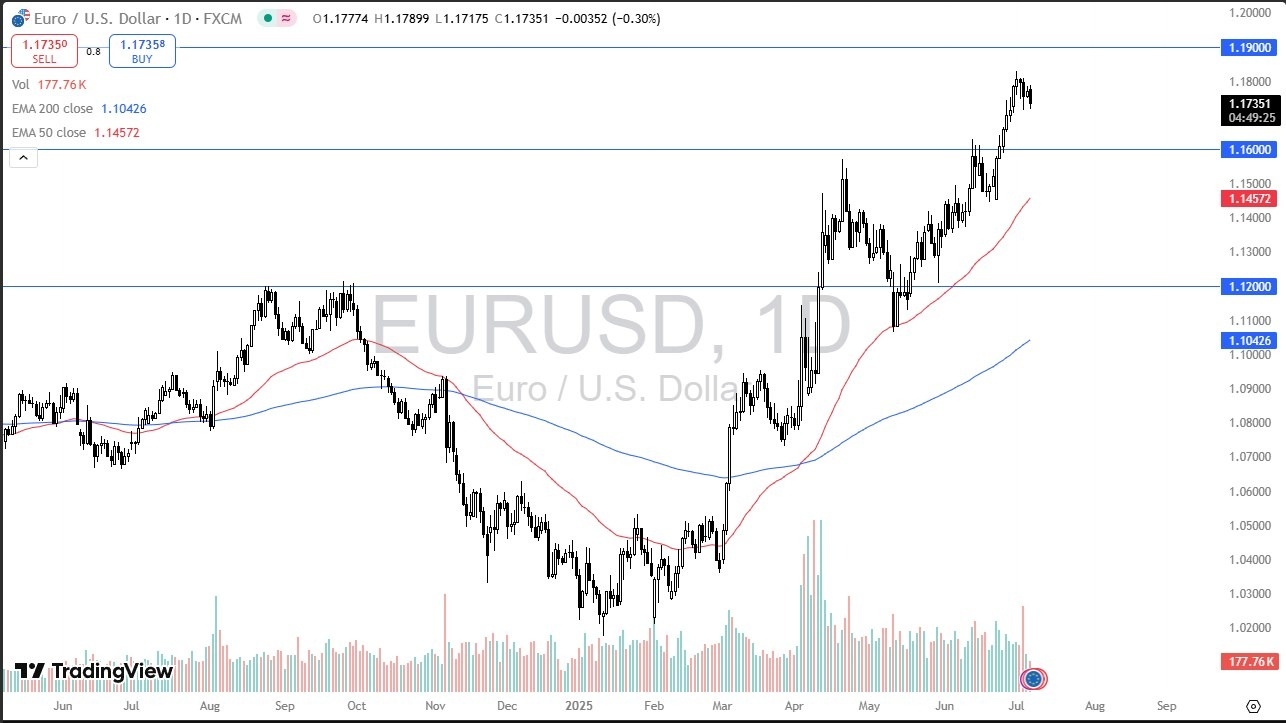

- The euro has fallen pretty significantly during trading here on Monday, as we continue to see a little bit of profit taken in a market that has gotten a bit overstretched.

- Furthermore, the noise coming out of the White House has caused a little bit of chaos in the market, at least later in the day as the White House is now claiming a 25 % tariff on South Korea and Japan is coming in August.

- While that doesn't, at least in theory, directly influence the euro, it suggests that we still have a long way to go before we have any sense of certainty.

Nonetheless, this is a market that's been bullish for a while. And I do think you have a situation where you have to look at this through the prism of just simply taking a bit of a breather.

Euro is Overdone

Quite frankly, the market had been rather overdone. So, it doesn't surprise me at all that we would see this market then perhaps try to fall in order to really see a collecting a profit, if you will, the 1.16 level is an area that I anticipate should offer pretty significant support based on not only psychology, but also the idea of market memory.

If we break down below there, then we start to target the 50 day EMA near the 1.1450 level. And that is an area that I think a lot of technical traders will be watching. If we get below there, then look out below, we really could start to change the trend. All things being equal though, I think we've got a situation where the euro continues to attract inflows. And if that ends up being the case, then I'm willing to buy the dip, especially near the 1.16 level, where I would be very interested in seeing a bounce that I can take advantage of if in fact we get it.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex demo accounts worth trading with.