Ethereum (ETH), the second-largest cryptocurrency by market capitalization, surged to new all-time highs of $4,953 on Sunday, eclipsing its previous record of $4,867 set in November 2021.

This rally, fueled by a confluence of macroeconomic signals, institutional adoption, and robust network fundamentals, has reignited discussions about Ethereum’s price potential.

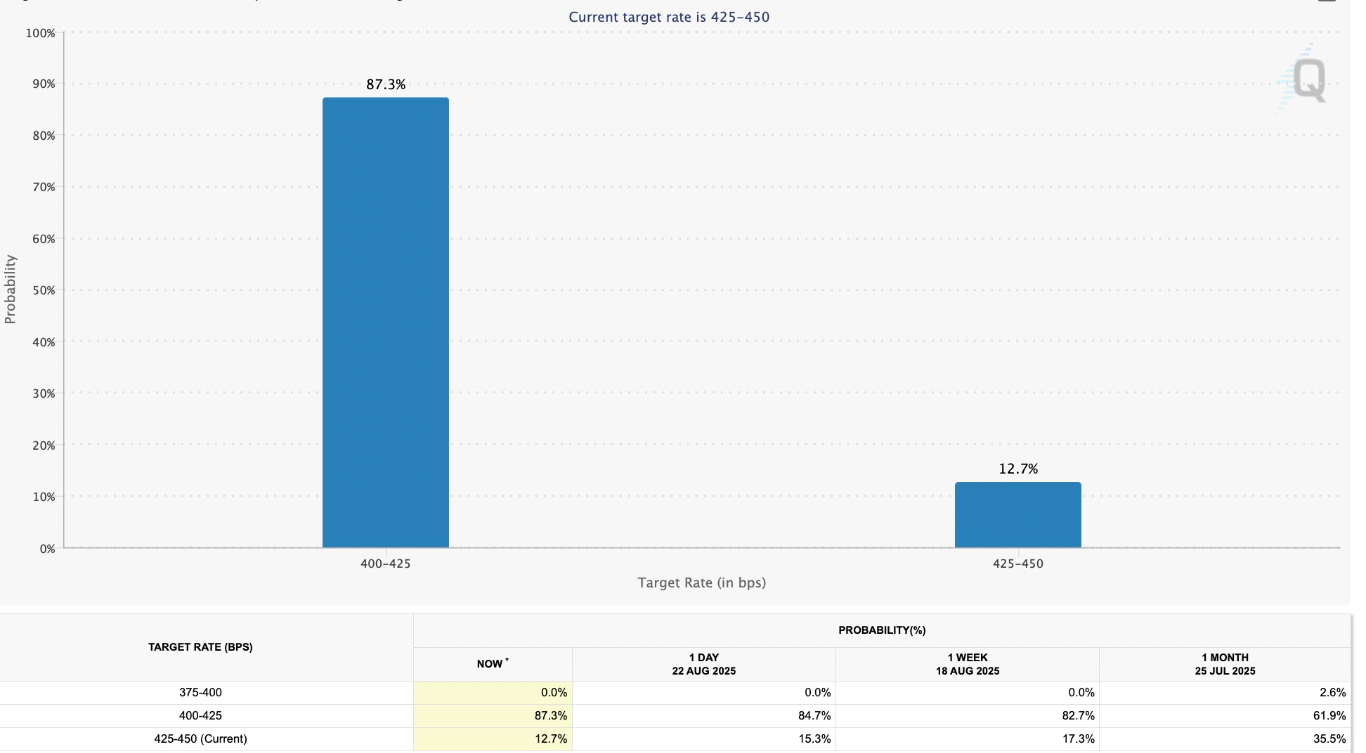

With Federal Reserve Chair Jerome Powell hinting at a September rate cut, the odds of a 0.25% reduction in rates have jumped to 87.3%, up from 62%, as shown in the figure below.

Target rate possibilities for Sep. 17 FOMC meeting. Source: Fedwatch tool

Let’s examine the key drivers behind this rally and explore how high ETH’s price might climb.

Rising Institutional Demand Backs Ether’s Bullishness

Ethereum’s recent surge past $4,900 has been propelled by unprecedented institutional demand and a noticeable capital rotation from Bitcoin (BTC).

Data from CoinMarketCap and TradingView shows that Ether rose from a low of $4,660 on Saturday, rising as much as 7% to hit a record high above $4,900. This outpaced Bitcoin’s performance, which dropped 5.4% from a high of $117,000 to a low of $110,671 over the same period.

This shift reflects a broader trend where investors are reallocating capital from Bitcoin, whose market dominance has dipped below 60%, to altcoins like Ethereum.

Bitcoin dominance hits eight-month lows. Source: TradingView

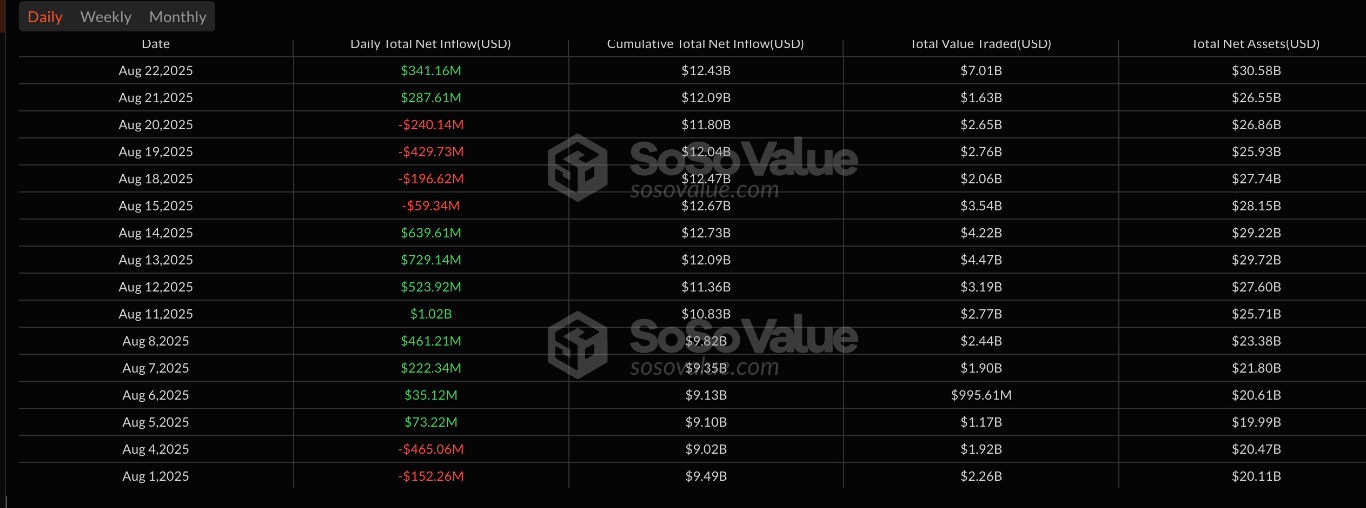

Institutional adoption is a major catalyst. Spot Ethereum ETFs have seen record flows, with net inflows totaling $2.9 billion so far in August, per data from SoSoValue. These investment products saw record single-day inflows of over $1 billion on August 11, a first since their launch in July 2024.

Spot Ethereum ETF flows table. Source: SoSoValue

Meanwhile, Corporate treasuries are also accumulating ETH at an aggressive pace, with companies like BitMine Immersion Technologies, SharpLink Gaming, and ETHZilla collectively holding nearly 3% of Ether’s total supply, valued at approximately $19 billion. BitMine alone has amassed over $7 billion in ETH and plans to raise an additional $20 billion for further purchases.

Source: Bitmine/X

These moves mirror Bitcoin treasury strategies pioneered by firms like Strategy (former MicroStrategy), but Ethereum’s unique value proposition—its role in decentralized finance (DeFi) and tokenization—makes it increasingly attractive to institutional players.

High Network Activity Boosts ETH Demand

Ethereum’s price rally is not just speculative; it’s underpinned by robust network activity and a thriving ecosystem. The Ethereum blockchain has seen transaction counts surpass 1.5 million daily, breaking records set in May 2021 during the NFT craze. This time, the surge is driven by stablecoin transfers, DeFi activity, and swaps, amplified by Ethereum’s increased gas limit of 45 million, as noted by Vitalik Buterin in July 2025.

The network’s base chain application revenue is nearing a breakout, and Layer-2 solutions like Base Chain are scaling activity while maintaining Ethereum’s dominance in DeFi liquidity, which exceeds Solana’s by nine times.

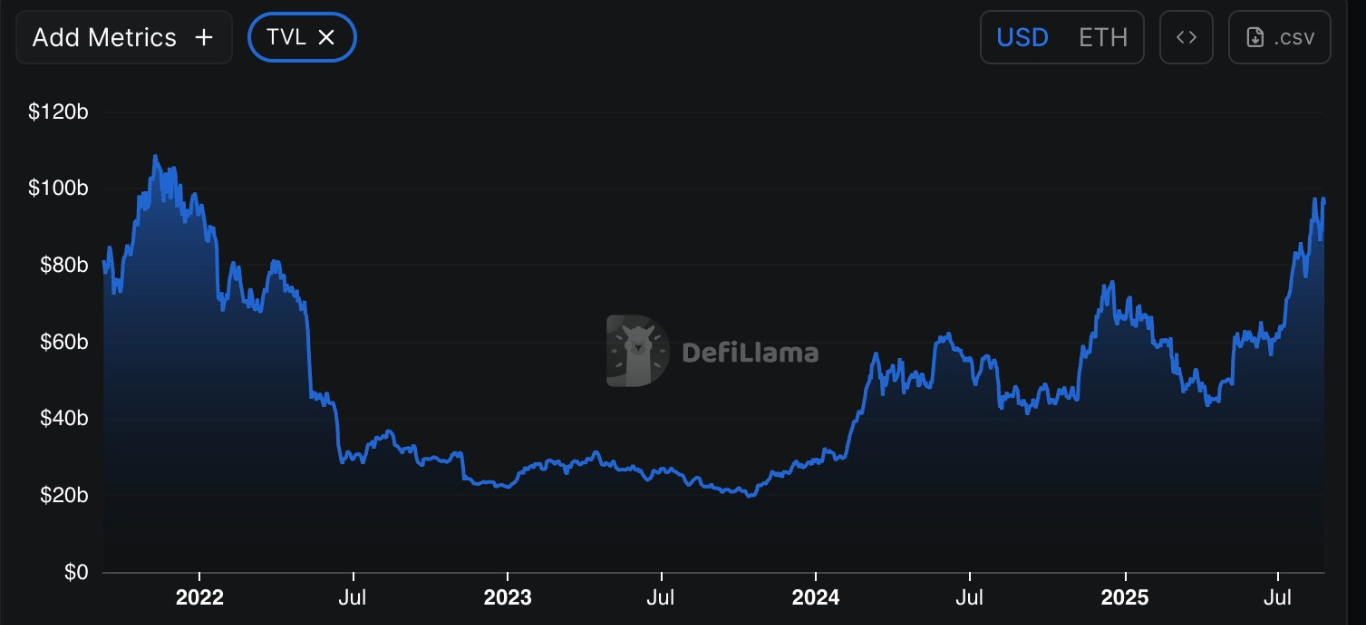

Total Value Locked (TVL) in Ethereum’s DeFi ecosystem remains a key indicator of its strength. Despite competition from other blockchains, Ethereum hosts the majority of DeFi liquidity, with billions locked in protocols like Aave, Uniswap, and MakerDAO.

Ethereum’s TVL has more than doubled since April, rising 117% to a four-year high of $97 billion on August 14, according to data from DefiLlama. It remains high at $95 billion at the time of writing. This high TVL reflects user confidence and network utility, directly supporting ETH’s price momentum.

Ethereum total value locked. Source: DefiLlama

Additionally, over 30% of ETH’s supply is staked, per data from UltraSound Money, effectively locking away a significant portion and reducing circulating supply. This deflationary pressure, combined with record open interest in ETH derivatives at $33.8 billion, signals strong market conviction, though bearish divergences suggest potential short-term corrections.

Analysts Are Bullish on ETH Price Going Higher

The bullish sentiment surrounding Ethereum is palpable, with analysts setting ambitious price targets. Standard Chartered’s Geoff Kendrick recently raised his ETH forecast to $7,500 by the end of 2025 and $25,000 by 2028, citing improved market conditions and institutional adoption.

More optimistically, Fundstrat’s Tom Lee has made waves with his prediction that ETH could hit $10,000 to $12,000 by year-end, with a longer-term target of $15,000. At the Ethereum NYC: NextFin Summit, Lee called Ethereum “the biggest macro trade of the next 10–15 years,” emphasizing its role in hosting Wall Street’s migration to blockchain technology.

Other analysts, like BitMEX co-founder Arthur Hayes, are even more bullish, projecting ETH could reach $20,000 this cycle due to its growing institutional appeal and regulatory tailwinds. The SEC’s “Project Crypto” framework and President Trump’s executive order allowing digital assets in retirement funds have removed significant barriers, widening the pool of potential ETH buyers. Prediction markets like Myriad Markets now show an 85% probability of ETH surpassing $5,000 in 2025, reflecting strong market confidence.

From a technical perspective, Ether's price action has validated a bull flag pattern on the daily chart.

ETH/USD daily chart. Source: Cointelegraph/TradingView

The bull flag resolved when the price broke above the upper trendline at $4,300 on Friday. ETH could then rise by as much as the previous uptrend’s height. This puts the upper target for the altcoin at $6,200 — up 33% uptick from the current price.

Additionally, the daily relative strength index is positive at 61. This suggests that the market conditions still favor the upside, boosting Ether’s chances of reaching its bull flag target.

Ready to trade ETH? Here’s a list of some of the best crypto brokers to check out.