the move lower in the NZD/USD the past month via technical perspectives allows for the suspicion that financial institutions are not only selling the NZD/USD when the broad market turns nervous, but because they do not like New Zealand’s economic data too and have doubts about internal fiscal policies via the Reserve Bank of New Zealand.

The ability to penetrate below 0.59000 and now traverse near 0.58190 – as the 0.58200 level looks to be a focal point short-term is interesting. Financial institutions globally are in a cautious mood because of the U.S Federal Reserve. Important meeting are being held today via the Fed’s annual Symposium in Jackson Hole. Forex and other global assets are showing a bit of hesitation the past couple of days via strong USD centric movement. The Fed is expected to cut interest rates in September, but predicting what they will do afterwards looks like a crapshoot.

Near-Term Gambles and Fast Action for the NZD/USD

The NZD/USD has lived up to its fast trading reputation the past few days. Now, worrisome for those with bullish perspectives possibly, is the technical perspective that lower levels are being sustained.

- The NZD/USD is actually touching lows not seen since the second week of April this year.

- The NZD/USD has shown a tendency to be slightly weaker compared to many of its major counterparts in Forex.

- It appears traders who believe the NZD/USD is oversold should be cautious.

- While the lows may look tempting as a place to wager on higher price action, timing a solid move upwards remains difficult in the NZD/USD.

- Caution may stay the name of the game today and tomorrow.

NZD/USD Short Term Outlook:

Current Resistance: 0.58235

Current Support: 0.58175

High Target: 0.58380

Low Target: 0.58040

Ready to trade our daily Forex analysis? Here's a list of the brokers for forex trading in New Zealand to choose from.