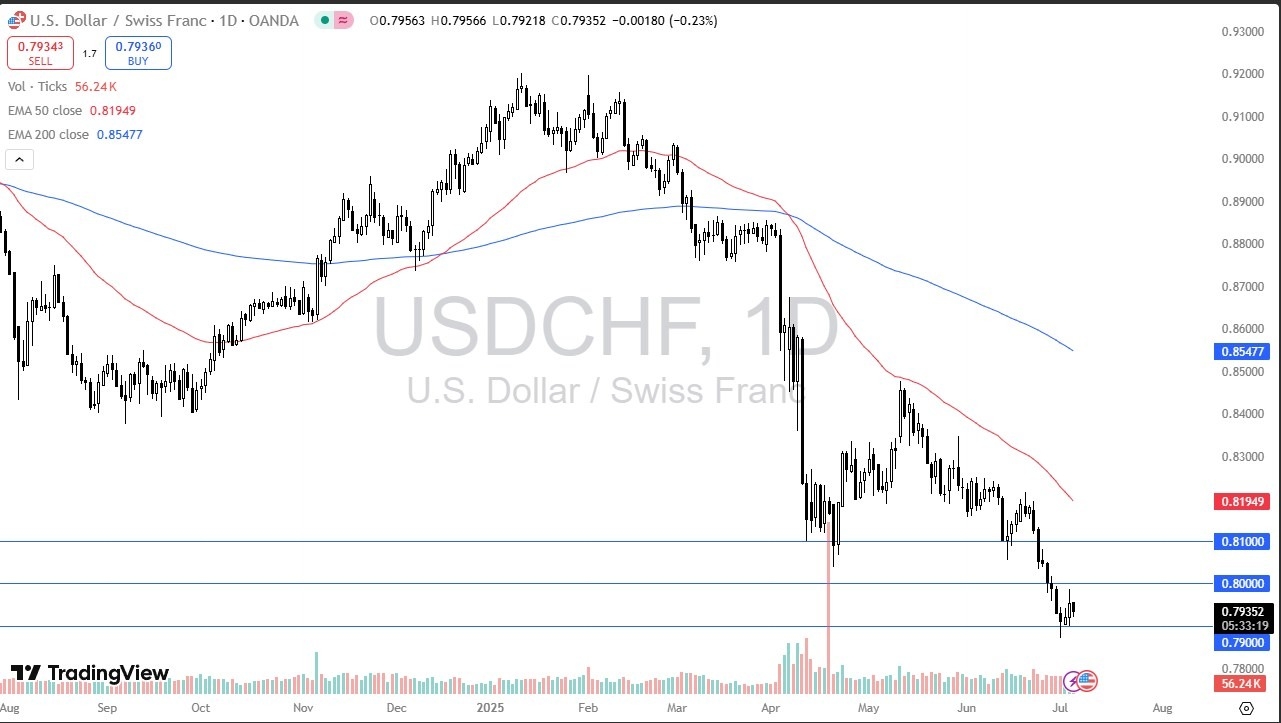

- The US dollar has fallen during the trading session on Friday against the Swiss franc yet again, as we continue to see a lot of US dollar selling overall, and perhaps more importantly in this pair, the Swiss franc buying.

- Ultimately, this is a market that is in an extreme downtrend, and until something changes the gets people excited about owning the US dollar again, it’s very likely that short-term rallies will continue to end up being selling opportunities.

- However, this is a pair that is a little bit different than many others due to one of the biggest players involved in it.

Swiss National Bank

Top Forex Brokers

One of the biggest differences in this pair than many others as the fact that the Swiss National Bank won’t hesitate to start shorting the Swiss franc if it gets a bit too strong. They have blown traders out multiple times in the past when the CHF attracted to much attention, and while it’s not necessarily going to be triggered by the USD/CHF pair, it will of course have a bit of a “knock on effect” over here if we do in fact see the Swiss start to short the Swiss franc, especially against the euro, it’s main trading partner.

This chart tells me that short-term rallies will probably be selling opportunities, perhaps all the way to the 50 Day EMA which is extensively of the 0.82 level. Again though, you need to be aware the fact that the Swiss National Bank could get involved if they have lost their sense of humor and could send this market rallying. The 0.79 level underneath is a significant support level in the short term, and breaking down below there would probably have the USD/CHF pair reaching toward the next large, round, psychologically significant figure in the form of the 0.78 handle.

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.