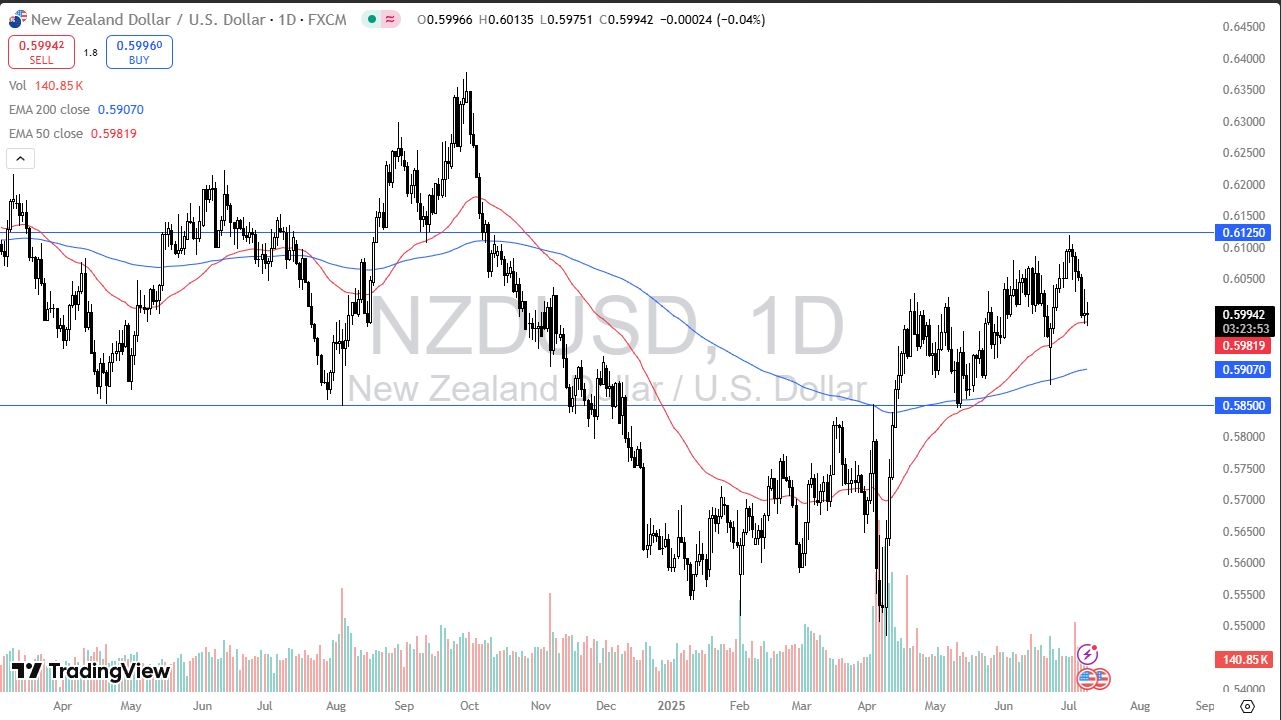

- The New Zealand dollar has been back and forth during the trading session on Wednesday as we sit just above the 50 day EMA.

- That being said, the market is likely to continue to see a lot of volatility in this area, mainly due to the fact that it's right in the middle of the larger consolidation area between 0.6125 at the top and 0.5850 at the bottom.

- But the 50-day EMA does come into the picture as a technical support and resistance level quite often.

Keep in mind that the central bank in New Zealand chose not to do anything with the rates and the inverted hammer from the previous session does suggest that there's a certain amount of pressure on the New Zealand dollar as it fell hard on Monday and could not get back some of those losses or at least hang on to the gains to mitigate those.

Recent Uptrend Channel

The market has been in a relative uptrend as of late. I think you could probably make an argument for a bit of a parallel channel here, although it is a little messy. And it's because of this that I'm watching this pair very closely because I do believe that if we start to break down again, we could see a drop down to the 0.5850 level.

Top Forex Brokers

Keep in mind that the New Zealand dollar is highly sensitive to risk appetite. So that is worth watching as well. Of course, the US dollar has been oversold for quite some time. Now, maybe not necessarily in the New Zealand dollar itself, but just overall in the Forex world. So, with that being the case, I think you have to look at this as a situation where you are looking at short-term rallies as potential selling opportunities, at least until proven otherwise. Ultimately, I think this is a messy market, but we are getting a little bit exhausted.

Ready to trade our Forex daily analysis and predictions? Check out the best forex brokers in New Zealand worth using.