- Gold initially gapped lower during the trading session, turned around and rallied and then fell again.

- At this point in time, I think it's safe to say that gold is in a bit of a malaise, although I don't necessarily think it is negative.

- I think we're just in the dead of summer and nobody really wants to put a huge position on in this environment.

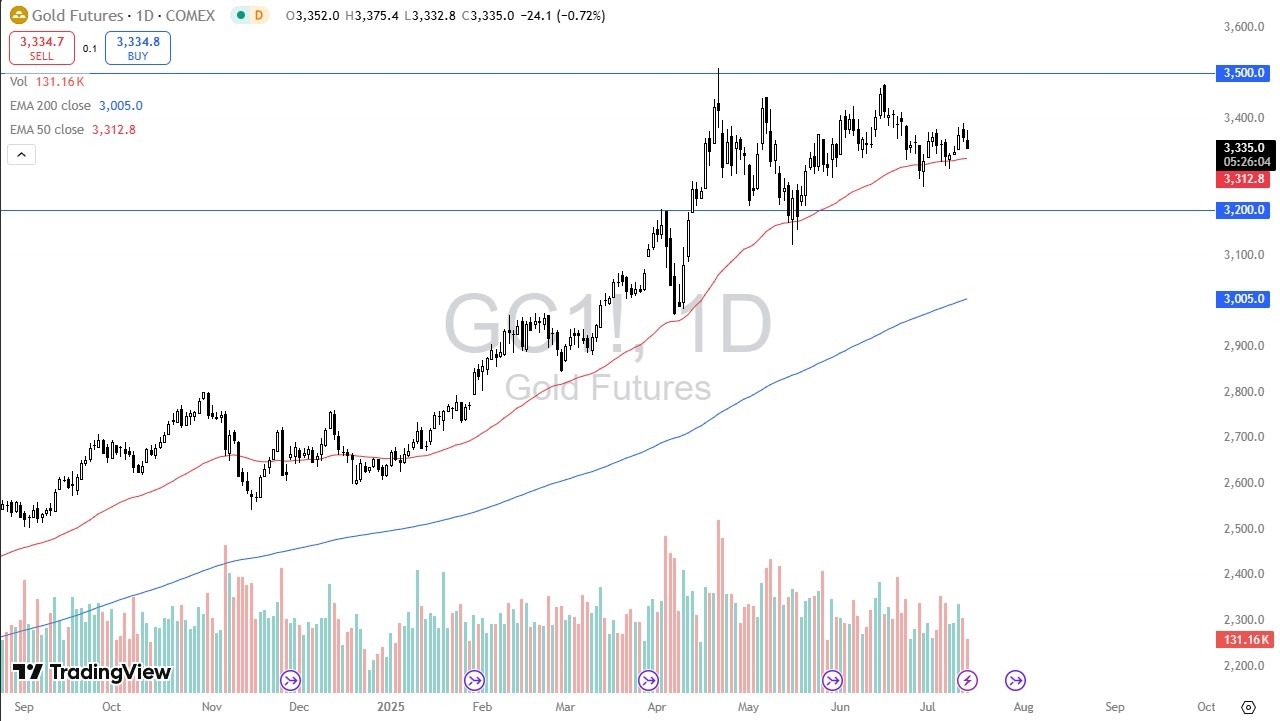

If you look at the chart, you can see that I have a support level near the $3,200 level, as well as a resistance level near the $3,500 level. The market has been in a $300 consolidation range in the last three months or so. And as a result, it just doesn't have anywhere to be. I think a short-term pullback at this point in time is possible, but really, I would put the odds of that at about 50%. I mean, literally this is flip a coin territory here with the 50 day EMA underneath offering support.

Top Regulated Brokers

But if we get a little bit of selling here, I can see gold dropping to $3,200. After all the U.S. dollar is a little oversold anyways, but that doesn't necessarily mean that the trend changes. I can see quite easily a move where we break to the $3,400 level followed by $3,500. And in fact, I do expect that to happen eventually, but I don't know if we get a deeper pullback or correction from here. I'm just being honest. This is a market that I get a lot of email about.

A lot of people really like to trade gold. I think it's just cause it's pretty and shiny. They don't understand how it actually works from a mechanical standpoint. Interest rates in America are fairly high. So, think about it. Would you rather put a billion dollars in treasury, which you will get a high return, or would you like to pay for storage and buy a billion dollars’ worth of gold? Now, there are external factors that work in both directions here. For the most part, they're positive. And that's why I think eventually we will resolve to the upside, but it may take the end of summer.

Central banks around the world continue to buy gold, so that's positive. We have plenty of geopolitical chaos and of course the tariff situation, who knows? Who really knows how that's going to go? At this point, that's chaos too.

Dollar is Oversold as Well

The US dollar being oversold, could lead to stronger dollar in a push to the downside in gold at the same time. So, watch the bond markets if they continue to sell off sooner or later, people prefer that paper. It's just cheaper to get your return that way. Gold had been in a massive uptrend previously. So, spending a few months going sideways isn't completely out of bounds. Speaking of being out of bounds, I'm looking to buy gold on pullbacks closer to $3,200 if I get that opportunity. If we were to break down below there, then $3,000 is your next floor, which happens to be where the 200-day EMA resides.

Ready to trade our Gold price forecast? We’ve made a list of the best Gold trading platforms worth trading with.