EUR/USD Analysis Summary Today

- Overall Trend: Neutral with an upward bias.

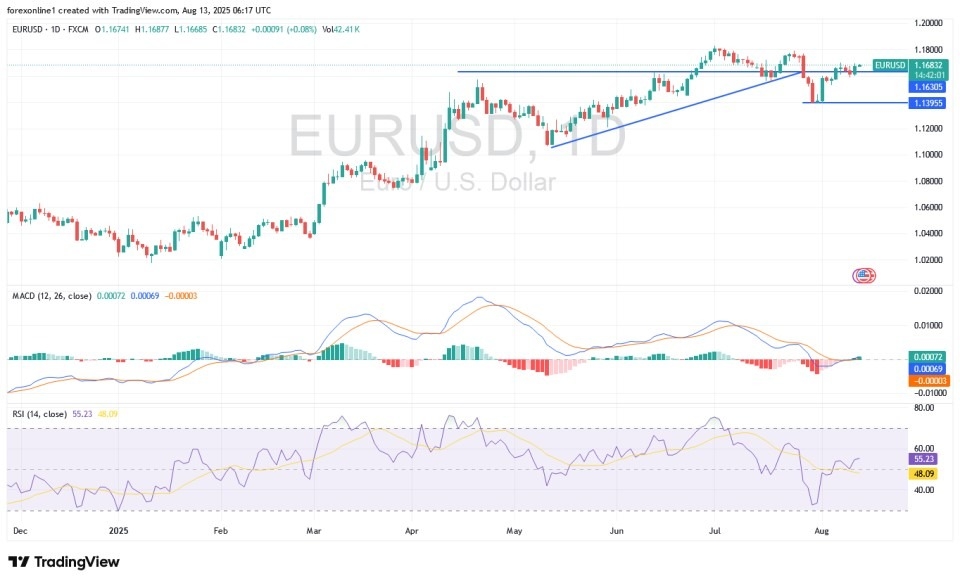

- Support Levels Today: 1.1630 – 1.1550 – 1.1480.

- Resistance Levels Today: 1.1720 – 1.1790 – 1.1870.

EUR/USD Trading Signals:

- Buy EUR/USD from the 1.1580 support level, with a target of 1.1800 and a stop-loss at 1.1500.

- Sell EUR/USD from the 1.1770 resistance level, with a target of 1.1500 and a stop-loss at 1.1810.

EUR/USD Technical Analysis Today:

The recent weak US inflation data has once again weakened the US dollar against other major currencies, allowing the EUR/USD pair to recover from its losses at the beginning of the week. After falling to the 1.1589 support level, the pair has rebounded and is now hovering around 1.1689. The euro is attempting to break through the 1.1700 resistance level, which could encourage further gains.

Today's EUR/USD trading is awaiting the announcement of the German inflation reading at 9:00 AM Cairo time, along with statements from several US Federal Reserve officials throughout the day.

From a technical perspective, the EUR/USD is in a neutral position on the daily chart. An upward bias would be confirmed if it breaks past the 1.1700 resistance. The recent rebound has moved the 14-day Relative Strength Index (RSI) to 55, moving away from the neutral line and awaiting stronger gains to confirm bullish control. The MACD indicator is also showing a slight upward turn.

Top Regulated Brokers

Trading Advice:

Traders are advised to wait for new selling opportunities for the EUR/USD pair, with the 1.1770 resistance level or higher being the most suitable, but without taking on excessive risk.

A bearish scenario for the EUR/USD over this period requires bears to head towards the support levels of 1.1630, 1.1540, and 1.1480, respectively. We expect limited movement today for the EUR/USD, awaiting strengthening factors from the course of trade tensions between the United States, the European Union, and China.

Keep in mind that underlying tensions remain high, especially given the importance of geopolitical developments, as markets monitor the situation in Ukraine and the trade dialogue between the United States and China.

Another factor affecting currency prices is the ongoing debate about the Federal Reserve's policy and independence, with the latest US inflation data being a key element. According to currency trading experts, the main obstacle to an early rate cut at the upcoming September FOMC meeting would be a larger-than-expected rise in US inflation over the summer. Moreover, Market participants will be closely watching the latest US Consumer and Producer Price Index reports for July this week for more evidence that rising tariffs are leading to higher inflation.

Regarding euro trading, currency experts are not convinced that the market's call for no further rate cuts from the European Central Bank is realistic. However, they view any potential re-pricing towards quantitative easing as a temporary setback within a broader trend of euro strength, supported by the dollar's structural weakness. The latest CoT data from the CFTC showed a slight decrease in non-commercial long positions for the euro, but the number is still high historically, which limits the scope for further buying.

Will the EUR/USD pair rise in the coming days?

In this regard, the latest survey of more than 30 of the world's largest investment banks shows that analysts have raised their mid-year euro trading forecasts compared to just three months ago. The survey shows that the median forecasts, which represent a consensus estimate of the EUR/USD exchange rate, have increased across all time periods. We consider the median and average forecasts to be the most accurate and reliable available, as they rely on the wisdom of the crowd. Clearly, they enable payers to make reliable and rational decisions when making timing decisions.

The survey also provides a range of variability by showing the highest and lowest forecasts in the data set. Most importantly, it identifies the investment banks that have been most accurate in forecasting the EUR/USD exchange rate over three months. NAB was the most accurate in the three-month forecast in the March survey, also ranking first in the GBP/USD and GBP/EUR surveys.

At the same time, the mid-year update shows that investment banks have made upward revisions to the euro across all timeframes. This improvement in expectations may influence the timing of individual or corporate purchases of euros or US dollars, as the consensus now points to a stronger euro until mid-2025. Converting 100,000 euros into US dollars would have generated several thousand dollars in additional profits under the June forecast compared to the March forecast for the three-month timeframe, based on the average.

Thus, the survey certainly does not indicate a significant strengthening of the euro, but rather a decline in the resilience of the US dollar that it enjoyed at the beginning of the year. In March, the trajectory of the single European currency indicated relative stability; by June, expectations had risen, with expectations of reaching multi-month highs over the next year. The reasons for this shift are generally well-documented and include signs of economic resilience in the eurozone, more lenient expectations for US interest rates, and reduced downside risks for the single currency.

As always, what lies ahead is uncertain, but consensus forecasts can provide a valuable anchor amid global exchange rate volatility.

Ready to trade our EUR/USD daily forecast? Here’s a list of some of the top forex brokers in Europe to check out.