Potential signal:

- I am a buyer of the US dollar against the Canadian dollar at the 1.3775 level.

- A stop at the 1.3650 level, and a target of at least 1.40 where I would take half off of the position, and move my stop loss to break even.

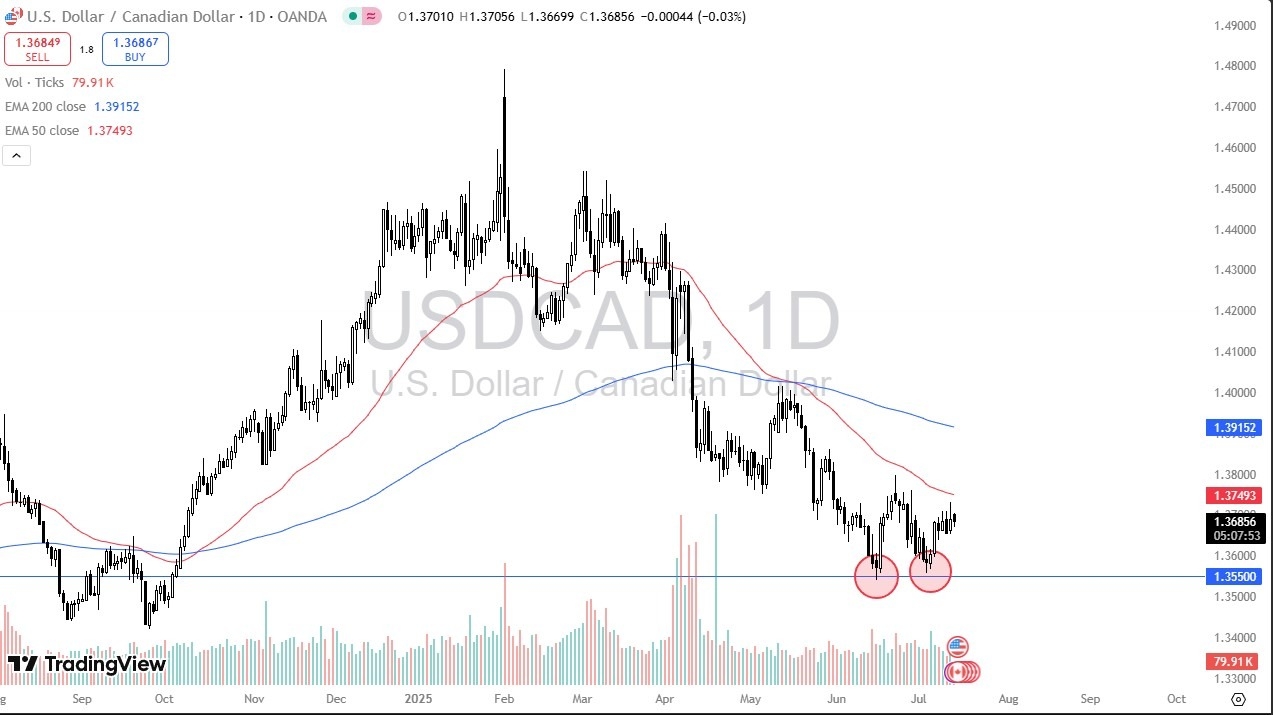

The US dollar has initially gapped higher against the Canadian dollar during the trading session on Monday, as we continue to see a lot of noisy trading, as we have recently formed a bit of a double bottom near the 1.3550 level. The 1.3550 level has been important a couple of times in the past, and it’s the middle of a larger area of interest going back multiple years.

Top Regulated Brokers

The fact that we still respect this area is worth noting, and I think you’ve got a situation here where eventually traders will have to make a little bit of a decision as to whether or not they want to be bullish of the US dollar, or if they are in fact going to continue to press the downside, perhaps trying to break this pair down. I do not think it would be easy to do, as the tariff rhetoric between the United States and Canada continues to heat up. Because of this, the market is one that I am watching closely, but I’m looking for some type of clarity before I get involved.

Potential Set up

I think there’s at least one potential set up here, not a couple of them. The first one is a break above the 1.38 level, because it would not only break above and an obvious area of resistance previously, but would also have the market breaking above the 50 Day EMA. The 50 Day EMA of course does attract a certain amount of attention, and I think a lot of traders will be paying close attention to how we behave there. Breaking above it could open up the possibility of a move to the 200 Day EMA, if not the 1.40 level.

Another potential set up would be a breakdown below the 1.3550 level, but I think you will run into some trouble at the 1.35 level. Anything below that level could open up the possibility of a much deeper drop, and I think at that point in time we would have to watch the US dollar itself against multiple currencies, to see if the overall attitude of the Forex market is still anti-US dollar.

Ready trade our USD/CAD Forex forecast? Here’s some of the best regulated forex brokers in Canada to check out.