- The euro fell significantly during the trading session on Tuesday after initially trying to rally, as the Consumer Price Index in the United States came out at 0.2% month over month, and instead of the expected 0.3%.

- Because of this, it suggests that the Federal Reserve is further away from cutting rates than most traders had dreamed of, which quite frankly has been a bit frustrating as it looks a whole lot like the trading public is just now starting to see the reality of the situation.

Trend Remains

Top Regulated Brokers

Despite the fact that I think the US dollar is oversold, especially considering that the Federal Reserve is likely to cut rates in the short term, the reality is that the trend is still to sell the US dollar. That has not changed during the trading session on Tuesday, despite the fact that the Euro has plunged toward a crucial support level.

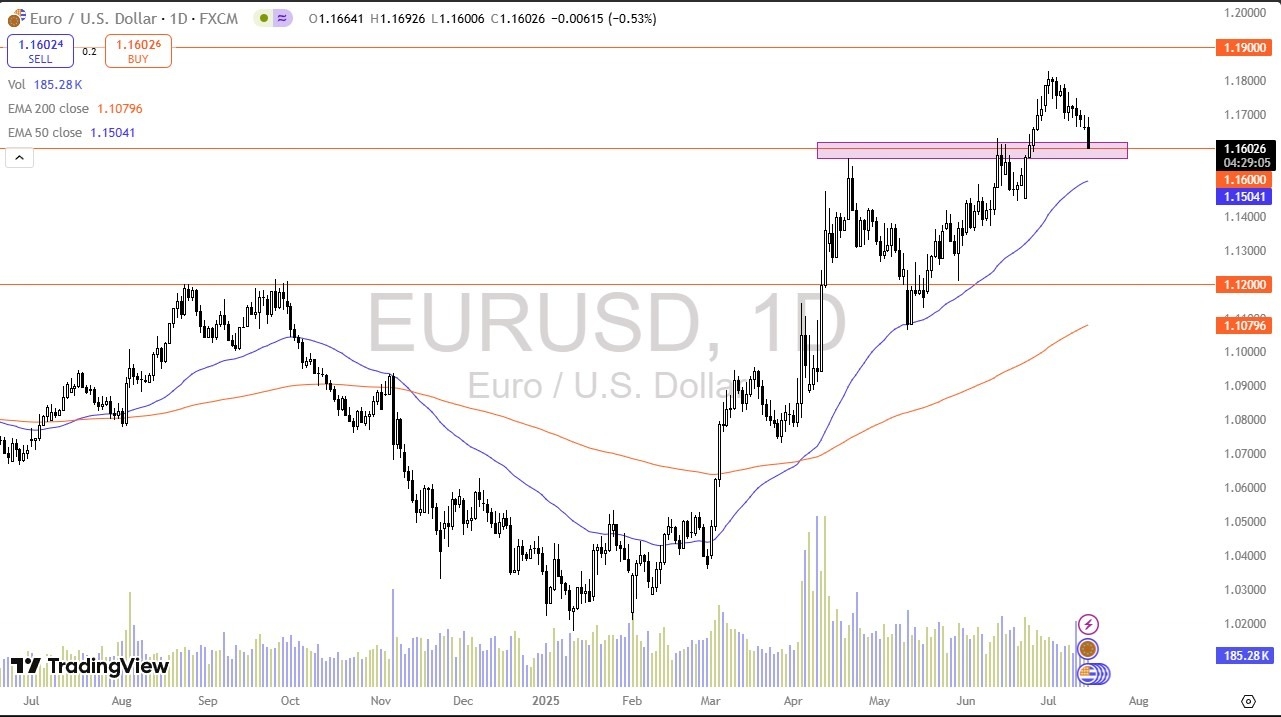

That support level, the 1.16 level, has a certain amount of market memory priced into it due to the fact that it was previous resistance, so I do think this is an area that could cause a bit of a bounce. Even if we were to fall from here, the 1.15 level is even more important, as it is a large, round, psychologically significant figure, but also features the 50 Day EMA, which of course a lot of people will be watching for potential dynamic support.

If we were to turn around and bounce from the 1.16 level, which is where we are as I write this, we could make a bit of a move toward the 1.17 level, possibly even the 1.18 level. However, I think it’s going to take a lot for the euro to continue higher without some type of conflicting information. The euro has been overdone for a while, so I think you’ve got a situation where this might just be the excuse that the market needed to sell and start taking some of the gains that they have enjoyed over the last couple of months.

Ready to trade our EUR/USD analysis and predictions? Here are the best European brokers to choose from.