Long Trade Idea

Enter your long position between 438.09 (Friday’s intra-day low) and 454.00 (Friday’s intra-day high).

Market Index Analysis

- CrowdStrike (CRWD) is a member of the NASDAQ 100 Index and the S&P 500 Index.

- Both indices have retreated from record highs but remain in a bullish chart formation.

- The Bull Bear Power Indicator of the NASDAQ 100 turned bearish.

Market Sentiment Analysis

Equity markets could start the first week of August trading higher after a two day selloff. Friday’s NFP report remains in focus, suggesting a much worse-than-expected labor market. While markets bet on a September interest rate cut, tariffs are putting upside pressure on inflation, as baseline tariff rates have increased. This raises the spectre of stagflation, but today’s mood remains bullish. The second quarter earnings season continues and should provide short-term directional guidance.

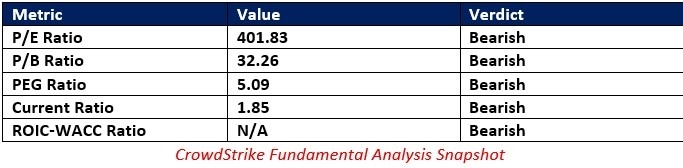

CrowdStrike Fundamental Analysis

CrowdStrike is a cybersecurity company with a promising push into AI-based and cloud-based cybersecurity solutions.

So, why am I bullish on CRWD despite its bearish correction?

CrowdStrike has some issues, but it delivered remarkable cash flow growth over the past five years. It allows it to continue making strategic acquisitions to bolster its AI-based cybersecurity portfolio. Gross margins are decent, and it has grown its earnings per share over the past year. While valuations are sky-high, I rate it among the top cybersecurity plays currently due to its promising prospects.

The price-to-earning (P/E) ratio of 401.83 makes CRWD an expensive stock. By comparison, the P/E ratio for the NASDAQ 100 is 40.51.

The average analyst price target for CRWD is 482.69. It suggests decent upside potential, but short-term downside risks remain.

CrowdStrike Technical Analysis

Today’s CRWD Signal

- The CRWD D1 chart shows price action stabilizing at a horizontal support zone.

- It also shows price action finding support at the ascending 50.0% Fibonacci Retracement Fan level.

- The Bull Bear Power Indicator is bearish but remains near its ascending trendline.

- Trading volumes remain bearish but within their average trading volumes.

- The CRWD correction started a few days before the NASDAQ 100 sell-off, but it should bounce with a NASDAQ 100 advance.

My Call

I am taking a long position in CRWD between 438.09 and 454.00. The balance sheet flashes a few bearish signs, but the recent correction already priced them in. I consider CrowdStrike a buy-the-dip candidate due to its AI-based cybersecurity outlook and acquisitions it made in this sector.

- CRWD Entry Level: Between 438.09 and 454.00

- CRWD Take Profit: Between 517.98 and 528.34

- CRWD Stop Loss: Between 404.63 and 410.57

- Risk/Reward Ratio: 2.39

Ready to trade our free daily signals? Here is our list of the best brokers for trading worth checking out.