- The British pound initially did rally a bit during the trading session on Tuesday but gave back those gains as the numbers in the United States, the ISM manufacturing PMI numbers came out a little bit hotter than anticipated.

- Jobs opening listed under the JOLTS number came out much hotter than anticipated.

- So, in other words, the United States isn't falling apart, and people started to lose their mind.

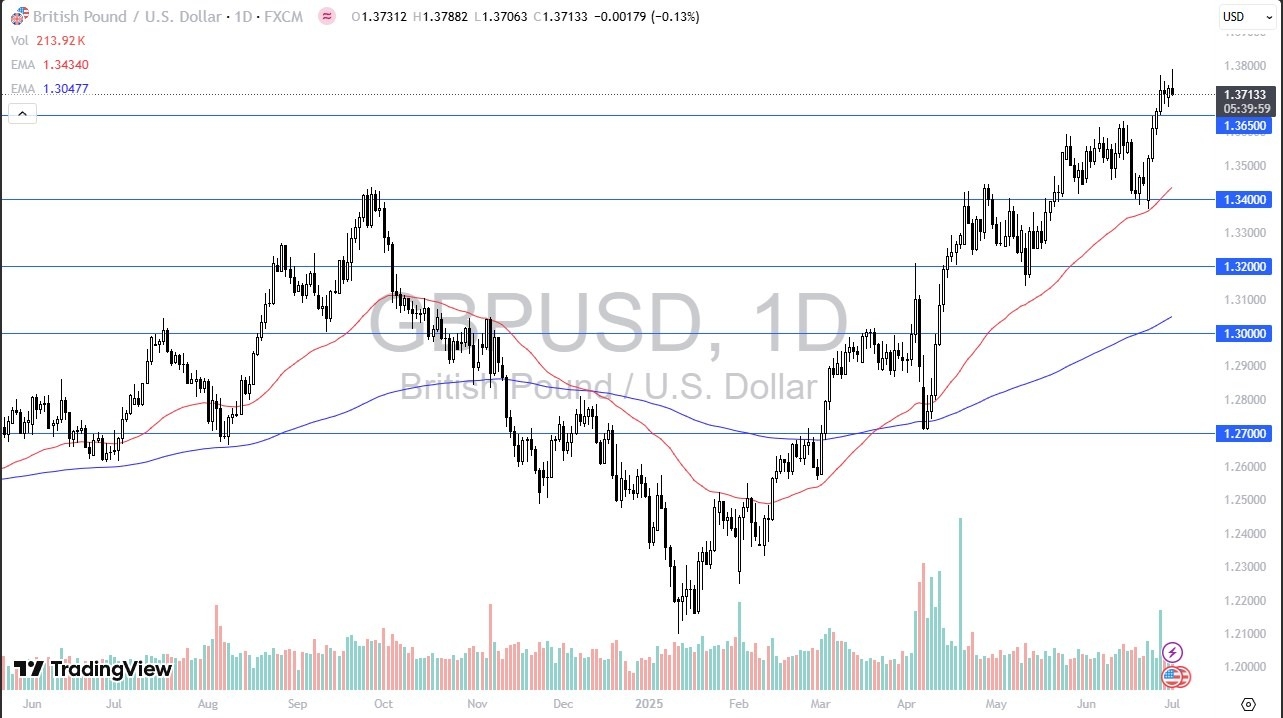

The idea being down the Federal Reserve may not be cut as quickly as people had counted on. This is a continuation of the noise and the chaos that has been the Federal Reserve guessing on interest rates. And it looks like the economy just isn't quite ready to drop, but all things being equal, this is a market that I think sees the 1.3650 level as support.

Top Regulated Brokers

If We Do Drop from Here

If we were to break down below there, then you could be looking at the 50 day EMA all the way down to the 1.34 level. Now, all of that being said, let's not get too far ahead of ourselves. I don't necessarily think that the trend is completely over, but at this point, it's obvious that the US dollar is oversold and this might have been one of the most obvious setups here where the US dollar got sold off so drastically that all it took was a little bit of contradicting news to have everybody freaking out.

That's essentially what we've seen. This shows that maybe there is a lot of “hot money” chasing at this point. Now, all things being equal, this is a market that I think continues to see sideways action with maybe a short term downside to it. Keep in mind though, Thursday is the non-farm payroll number in the United States and that will cause chaos.

Ready to trade the GBP/USD Forex analysis? Check out the best forex trading company in UK worth using.