Long Trade Idea

Enter your long position between 221.65 (yesterday’s intra-day low) and 227.85 (yesterday’s intra-day high).

Market Index Analysis

- FedEx (FDX) is a member of the S&P 100 and the S&P 500

- Both indices hover near record highs, but bearish pressures are mounting

- The Bull Bear Power Indicator of the S&P 500 has been retreating since mid-May

Market Sentiment Analysis

Higher tariffs kicked in today after midnight, and US President Trump has threatened 100% tariffs on semiconductors and 250% tariffs on pharmaceuticals. Equity markets overlook the potential for higher prices and assume companies will weather the storm, while they expect the US Federal Reserve to lower interest rates. China could see another tariff hike similar to the one imposed on India for buying Russian oil. Discounting the tariff impact, as markets are doing, could lead to increased volatility and downside surprises ahead.

Top Regulated Brokers

FedEx Fundamental Analysis

FedEx is a transportation, e-commerce, and business services conglomerate with over 210,00 motorized vehicles.

So, why am I bullish on FDX after its breakout?

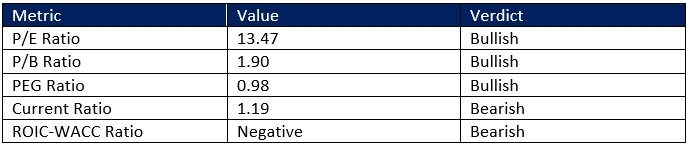

FedEx has a healthy balance sheet with low valuations. The spin-off of its FedEx Freight unit may bolster its finances. While FedEx struggles with shareholder value destruction, its PEG ratio and P/B ratio provide a floor under the share price. I am confident in FedEx’s business outlook, even in a slowing economy, as e-commerce continues to expand at a solid rate, and FDX has an excellent delivery and reliability score.

FedEx Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 13.47 makes FDX an inexpensive stock. By comparison, the P/E ratio for the S&P 500 is 29.07.

The average analyst price target for FDX is 266.40. It suggests impressive upside from current levels.

FedEx Technical Analysis

Today’s FDX Signal

- The FDX D1 chart shows price action completing a breakout above its horizontal support zone

- It also shows price action finding support at the ascending 61.8% Fibonacci Retracement Fan level

- The Bull Bear Power Indicator is bearish, but remains near its ascending trendline

- Bullish trading volumes have increased during the breakout

- FDX struggled more than the S&P 500, but it has superior upside potential

My Call

I am taking a long position in FDX between 221.65 and 227.85. I believe the spin-out is good news, and I buy the low valuations and PEG ratio. E-commerce should expand even as the broader economy slows, and FedEx is well-positioned to deliver. The 2.60% dividend yield is a nice bonus, and I will add to my FDX holding during sell-offs.

- FDX Entry Level: Between 221.65 and 227.85

- FDX Take Profit: Between 245.76 and 253.94

- FDX Stop Loss: Between 210.06 and 214.35

- Risk/Reward Ratio: 2.08

Ready to trade our free daily signals? Here is our list of the best brokers for trading worth checking out.