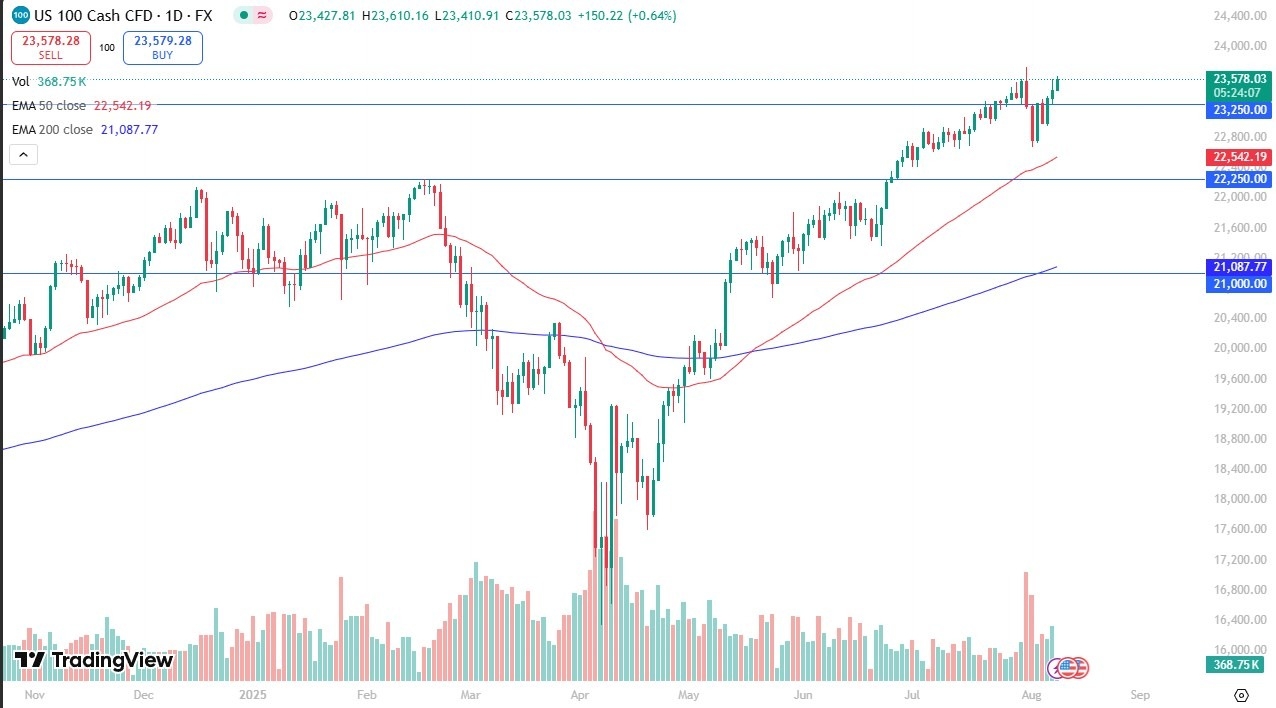

- The NASDAQ 100 has rallied a bit during the trading session on Friday, as it looks like we are trying to get to the recent all-time highs, opening up the possibility of a bigger move to the upside, perhaps reaching toward the 24,000 level.

- That being said, if we do pull back, the 23,250 level is probably going to end up being a short-term support, followed by the 50 Day EMA.

All things being equal, the NASDAQ 100 is a little overdone, and at this point in time I think you are likely to continue to see more of a “buy on the dips” type of attitude, but that doesn’t necessarily mean that it’s going to be very easy to get to the upside. I think ultimately, this is a market that given enough time we will continue to see a lack of volume as well, so that is a problem. Ultimately, I think the entire month of August could be very problematic, but we are still in an uptrend, so therefore I still prefer to buy dips, but I recognize that this is a “see money, take money” type of market.

Top Forex Brokers

Trend is Hard to Fight

The trend is going to be hard to fight, and therefore I think we’ve got a situation where you will continue to see a lot of buyers out there, but I would also point out that there are a lot of questions out there when it comes to what the Federal Reserve is going to do, and therefore we will continue to see it cause a lot of noise in this marketplace. That being said, I think we also have a situation where we could get sudden selloffs, because quite frankly that’s what I’ve been seeing during intraday trading over the last several sessions. In other words, although it is an uptrend, it’s very difficult market to trust at the moment. Regardless, I do think that we will eventually go to the 24,000 level, and possibly even beyond that.

Ready to trade our stock market forecast and analysis? Here are the best CFD stocks brokers to choose from.