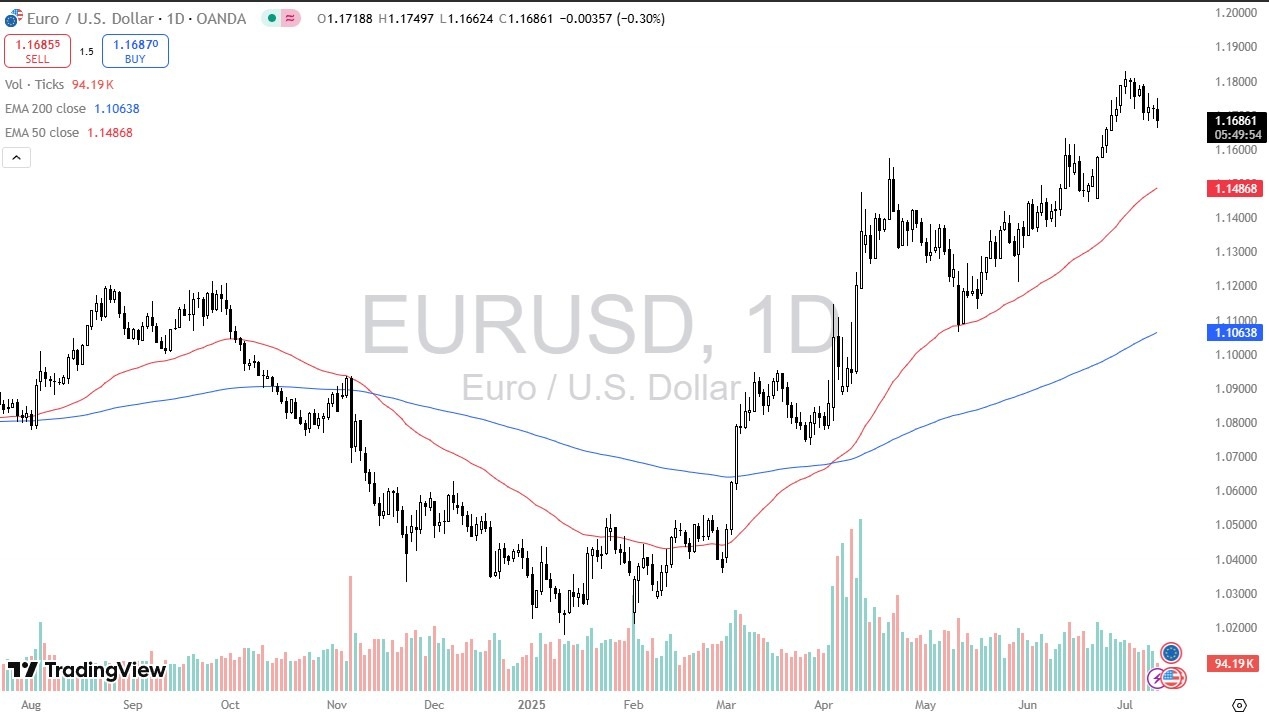

- The euro has pulled back just a bit during the trading session on Thursday, as we continue to see a lot of volatility overall.

- At this point in time, I think the market is just simply pulling back from a little bit of an overextended state, which makes sense as markets cannot go in one direction forever.

- Nonetheless, I do think this is a situation where eventually we will find support, but I am paying close attention to the 1.16 level, because I think it will matter rather significantly.

Technical Analysis

Top Regulated Brokers

When I look at this chart, the 1.16 level is the most obvious support level as was a previous high. After that, we have the 50 Day EMA underneath offering a little bit of support, sitting just below the 1.15 level. That of course is an indicator that a lot of people will be following and therefore could offer a little bit of dynamic support. If we were to break down below there, then I think the euro has a lot of issues. On the other hand, if we were to break above the 1.18 level on a daily close, it could very well open up the possibility of a move to the 1.20 level, but I also recognize that it could be very difficult to get there as we would be grinding to the upside.

If we do fall from here, then it’s likely that the US dollar will strengthen against almost everything. Keep in mind that the euro is a major part of the US Dollar Index, so I think at this point in time it makes a certain amount of sense that you follow this chart, regardless of the pair you are trading. Ultimately, I think this is a market that is overall bullish at the moment, but watch for sudden shifts, because it can give you a bit of a “heads up” against other major currencies as well for the greenback. Remember, if you get the US dollar right, you generally get most things right in the Forex world.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex trading platforms for beginners worth trading with.