- The gold market continues to see a lot of sideways choppy action on Monday, as the markets are still trying to work off the froth from the move higher that we have seen really propel things over the course of several months.

- The gold market continues to see a lot of external factors involving gold, including geopolitics, the US dollar, and of course, central bank gold buying.

Gold Continues to Wait for Something

Top Regulated Brokers

The gold market continues to simply go back and forth, as we are seemingly waiting for something to happen externally. The world is a crazy place at the moment, as tariff talk ramped up over the weekend again. With this, the gold market initially rallied as traders in Asia looked for safety. However, we have since seen rates in the US rise a bit, driving the value of the Dollar higher. With this, the gold market gave back some of its gains, to actually roll over and go negative for the session.

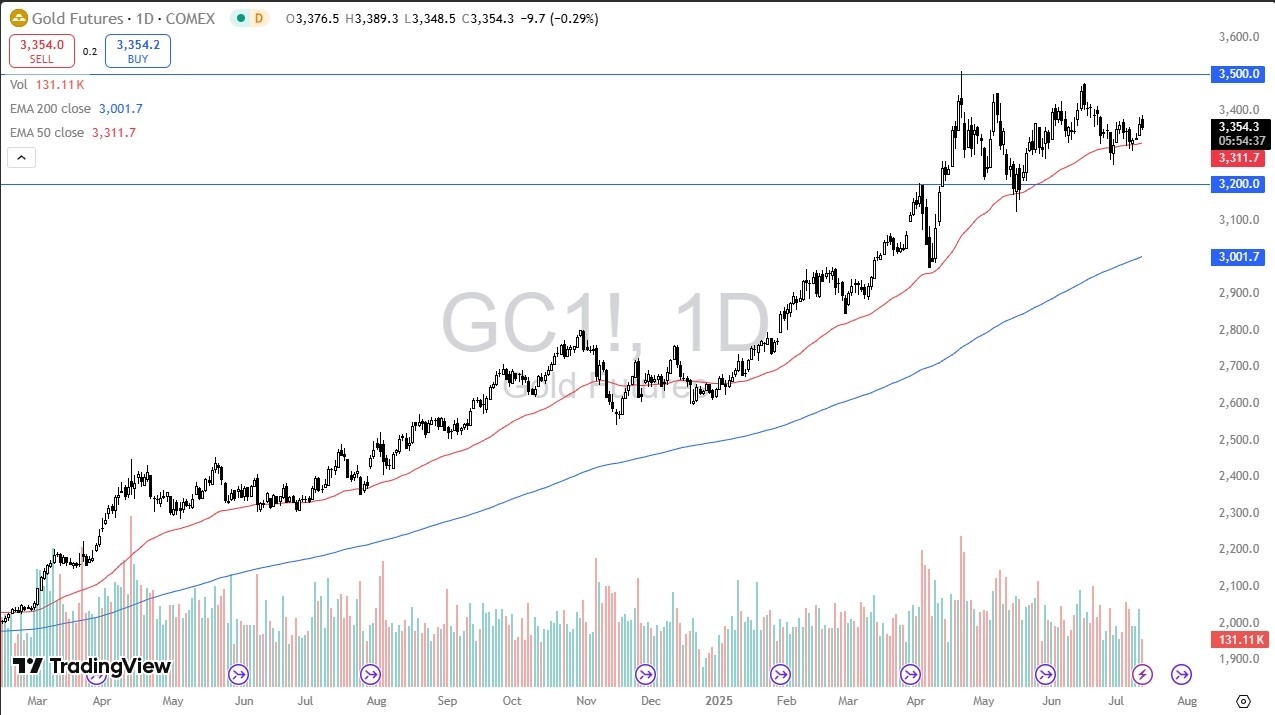

This is not a huge surprise considering how the markets have chosen to go back and forth over the last several weeks and months, and at this point in time I think we need to pay close attention to the 50 Day EMA below, as it is an area that a lot of people will look at as potential support, and quite frankly it has acted somewhat like an uptrend line, so I am watching that very closely. All things being equal, even if we break down below there will be looking for support at the $3200 level. The $3200 level of course is a large, round, psychologically significant figure that a lot of people will be watching, as it has already proven itself to be attractive for both buyers and sellers. A certain amount of “market memory” should continue to be the case there.

To the upside, we have the $3500 level that I think will offer significant resistance and if we were able to go above there and continue, that opens up the possibility of a $300 move based on “the measured move” of the $300 consolidation that we are currently in.

Ready to trade today’s Gold prediction? Here’s a list of some of the best XAU/USD brokers to check out.