EUR/USD Analysis Summary Today

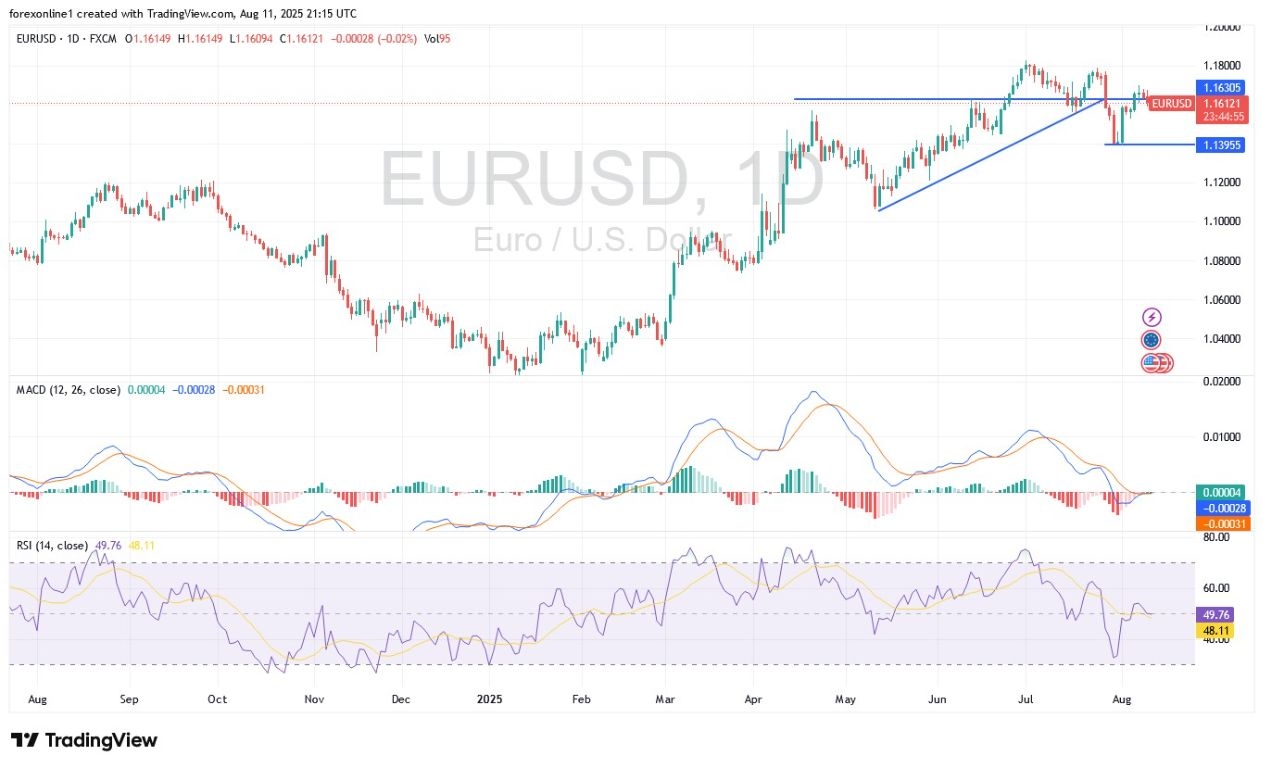

- Overall Trend: Neutral.

- Today's Support Levels: 1.1580 – 1.1500 – 1.1420.

- Today's Resistance Levels: 1.1700 – 1.1770 – 1.1860.

EUR/USD Trading Signals:

- Buy EUR/USD: from the support level of 1.1530 with a target of 1.1800 and a stop loss at 1.1460.

- Sell EUR/USD: from the resistance level of 1.1770 with a target of 1.1500 and a stop loss at 1.1810.

EUR/USD Technical Analysis Today:

Ahead of today's U.S. inflation data release at 3:30 PM Egypt time, the EUR/USD exchange rate is stable around 1.1600. It may receive the U.S. figures under downward pressure after a period of neutrality. According to reliable trading platforms, the EUR/USD pair is stable near 1.1600. We are nearing the middle of August trading, which is slightly below its high from last month of 2021, as traders weigh economic, political, and monetary outlooks.

Solving the Russia-Ukraine Crisis and its Impact on the Euro

According to the expectations and views of currency trading experts. Attention is turning to Friday's meeting between US President Trump and Russian President Putin, which aims to find a solution to the conflict in Ukraine. Ukrainian President Zelensky is reportedly not expected to participate. Resolving the dispute could significantly boost the euro's gains against other major currencies, while the meeting fails to achieve progress that satisfies markets and investor sentiment.

On the U.S. monetary policy front, expectations for an imminent interest rate cut by the Federal Reserve have grown, especially following weak U.S. jobs data and the ISM U.S. Services PMI. At the same time, the European Central Bank (ECB) ended its current easing cycle in July after eight cuts over the past year, which lowered borrowing costs to their lowest level since November 2022. However, some market participants see the possibility of another rate cut by the ECB before the end of the year.

On the economic front, the eurozone's GDP grew by 0.1% in the second quarter, while inflation held steady at 2% in July. However, risks remain, as the European Union faces 15% tariffs on most European goods exported to the United States.

Top Regulated Brokers

Today's EUR/USD Trading Scenarios:

EUR/USD Bearish Scenario: Dear reader, based on the daily chart, the bearish momentum of the EUR/USD pair may increase if bears move the pair toward the support levels of 1.1530 and 1.1400, respectively. From the latter level, technical indicators may head toward strong oversold levels. Currently, the 14-day RSI is around the 50 level, a neutral zone between bears and bulls. At the same time, the MACD lines are also turning down.

EUR/USD Bullish Scenario: Conversely, on the same timeframe, the psychological resistance at 1.1800 will remain the most important level for further bull control of the EUR/USD pair in the coming days. This requires confidence in investor sentiment toward the euro following the announcement of important economic data and influential events.

Trading Tips:

Traders advise waiting for the market's reaction to US inflation announcements and the Putin-Trump meeting to make sound and informed decisions regarding EUR/USD trading.

Keep in mind that the policies of the Federal Reserve and the U.S. administration will remain crucial in the short term. Financial markets will also consider the issue of the next Federal Reserve chairman nomination. Regarding the Eurozone, financial markets will continue to monitor the detailed negotiations related to the U.S.-EU trade agreement.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex demo accounts worth trading with.