- Nvidia skyrocketed during the trading session on Tuesday, despite the fact that the overall markets were only so-so as far as momentum is concerned.

- Quite frankly, the market is reacting to the fact that Nvidia is getting the green light from the trough administration to sell certain AI chips to China.

- This opens up one of the world’s largest markets, so it’s no huge surprise to see that Nvidia rallied roughly 5% midday.

Technical Analysis

Top Forex Brokers

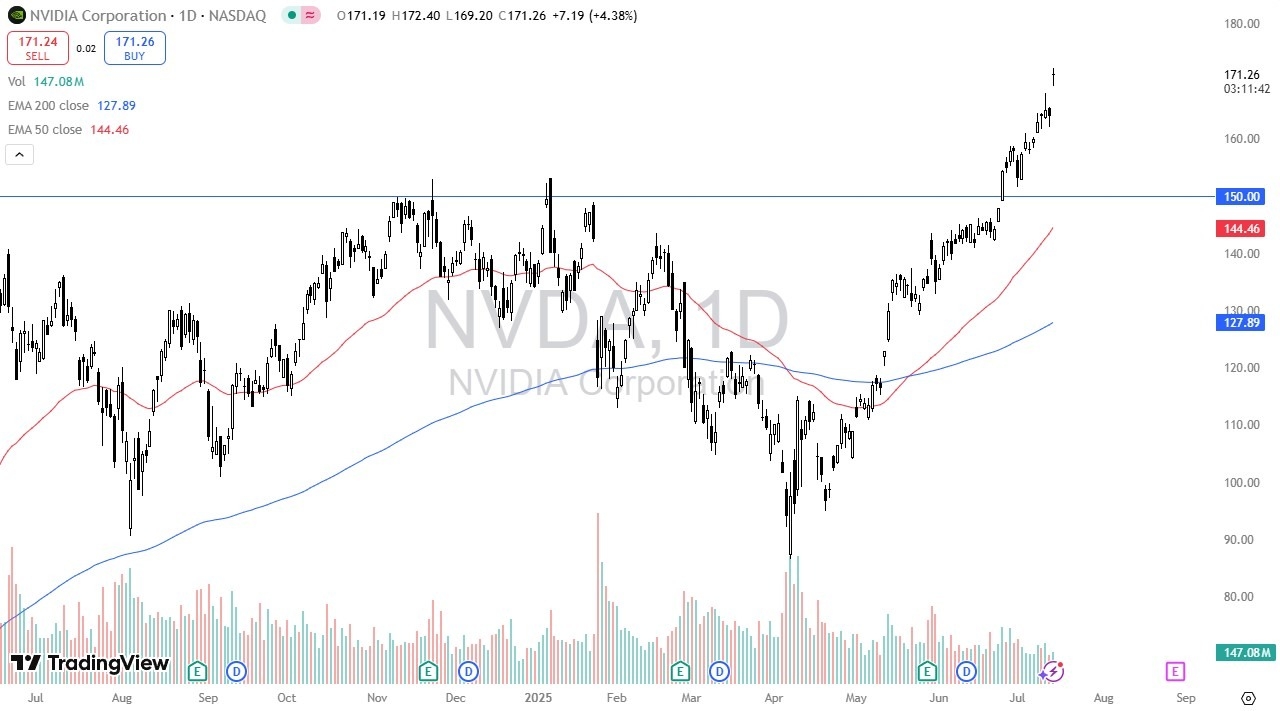

The technical analysis for Nvidia is obviously very bullish, and quite frankly it has been for some time. That being said, we are a little bit stretched, so I would like to see some type of pullback toward the $165 level to get long. The 50 day EMA is near the $145 level and is rising, perhaps trying to get to the $150 level. I find that interesting, because the $150 level at this point in time probably defines the entire trend. Anything below opens up the possibility of a complete turnaround, but I don’t think that happens anytime soon. To the upside, I believe that the $175 level probably offers at least a little bit of psychological resistance.

Keep in mind that Nvidia is a mainstay of most institutional traders and funds, including retirement accounts. It’s a play on the idea that AI is going to be a mainstay of our lives going forward, and therefore a lot of longer-term traders or to simply buying and holding. I think there will be a considerable bid in Nvidia because of this, and therefore I have no interest in shorting this market anytime soon. Quite frankly, Nvidia will continue to be a major leader in the stock market, despite the fact that we are a little overbought. I would love to see a $15 drop in the stock, but the likelihood that might be a little bleak at this point. I would settle on a move down to fill the gap from the open today. A break of the top of the candlestick for the session means that we are probably going to enter a new impulsive bullish phase, and I will be part of that as well.

Ready to trade our stock market forecast and analysis? Here are the best CFD stocks brokers to choose from.