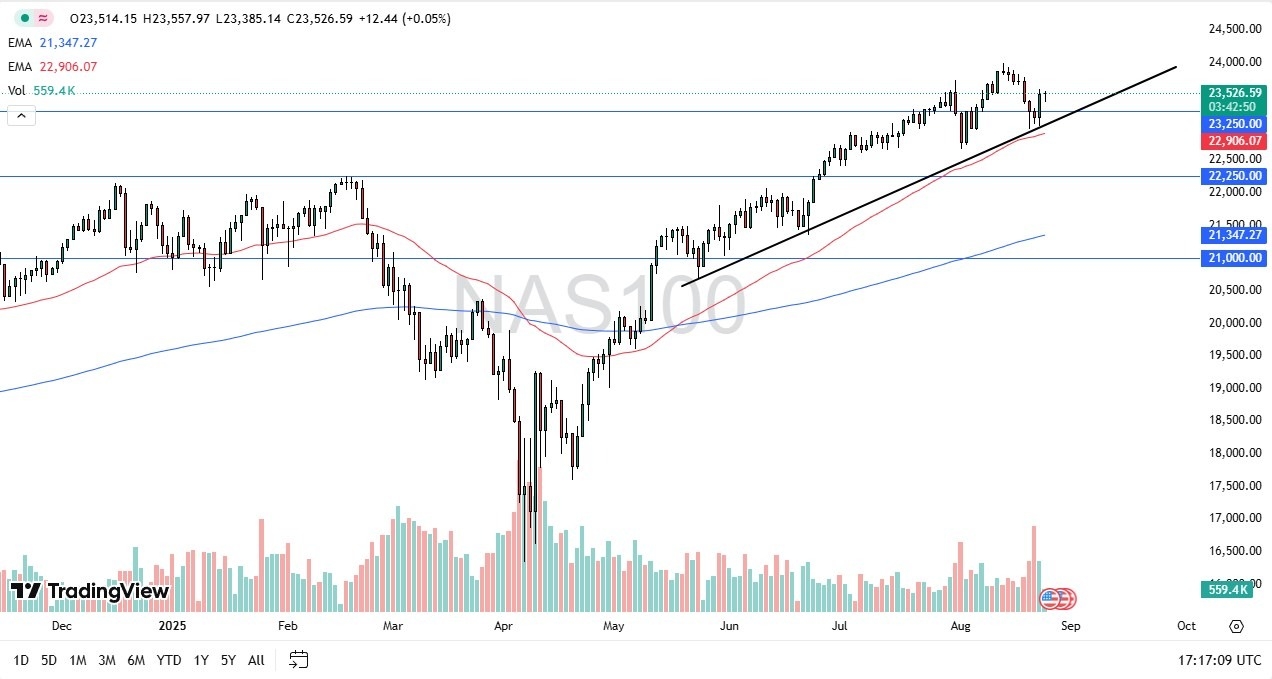

- NASDAQ 100 initially did pull back just a bit during the trading session on Monday, but it looks like we are trying to recover.

- It's probably worth noting that as soon as the Europeans left, we did see a little bit more of a push to the upside.

- Although, in all fairness, it wasn't exactly a horrific sell-off in the beginning of the session anyways.

There is an uptrend line underneath that I think continues to offer support here, which happens to be backed up by the 50 day EMA simultaneously. So we have a couple of different things here that are working in the favor of the NASDAQ 100. Remember that the NASDAQ 100 is not an index of 100 stocks. It's really an index of about eight, and Nvidia has its earnings report on Wednesday, which will have a major influence on what happens with the NAS 100 because it is 14 % of the weighted average. I think part of what you're seeing here is the market may be a little bit quieter over the next couple of days as it's waiting to see what Nvidia actually does. If we do fall from here, not only do we have the uptrend line as a board, but we also have the 23,250 level.

On Rallies

Top Forex Brokers

To the upside, I see the 24,000 level as a bit of a barrier but breaking that could open up more buying a little bit of FOMO trading. And after the Nvidia report, that might be the result. We just don't know yet. Either way, this is a bullish market. I don't have any interest in shorting it.

I don't like shorting indices in general, just because they're not constructed in a way to make them conducive to falling for the longer term. So, swimming upstream or swimming downstream, it's your decision, but I prefer to swim with the current, meaning that I'm buying dips. Nothing in the behavior of the market since early April has shown me anything different. It just looks like a market that wants to go higher.

Ready to trade our stock market forecast and analysis? Here are the best CFD stocks brokers to choose from.