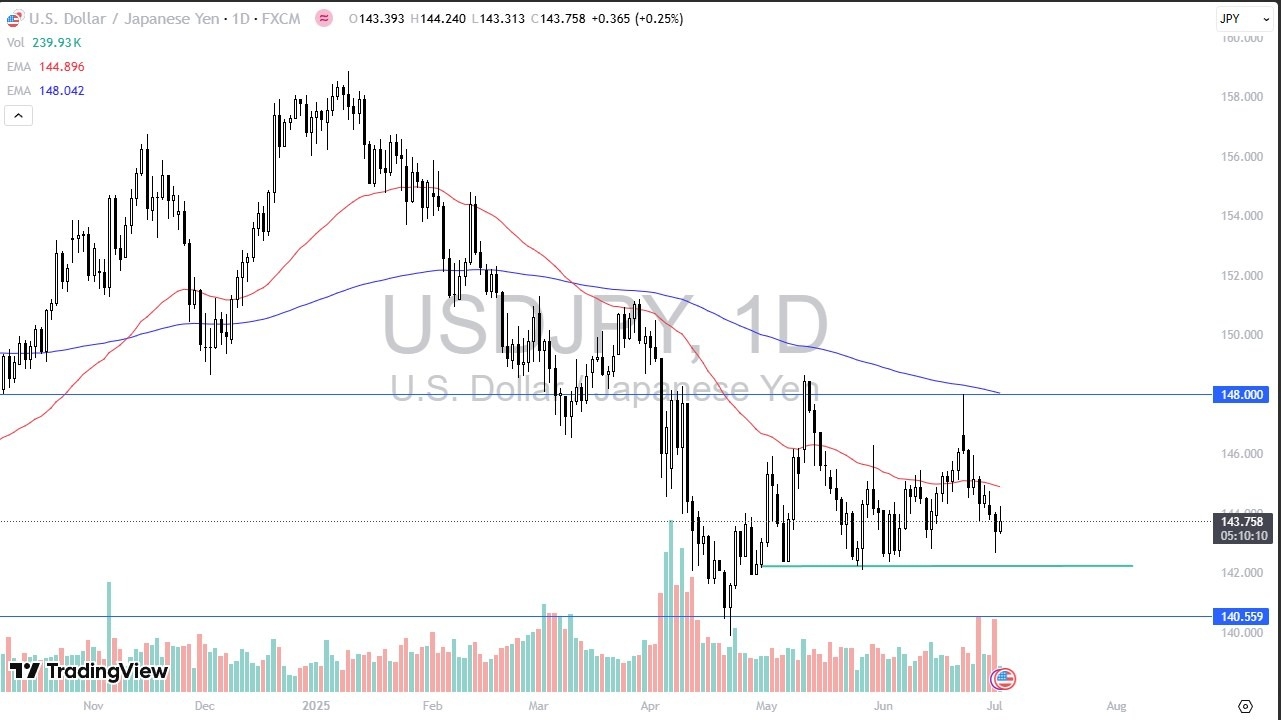

- The US dollar has rallied a bit during the trading session here on Wednesday, but really at this point in time, the market is likely to continue to see a lot of noisy behavior.

- And with that being the case, I think you have to understand that short-term pullbacks will probably get bought into.

- With that being said, I think you've got a situation where what you will be watching more than anything else is how do we pay close attention and react to the non-farm payroll announcement.

The 142 yen level continues to be significant support level here on short-term dips, I think as long as we stay above there, then it’s possible that we could see value hunting here because of the interest rate differential.

Other Important Factors

Top Regulated Brokers

This has been a situation that while the US dollar has been weak, the Japanese have a significant problem with the bond market. So, it's probably only a matter of time before the Bank of Japan has to enter and start quantitative easing. So therefore, I still like the idea of buying the US dollar against the Japanese yen, but I also recognize that perhaps it is going to be a situation where things are going to be rocky. They're going to be noisy.

Hopefully, if you get long on a pullback, you are patient enough to take advantage of the interest rate differential during the swap and waiting on it to go higher. Ultimately, if we break down below the 142 yen level, then we could drop to the 140 yen level. All things being equal, this is a market that I think eventually will find a reason to go to 148 yen, although it could take some time from now to get there.

Want to trade our USD/JPY forex analysis and predictions? Here's a list of forex brokers in Japan to check out.