Short Trade Idea

Enter your short position between 227.64 (yesterday’s intra-day low) and 237.14 (the mid-range of its horizontal resistance zone).

Market Index Analysis

- Garmin (GRMN) is a member of the S&P 500

- This index hovers near a record high, but bearish pressures are mounting

- The Bull Bear Power Indicator of the S&P 500 has been retreating since mid-May

Market Sentiment Analysis

Higher tariffs kicked in today after midnight, and US President Trump has threatened 100% tariffs on semiconductors and 250% tariffs on pharmaceuticals. Equity markets overlook the potential for higher prices and assume companies will weather the storm, while they expect the US Federal Reserve to lower interest rates. China could see another tariff hike similar to the one imposed on India for buying Russian oil. Discounting the tariff impact, as markets are doing, could lead to increased volatility and downside surprises ahead.

Garmin Fundamental Analysis

Garmin is a tech company known for its GPS, navigation, communication, and sensor-based products catering to the automotive, aviation, marine, and recreational markets.

So, why am I bearish on GRMN amid its bounce higher?

Declining profit margins and high valuations stand out, but the high-volume sell-off after its most recent earnings release should concern investors the most. The current share price exceeded average analyst expectations, and no upgrades followed. I think Garmin will struggle with tariffs and the overall economic slowdown, which will impact its industrial client base and result in a drag on future earnings.

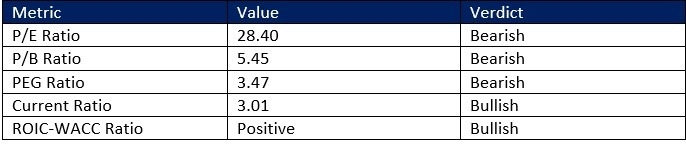

Garmin Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 28.40 makes GRMN an expensive stock. By comparison, the P/E ratio for the S&P 500 is 29.07.

The average analyst price target for GRMN is 212.17. It shows price action overshooting its price target with growing downside potential.

Top Regulated Brokers

Garmin Technical Analysis

Today’s GRMN Signal

- The GRMN D1 chart shows price action just below its horizontal resistance zone

- It also shows price action finding support at the ascending 38.2% Fibonacci Retracement Fan level

- The Bull Bear Power Indicator turned bullish, but in line with its descending trendline

- Bearish trading volumes have spiked during sell-offs, while bullish trading volumes remain subdued

- GRMN corrected with the S&P 500 near a record, a significant bearish signal

My Call

I am taking a short position in GRMN between 227.64 and 237.14. The spike in bearish trading volumes and subdued bullish ones suggests the recent advance is a dead cat bounce. Price action faces pressure between its horizontal resistance zone and ascending Fibonacci Retracement Fan. I expect a breakdown sequence to follow.

- GRMN Entry Level: Between 227.64 and 237.14

- GRMN Take Profit: Between 197.36 and 212.17

- GRMN Stop Loss: Between 238.00 and 246.50

- Risk/Reward Ratio: 2.92

Ready to trade our free daily signals? Here is our list of the best brokers for trading worth checking out.