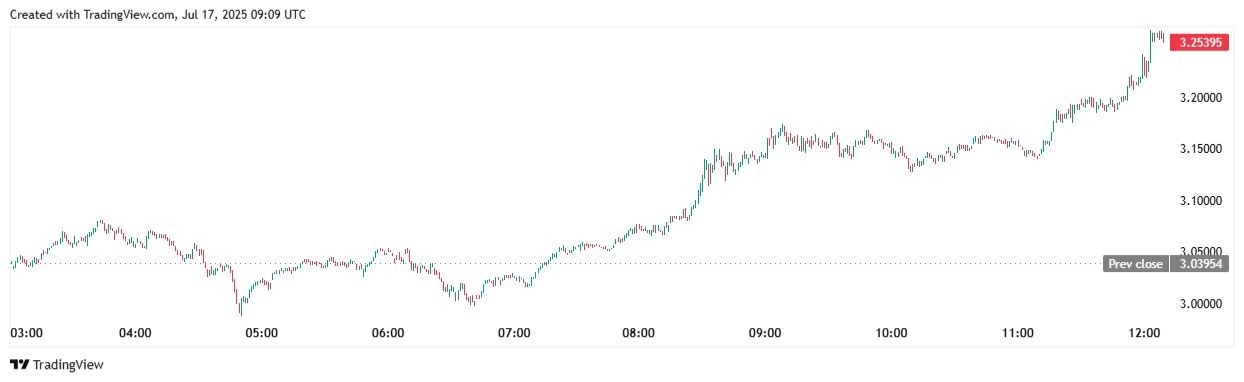

XRP is trading around $3.25, maintaining strong bullish momentum after reclaiming the $3 level earlier this week.

Ripple’s upwards move follows a decisive shift in market sentiment, supported by improving liquidity and renewed confidence in Ripple’s ecosystem.

Price Overview and Recent Performance

XRP has gained nearly 7% in the last 24 hours, extending its weekly surge to over 30%.

XRP Price Chart | Source: TradingView

After consolidating between $2.30 and $2.85 for several weeks, the token broke through the $3 psychological barrier and held the level for three consecutive sessions. This breakout has positioned XRP among the top-performing large-cap cryptos in July.

The broader market environment remains constructive. Bitcoin is trading above $118,000 and Ethereum near $6,400, creating a favorable backdrop for altcoins.

XRP’s sharp move higher indicates the presence of fresh capital and strong directional conviction among buyers.

Support and Resistance Levels

Immediate support now sits between $2.98 and $3.00, an area that flipped from resistance into a key demand zone.

This level has already absorbed intraday profit-taking that reinforces its importance for short-term trend stability. If XRP were to lose this level, the next significant support lies around $2.85, a zone that previously capped downside during the consolidation phase.

On the upside, the first resistance is near $3.20, which coincides with Fibonacci extensions from the previous range.

A daily close above this level could open the path to $3.40, followed by $3.60. A more extended bullish scenario points to $4.50, an area associated with historical highs from the 2021 cycle.

Technical Indicators Remain Bullish

Momentum indicators remain firmly bullish but suggest that the market is approaching overextended conditions. The Relative Strength Index (RSI) has moved above 70, indicating overbought territory.

While this confirms the strength of the rally, it also raises the probability of near-term consolidation or minor pullbacks.

The Moving Average Convergence Divergence (MACD) continues to favor buyers, with a strong positive histogram and the MACD line comfortably above the signal line. The alignment of major exponential moving averages - 20, 50, 100, and 200 - beneath current price levels further confirms an established uptrend.

The price is also riding the upper band of the Bollinger Bands on the daily chart, a classic signal of strong directional bias, though often followed by periods of sideways movement.

On-Chain Metrics and Market Sentiment

Blockchain data shows increased accumulation among large holders. Whale wallets have added over 190 million XRP this week, reversing the distribution trend observed earlier in the year.

The total number of addresses holding significant XRP balances is at its highest level since early 2021, which shows renewed long-term confidence.

Exchange flows present a mixed picture. While accumulation by whales is evident, exchange reserves have also climbed, potentially signaling that some traders are positioning to take profits.

Historically, similar patterns have preceded short-term retracements even during strong uptrends.

Network activity has improved alongside price. Daily active addresses and transaction counts have increased, pointing to growing utility and engagement within the XRP Ledger ecosystem.

Price Scenarios to Watch

If XRP closes decisively above $3.20 with rising volume, the next targets are $3.40 and $3.60. A continuation beyond those levels could set the stage for a retest of $4.50 in the coming weeks. Failure to sustain current levels, on the other hand, may bring the price back to $2.98, with deeper pullbacks finding buyers near $2.85 or even $2.70 in the event of broader market weakness.

Conclusion

XRP has reclaimed a critical price level, supported by strong technical structure and fundamental catalysts. While indicators suggest a short-term cooldown is possible, the broader trend remains bullish.

Traders should watch how XRP behaves around $3.20; whether it consolidates, breaks higher, or loses footing will determine the next phase of this rally.

Ready to trade our technical analysis of Ripple? Here’s our list of the best MT4 crypto brokers worth reviewing.

Top Forex Brokers