Short Trade Idea

Enter your short position between 65.49 (yesterday’s intra-day low) and 66.22 (the intra-day high of its latest bearish candlestick).

Market Index Analysis

- Alliant Energy (LNT) is a member of the S&P 500 Index.

- This index trades near record highs with a rising wedge formation, a bearish chart pattern.

- The Bull Bear Power Indicator of the S&P 500 shows a negative divergence.

Market Sentiment Analysis

Futures remain mixed after NVIDIA reported earnings after the bell yesterday. Despite beating on the top and bottom line, shares dropped amid a second consecutive miss in its data sales segment. Total revenues hit a record, but the growth rate was the slowest since the first quarter of 2024. It fueled concerns about spending in the AI sector and raised concerns over a bubble. GDP data could inject volatility today, but investors await tomorrow’s PCE and Chicago PMI reports.

Top Regulated Brokers

Alliant Energy Fundamental Analysis

Alliant Energy is a utility company. Its subsidiaries include Interstate Power and Light Company, Wisconsin Power and Light Company, and Travero. It provides services to Iowa and Wisconsin.

So, why am I bearish on LNT after a positive earnings release?

Alliant Energy beat earnings expectations, driven by a one-time tax credit of $162 million. The return on invested capital remains discouraging, and LNT shareholders face value destruction from the current business model. The balance sheet remains shaky, and with the revenue miss excluding the tax credit, investors should question the dividend sustainability, as it pays out an unsustainable 60.94% of its income as a dividend.

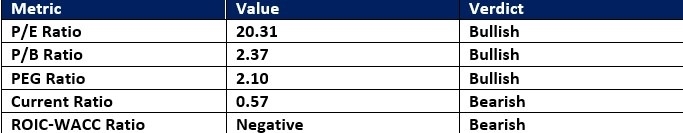

Alliant Energy Fundamental Analysis Snapshot

The price-to-earning (P/E) ratio of 20.31 makes LNT an inexpensive stock. By comparison, the P/E ratio for the S&P 500 is 29.84.

The average analyst price target for LNT is 68.95. It suggests limited upside potential from current levels.

Alliant Energy Technical Analysis

Today’s LNT Signal

Alliant Energy Price Chart

- The LNT D1 chart shows a price action breaking down below its horizontal resistance zone.

- It also shows price action between its ascending 0.0% and 38.2% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator is bullish, with a descending trendline, and approaching a bearish crossover.

- The average bearish trading volumes are higher than the average bullish trading volumes.

- LNT corrected as the S&P 500 pushed higher, a significant bearish trading signal.

Top Regulated Brokers

My Call on Alliant Energy

I am taking a short position in LNT between 65.49 and 66.22. Valuations are lofty for a utility company. There is limited upside potential based on the average analyst price target, and the dismal return on invested capital is equally concerning.

- LNT Entry Level: Between 65.49 and 66.22

- LNT Take Profit: Between 59.62 and 60.91

- LNT Stop Loss: Between 67.11 and 68.95

- Risk/Reward Ratio: 3.62

Ready to trade our daily Forex analysis? We’ve made a list of the best forex trading accounts worth trading with.