Short Trade Idea

Enter your short position between 23.21 (the intra-day low of its recent volatility) and 25.31 (the upper band of its horizontal resistance zone).

Market Index Analysis

- Intel (INTC) is a member of the NASDAQ 100, the Dow Jones Industrial Average, the S&P 100, and the S&P 500

- All four indices sustain record highs, but volatility and AI bubble concerns are rising

- The Bull Bear Power Indicator of the NASDAQ 100 turned bearish, and the negative divergence remains intact

Market Sentiment Analysis

Concerns over AI spending, fatigue over Big Tech amid excessive valuations, and comparisons to the Dot-Com bubble have spiked worries that the current market environment resembles an AI bubble. The release of minutes from the latest FOMC meeting showed inflation as the primary focus amid the ongoing tariff uncertainty. All eyes are now on earnings from Walmart and the Jackson Hole Economic Symposium. Equity futures indicate an ongoing sell-off, and tech stocks may face further pressure.

Intel Fundamental Analysis

Intel is a technology company that primarily designs CPUs for business and consumer markets. It lost its leadership position to AMD and missed out on the AI wave, while its future chips will rely heavily on TSMC.

So, why am I bearish on INTC following its breakdown?

Despite the SoftBank investment announcement, the 10% government stake raises a red flag. It does not suffice to halt the missed AI investment. The latest earnings release confirms an insufficient balance sheet, which is unable to support the capital expenditure necessary to achieve its goals. Intel may issue more equity or raise debt in the medium term, potentially diluting shareholder value. Its reliance on TSMC for its future chips is equally worrisome.

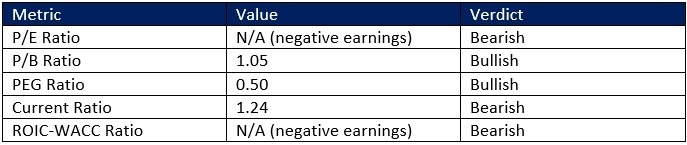

Intel Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio is negative, but the forward P/E is 212.77, which makes INTC an expensive stock. By comparison, the P/E ratio for the NASDAQ 100 is 41.38.

The average analyst price target for INTC is 21.95. It shows no upside potential with excessive downside risk.

Intel Technical Analysis

Today’s INTC Signal

- The INTC D1 chart shows price action completing a breakdown below its horizontal resistance zone

- It also indicates price action between its ascending 0.0% and 38.2% Fibonacci Retracement Fan levels

- The Bull Bear Power Indicator is bullish, but has been decreasing

- The average bearish trading volumes are higher than the average bullish trading volumes

- INTC rallied with the NASDAQ 100, a bullish trading signal, but the reasons were due to one-time, short-term factors

Top Regulated Brokers

My Call

I am taking a short position in INTC between 23.21 and 25.31. The government stake is a red flag, the balance sheet is a mess, and INTC may have to issue more equity or raise debt to achieve its turnaround. I see a repeat of the post-earnings-release sell-off.

- INTC Entry Level: Between 23.21 and 25.31

- INTC Take Profit: Between 17.67 and 18.97

- INTC Stop Loss: Between 25.65 and 26.53

- Risk/Reward Ratio: 2.27

Ready to trade our free daily signals? Here is our list of the best brokers for trading worth checking out.