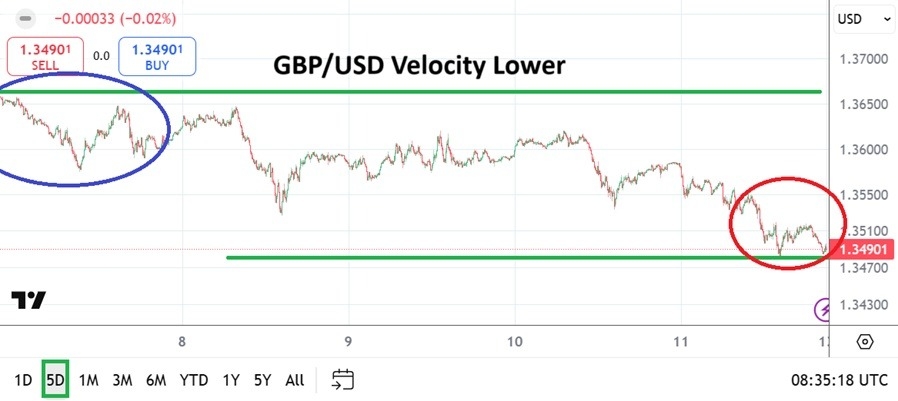

- The GBP/USD is set to begin this week’s trading near the 1.34900 level. The currency pair began last week’s trading around the 1.36790 ratio. The move lower in the GBP/USD did correlate with the broad Forex market as risk adverse tendencies started to build momentum as the week progressed.

- President Trump ramped up tariff threats and caused nervous reactions within financial institutions.

- However, U.K growth numbers this past Friday also came in below expectations and the weaker GDP numbers likely added some fuel to selling pressure in the GBP/USD.

- The stage is set for an immediate test of sentiment early on Monday and it would not be surprising to see some additional momentum lower if large commercial traders in Forex are listening too intently to President Trump’s rhetoric this weekend regarding higher tariff duties for a host of countries.

The U.K is Not a Bubble in Forex

Although the U.S and U.K announced the framework for a tariff deal before, White House threats against other major players like the E.U and Japan are certainly causing some anxiousness in Forex. President Trump’s antics may be looked upon as empty threats by some, but financial institutions are reacting in the short-term and this is having a knock on effect with the GBP/USD.

Top Regulated Brokers

The ability to dive below the 1.35000 level late last week was important, but perhaps the more damaging signal occurred earlier on Friday when the 1.35500 level became vulnerable upon poor economic data from the U.K. Weaker than anticipated numbers from the U.K will cause additional pressure for the Bank of England which has seemingly wanted to remain cautious regarding their monetary policy statements until they know which direction the U.S Fed is leaning.

Speculative Notions Amidst Uncertainty

Talk of tariffs from the U.S White House and poor GDP numbers in the U.K adds outlook shadows which make things murky for financial institutions. President Trump may continue to threaten nations this coming week, and this could cause some more downside to be tested.

- Although the GBP/USD had produced solid momentum higher in the past few months, a test lower during a heightened state of nervousness could develop.

- The U.S will release inflation data this week via the CPI and PPI numbers. Retail Sales will also be published from the U.S later this week.

- As much as some believe the U.S Fed should cut interest rates in late July, uncertainty via tariff negotiations will be words that the Fed likely continues to sing in the coming two weeks.

- This could create headwinds for the GBP/USD near-term.

GBP/USD Weekly Outlook:

Speculative price range for GBP/USD is 1.33850 to 1.37100

Awkward lower momentum was seen this week. Some traders may have believed selling was overdone when the 1.36000 level was challenged on Thursday, but the level did not produce durable support and Friday’s selling built up more power. The price velocity lower on Friday should be a red flag for day traders and make them hesitate just a bit if they believe they think the GBP/USD has been oversold. Perhaps the currency pair will prove to be oversold sooner compared to later, but financial institutions have proven that nerves can become a difficult task to fight if they are uncertain about outlook.

Traders who are convinced the market is oversold and the USD is too strong may be correct, but timing the moment the GBP/USD can shake off its nervousness being displayed for the moment may be difficult and dangerous. If downside pressure continues into Tuesday this could be intriguing for speculators. Tuesday’s CPI numbers from the U.S could prove a Las Vegas like moment. If U.S inflation meets expectations or if it comes in weaker than expected via the CPI ,and the PPI the following day, then the GBP/USD could see some buying develop. Forex markets are likely in for volatility this week as sentiment is put to the test, the GBP/USD will not escape volatility.

Ready to trade our weekly forecast? Check out the best forex trading company in UK worth using.