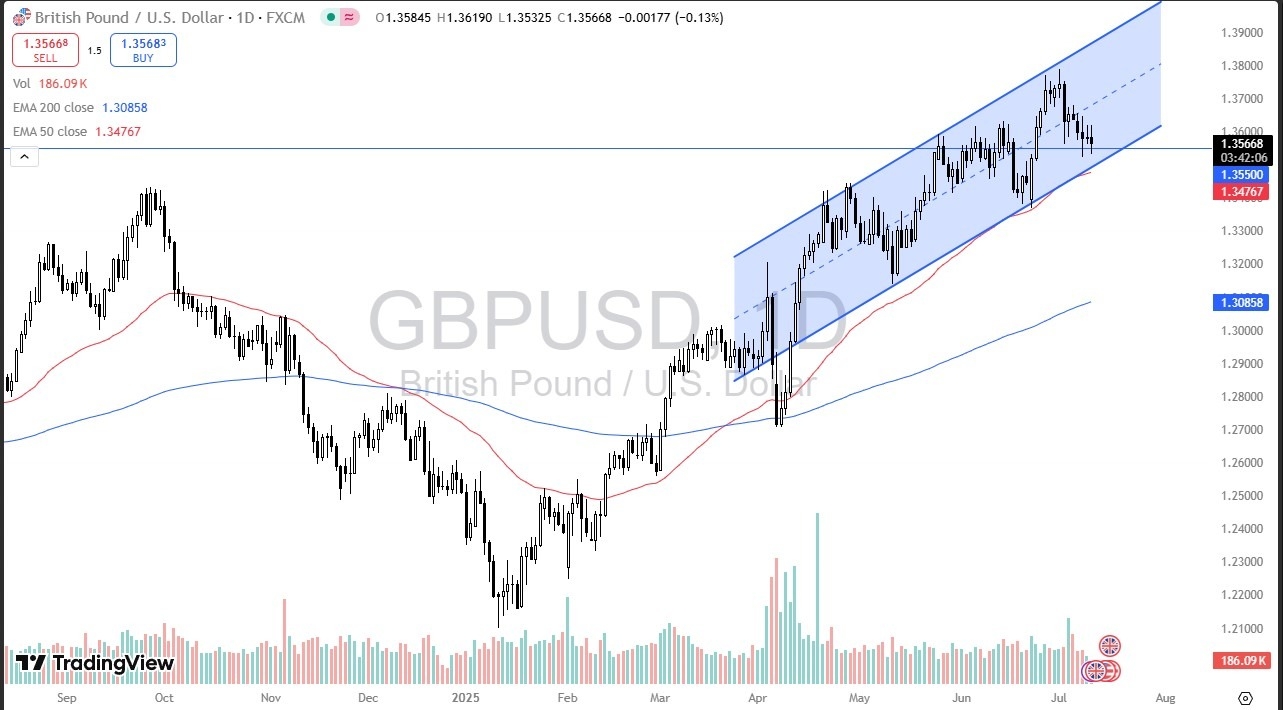

- The British pound has been all over the place during the trading session here on Thursday as we continue to pay close attention to the 1.3550 level.

- As long as this area holds and maybe just a little bit below there at the 50 day EMA, I think you're still in an uptrend.

- After all, you can see that on the chart, I have a significant up trending channel plotted and we have been in that since basically the beginning of April.

With that being the case, there is more of a steady as she goes type of attitude in this market and there's no reason to fight the overall trend. There isn't really a whole lot out there that's going to change things that I can see. And it is worth noting that for quite some time, the British pound has outperformed most of its contemporaries against the US dollar even on the way down in late last year. It just fell less, so it makes sense that as the US dollar struggles, it rises quicker.

The 1.38 Level is Important

Ultimately, I do think that the 1.38 level is worth paying close attention to as it was recent resistance. If we were to break down below that 50-day EMA though, it could open up a move down to roughly 1.3350. Overall, though, if this market does start to sell off, I imagine you're probably going to be better off buying dollars against other currencies because none of them for the most part are as strong as the British pound has been with maybe the recent exception of the euro.

So basically, you would be looking to buy dollars in short Asia, for example. Europe looks relatively strong or at least steady as she goes. And that of course translates into the British pound doing the same thing as the Euro and other European assets. With this, I remain a little bit positive, but I'm not looking for huge moves. I'm just looking for a grind higher.

Top Regulated Brokers

Ready to trade our daily Forex GBP/USD analysis? We’ve made this UK forex brokers list for you to check out.