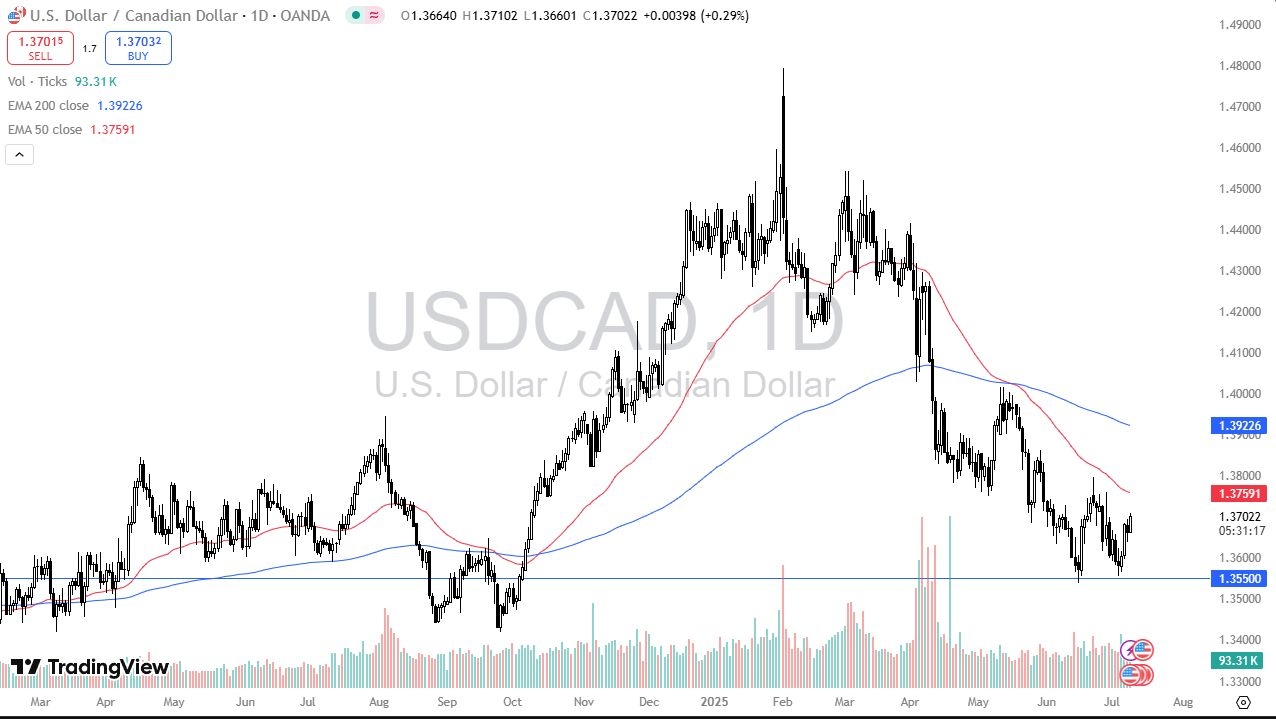

- The US dollar initially rally during the trading session on Wednesday, and quite frankly did not bother looking back against the Canadian dollar.

- We are in the midst of trying to form some type of larger “double bottom”, so it’ll be interesting to see how this plays out from here.

- The FOMC Meeting Minutes are going to come and go late in the session, but quite frankly the Federal Reserve has made its intentions fairly obvious as of late, so it’s likely that it won’t be a mover.

Massive Level

Top Regulated Brokers

There is what I believe is a massive level underneath near the 1.3550 level, and that is the bottom of the “double bottom” that we are in the midst of forming. That being said, we also have to pay attention to the 50 Day EMA above, which is closer to the 1.3760 area. If the market were to break above there, it would be a very strong turn of events for the US dollar, and we might see US dollar strength around the world if that does in fact happen. After all, as a general rule, the US dollar moves in the same direction against most currencies, so you can essentially say “if you get the US dollar correct, you get the Forex markets correct.”

If we were to break down below the 1.3550 level, then we could drop to the 1.35 level, which is also a support level worth paying attention to as well. If we were to break down below the 1.35 level, then it could be very negative for this pair, and we could drop rather significantly. Ultimately, this is a market that I think continues to see a lot of noise in this area, but keep in mind that the interest rate differential continues to favor the dollar. I think that ends up being the case, and therefore buyers will continue to focus on getting paid at the end of every day.

Ready to to trade our daily USD/CAD analysis? We’ve made a list of the best forex brokers accepting Canadian clients to trade Forex worth using.