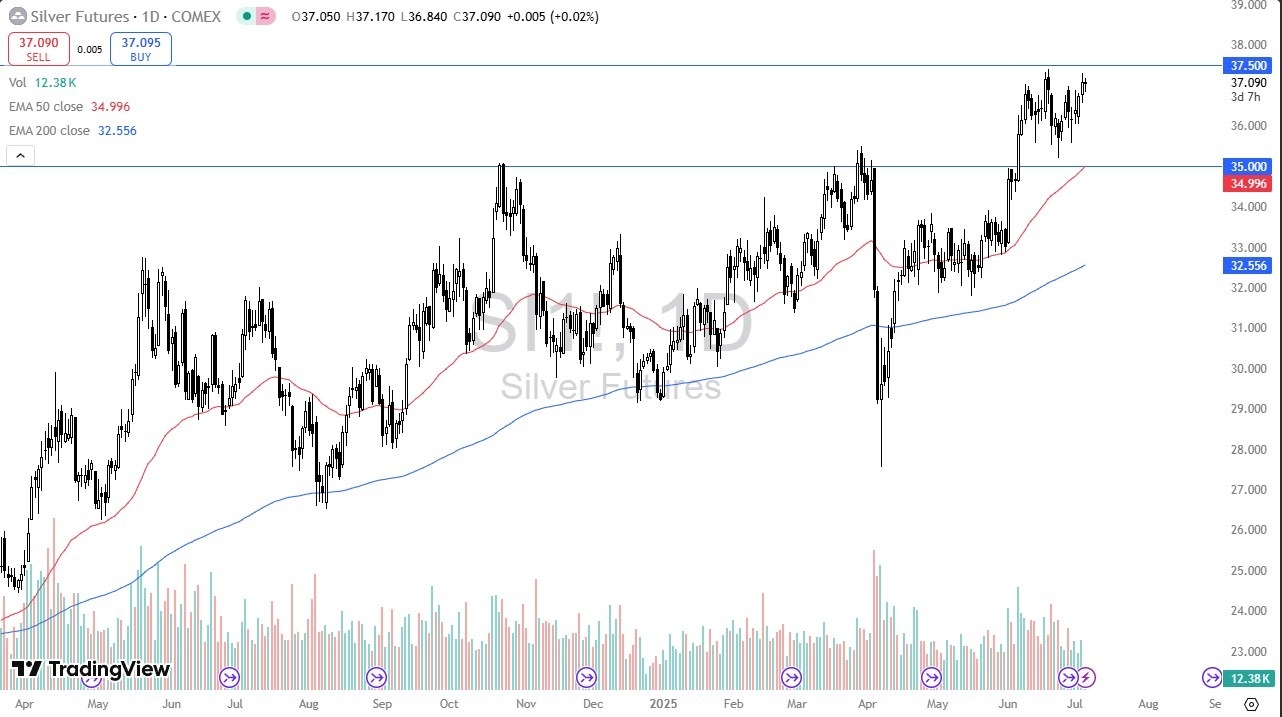

- Silver has gone back and forth in rather choppy trading during the trading session on Friday, as it was a shortened holiday session.

- After all, it was Independence Day, and the market is likely to see a lot of questions asked about the $37.50 level above.

- And it has been massive resistance I wouldn't read too much into the price action on Friday, obviously almost nobody was at work, and it would have been basically Asian and European traders, which in the futures market is not necessarily a lot. London maybe being the exception.

So, with that being said, short-term pullbacks, I think there will continue to be buying opportunities, and I do look at the $37.50 level as a very difficult barrier to break out of. If we do, then you extrapolate the measured move of the consolidation between $37.50 and the $35 level for a target of $40.

Top Forex Brokers

Consolidation in this Market

Silver has been consolidating for a while, working off the massive momentum that we had picked up on the way to get here. I think that the $35 level is also starting to be backed up by the 50 day EMA. So, it does continue to be at a very important level. If you add patience, you can buy dips in silver and take advantage of this overall uptrend, but I do think that choppiness is probably a feature, not a bug, of this market.

Pay attention to the US dollar. If it starts to sell off, that probably helps silver as well, as typically the correlation between the two markets is extraordinarily negative. If we break down below the $35 level, something that I don't expect to see anytime soon, we could drop down to $33.50 where we had seen action previously. Again, though, I don't think that's a very likely outcome.

Ready to trade our daily Forex forecast? Here’s a list of some of the Top Silver Trading Brokers to choose from.