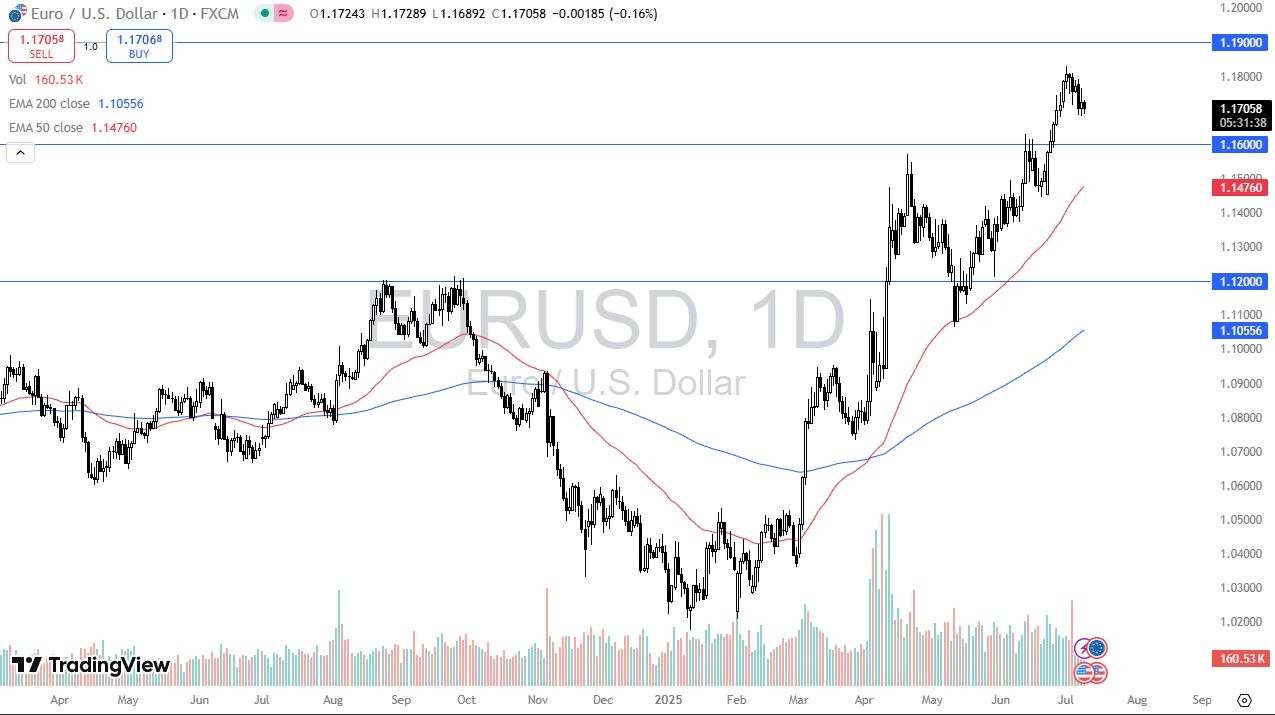

- The euro drifted a little bit lower during the trading session on Wednesday as we continue to see a lot of noisy behavior.

- All things being equal, this is a market that I think is still very bullish, despite the fact that we ended up forming an inverted hammer during the previous session on Tuesday.

- If we were to break down below the bottom of that hammer, then I’ll be looking for the euro to drift down toward the 1.16 level, an area that has been important multiple times.

Technical Analysis

Top Regulated Brokers

The technical analysis for this pair is still very bullish, and therefore you would probably look at a drop down to the 1.16 level as a potential target to the downside, where I would anticipate quite a few buyers jumping in to take advantage of an area that has been important more than once. That was a swing high at one point, and I think you have the very real possibility that a bit of “market memory” comes into the picture.

Anything below there then opens up the possibility of a move down to the 50 Day EMA, which is currently sitting at the 1.1475 level and rising. This has been a nice uptrend for some time, and until proven otherwise, I have to assume that we will continue to see more of the same. If we were to break down below that 50 Day EMA though, then I would have to start to look at the bigger picture and see what the US dollar is doing against everybody else.

The EUR/USD pair is important only because it’s such a huge part of the US Dollar Index, and I rarely trade this market as it just doesn’t move much. Most of the time, it will just chop back and forth, as traders try to kill each other over 50 pips. However, what it does is give you an idea as to where the US dollar might go against other currency pairs. I know that a lot of retail traders like the EUR/USD pair due to the tight spread, but quite frankly I tend to use it more or less as an indicator. At this point, the chart still tells me that the US dollar in general is fairly soft, but it is at least trying to fight back.

Ready to trade our Forex EUR/USD forecast? We’ve shortlisted the best European brokers in the industry for you.