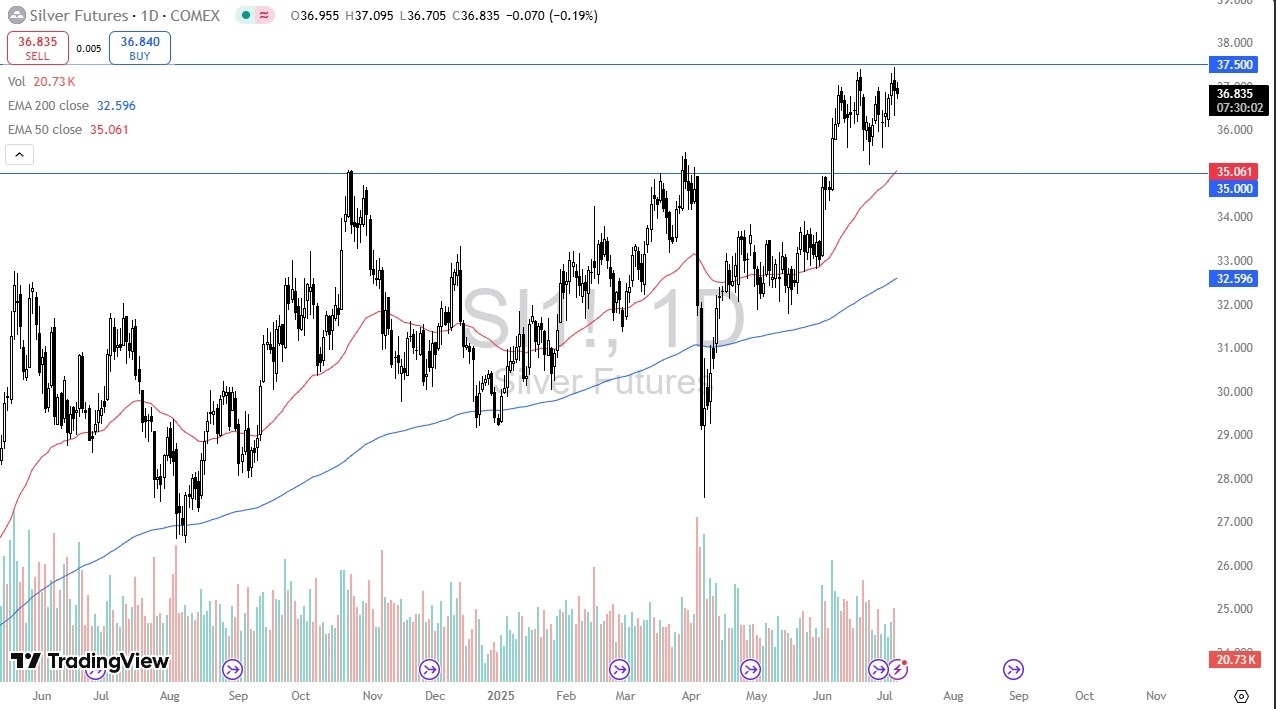

Potential signal:

- I’m a buyer of silver at the $37.60 level, with a stop loss at $37.

- I’d be aiming for $39.20 level.

The silver market has gone back and forth during the early hours on Tuesday, as we continue to see a lot of resistance just above. Ultimately, the market is likely to continue to see a lot of back-and-forth trading in general, as we are looking at a major ceiling in the form of $37.50. This, of course, is an area that’s been difficult to get above, but if we do, it will capture a lot of attention.

Consolidation

Top Regulated Brokers

I believe that this is a market that is simply consolidating after a massive move to the upside, but quite frankly, I’m not looking to get short anytime soon. Because of this, I think you have a situation where traders continue to look at dips as potential buying opportunities, but we also don’t have any real external factor to get silver moving. Keep in mind that there is a negative correlation to the US dollar most of the time, but not always. Furthermore, we also have to keep in mind that the market may be trying to figure out what the industrial demand situation might be, as the economy around the world is a bit mixed, but it is worth noting that the job numbers in the United States remain strong.

Ultimately, the market can’t go in one direction forever, and I think you’ve got a situation where anytime we do pull back, it will offer value. The $35 level is a massive support level, and it’s not until we break significantly below there that I would be concerned about the overall trend. If that were to be broken to the downside, it would be a completely different situation, but right now that doesn’t look very likely. I think if we can break above the $37.50 level, then you would have to get bullish again, mainly because the momentum will be picking up. At that point in time, it would not surprise me at all to go looking toward the $40 level, which of course is the next large, round, psychologically significant figure.

Ready to trade our daily forex analysis? Here are the best Silver trading platforms to choose from.