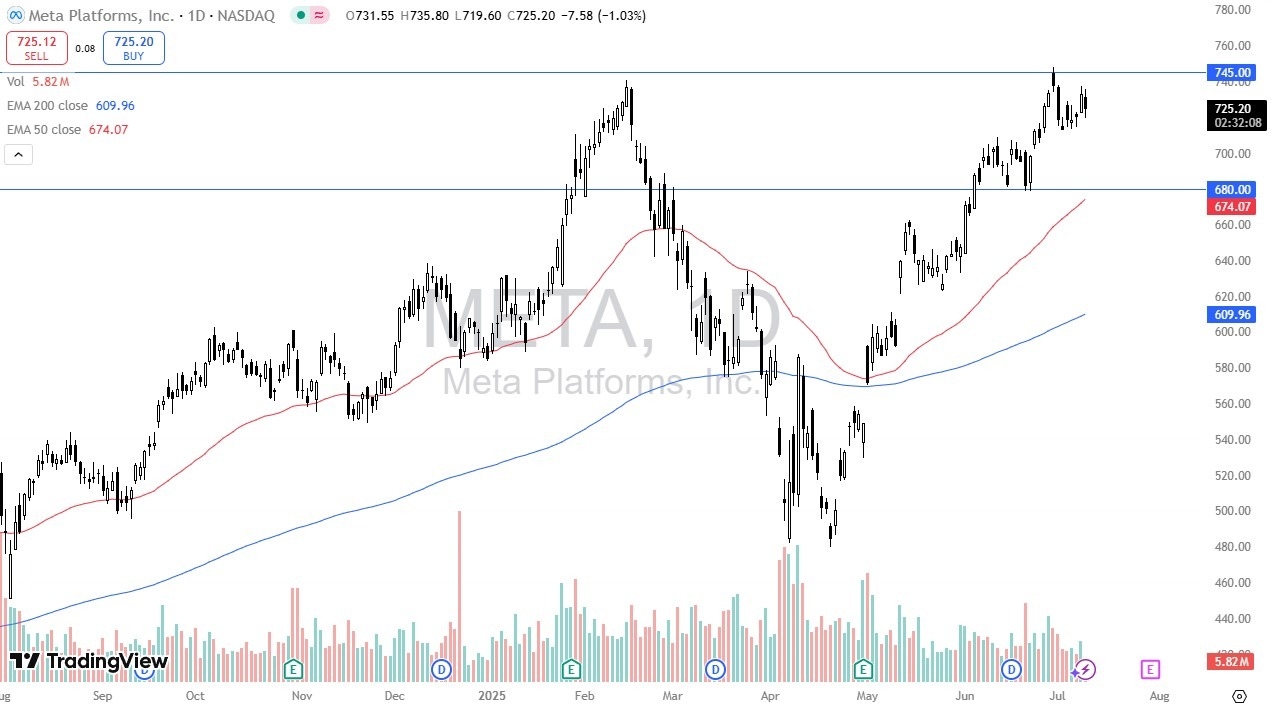

- Meta continues to see a lot of noisy trading here just below the crucial $745 level.

- The $745 level of course is an area that has been a swing high in the last couple of weeks. So, I'll be watching that closely.

- And I think that it probably extends to the $750 level as traders like those large round psychologically significant levels.

Now, having said that, I think a short-term pullback at this point in time probably brings in a lot more buying pressure with the market dropping here. think then we have the possibility of the $700 level offering support followed by the $680 level, which is basically where the 50 day EMA is running toward.

Top Forex Brokers

Shorting is Impossible

Ultimately, this is a scenario where you do not want to get short of this market. And with the 50 day racing, 50 day EMA racing towards the $680 level, it does suggest that perhaps that will become a floor. We'll just have to wait and see. Regardless, the stock market seems to be willing to go higher in general. I don't want Meta to be the outlier here.

I'm not going to try to short stocks at all right now, but Metta of course is one that a lot of institutions own. The one thing I see with the Meta stock that might be worth paying attention to is volume is getting lower and lower. That being said, let's be honest here. That's the truth with most things in the stock market right now. We are in the middle of summer. This is typically a fairly quiet time of year. So that's why I think you're looking for pullbacks in order to find a little bit of value. It can buy you some time to ride the market back to the upside. If we can clear $750, then I think Meta starts to look at $800.

Ready to trade our stock market forecast and analysis? Here are the best CFD stocks brokers to choose from.