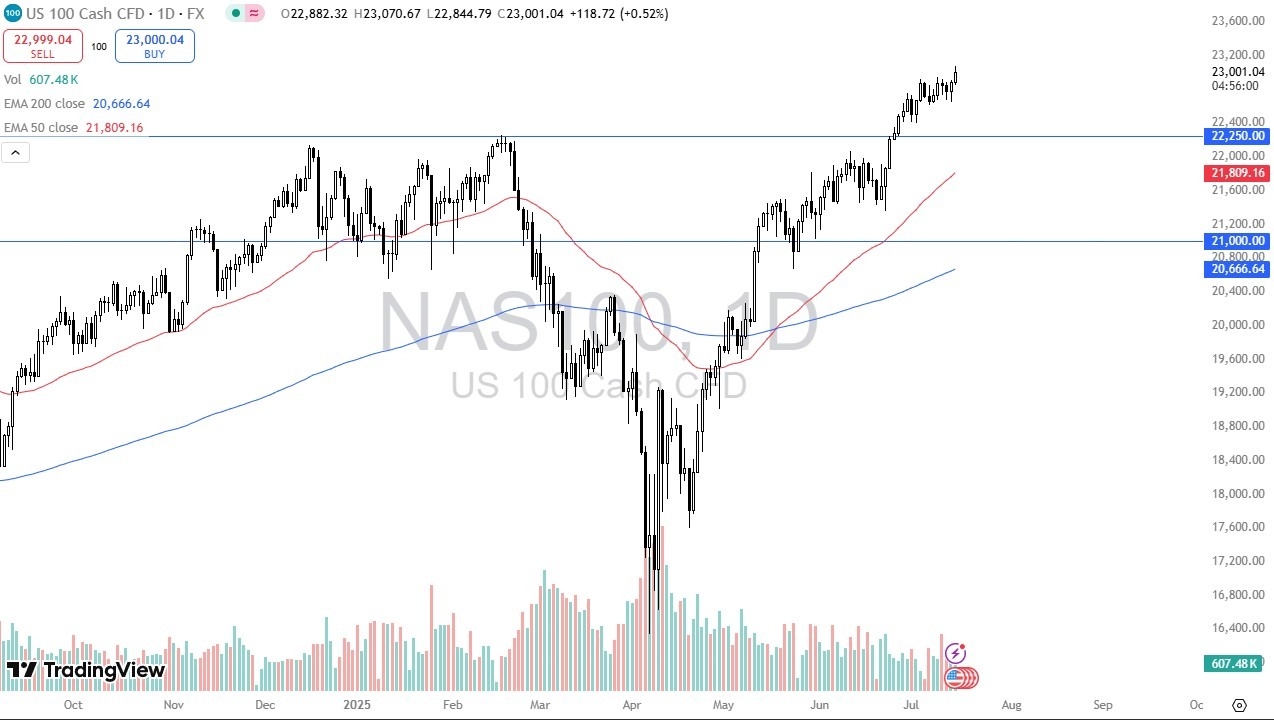

- The NASDAQ 100 is positive for the trading session on Tuesday so far, but really, we saw a big shot above the 23,000 level.

- And now we are giving back a bit of the gains made for the day.

- What this tells me is that although we're most certainly in the uptrend mode at the moment.

The reality is the market might be a little lacking interest and that's mainly because of the seasonality. Quite frankly, we're right in the dead of summer and the volume just isn't there. And in fact, if you look at the chart, you can see it's been drifting lower as we've been rising while this has been a great rally from the bottom.

Volume Has Been a Problem

Top Forex Brokers

The further we get into it, the less volume there is. While I'm not necessarily saying that is a reason to start shorting, I think maybe it's a reason to cut down on some of your expectations. The months of July and August, some years, are just horrible for momentum. We may be in one of those situations and it really wouldn't take a lot to imagine that, especially when you look at it through the prism of random tariff announcements, geopolitics, wars and federal reserve that doesn't necessarily seem to know what it's going to do next.

Most people believe that they're going to cut raids, but honestly, the inflation numbers during the trading session on Tuesday really didn’t scream that they need to be in a rush. So, it's hard to tell really what happens from a day to day perspective in this type of environment. But the one thing that you can do is just simply look at the chart and realize it's going from the lower left to the upper right. But that doesn't mean it's going to get to high levels in a matter of minutes. So, keep that in mind, you're going to have to be very patient.

Ready to trade our stock market forecast and analysis? Here are the best CFD stocks brokers to choose from.