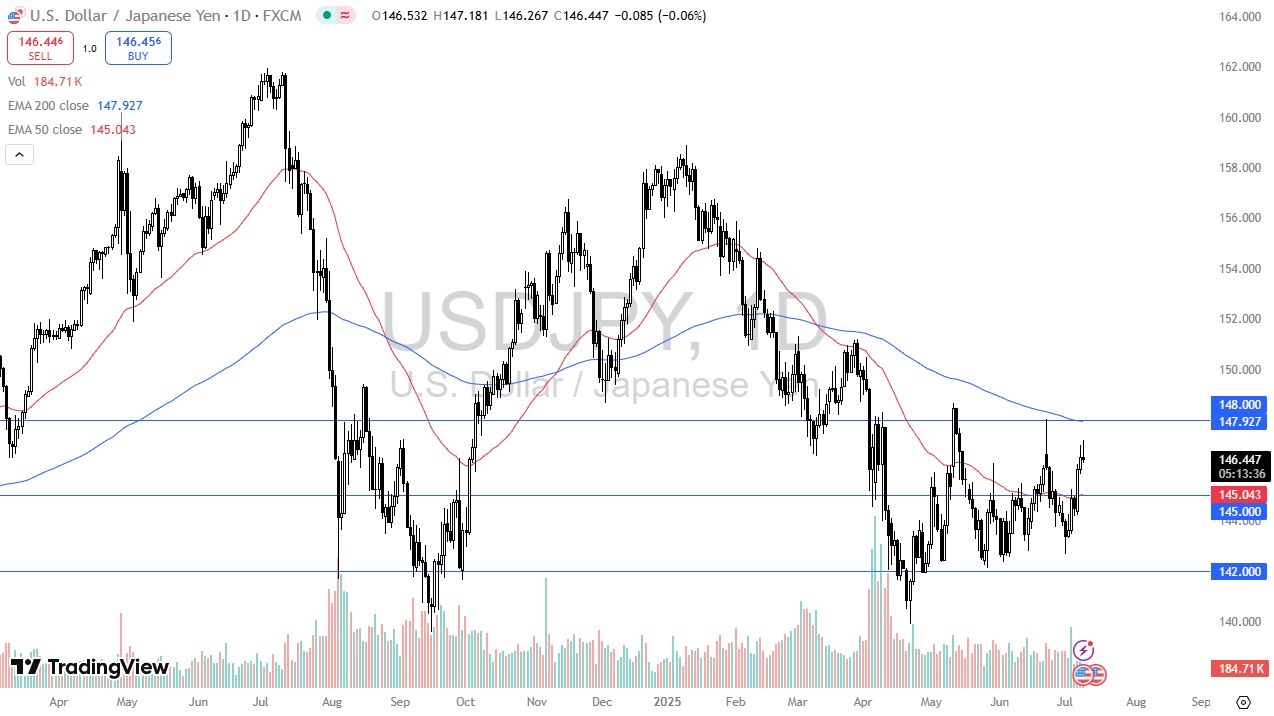

- During the trading session on Wednesday, we see the US dollar rally against the Japanese yen to reach toward the ¥147 level, but it has turned back around to show signs of hesitation.

- This is not a huge surprise, considering that the market has been in a range for what seemed like a lifetime, and we are getting close to the top of it.

Interest Rate Differential

Top Regulated Brokers

I believe that the interest rate differential will eventually propel the US dollar higher against Japanese yen, especially considering the fact that the Japanese bond market is a bit of a disaster at the moment. The Bank of Japan may have to step in and start buying bonds, which is essentially the same thing as quantitative easing, so that could really play havoc on the Japanese yen. That being said, they have not done it yet, so there is a little bit of hesitation and there are a lot of questions asked of whether or not they would actually do it. Or, you also have to keep in mind that we are in a downtrend to get this is area, and typically speaking, consolidation leads to continuation. However, the fundamentals don’t necessarily scream that we should be selling off.

When we do pull back, I’ll be looking for buying opportunities underneath current levels, such as the ¥145 region, followed by the ¥142 region. Ultimately, I think it’s only a matter of time before we see value hunters coming back into the market, but if we were to break above the ¥148 level, then we snap through the 200 Day EMA, which of course would be very bullish to say the least. If that were to happen, then I would anticipate that we have a longer-term “buy-and-hold” type of market. Ultimately, I think we do see a lot of volatility, but I’ll be looking to buy the dip here as we should continue to go back and forth in this range in the short term, before finally breaking out and making a bigger move.

Want to trade our USD/JPY forex analysis and predictions? Here's a list of forex brokers in Japan to check out.