Crypto holders across social media are celebrating as Bitcoin (BTC) rallied to a new all-time high above $123,000 on Monday despite a rocky start to the so-called “Crypto Week” in the U.S.

The “crypto week” moniker comes as Congress debates three pieces of cryptocurrency-focused legislation: the CLARITY Act, the GENIUS Act, and the Anti-CBDC Surveillance State Act. The CLARITY Act aims to define regulatory oversight, the GENIUS Act establishes a stablecoin framework, and the Anti-CBDC Surveillance State Act seeks to ban the creation of a digital dollar.

Excitement about the passage of digital asset regulation sparked a bout of FOMO on Monday, with Bitcoin spiking to a record high of $123,238 in the early morning hours. However, the swift approvals expected by many hit a roadblock amid political infighting, deflating some of the building optimism.

Amid the focus on crypto legislation, market watchers are also closely monitoring statements from the Fed regarding interest rates following the latest Consumer Price Index (CPI) reading, which came in hot, while the Producer Price Index (PPI) cooled more than expected.

The mixed readings on inflation added to the market volatility, with BTC's price swinging more than 6.1% between Monday’s high and Tuesday's low of $115,715. At the time of writing, it is consolidating near support at $118,000.

BTC/USD 1-Day Chart. Source: TradingView

The pullback into consolidation was anticipated by many, as Bitcoin has rallied more than 65% from the April 9 low of $74,440.

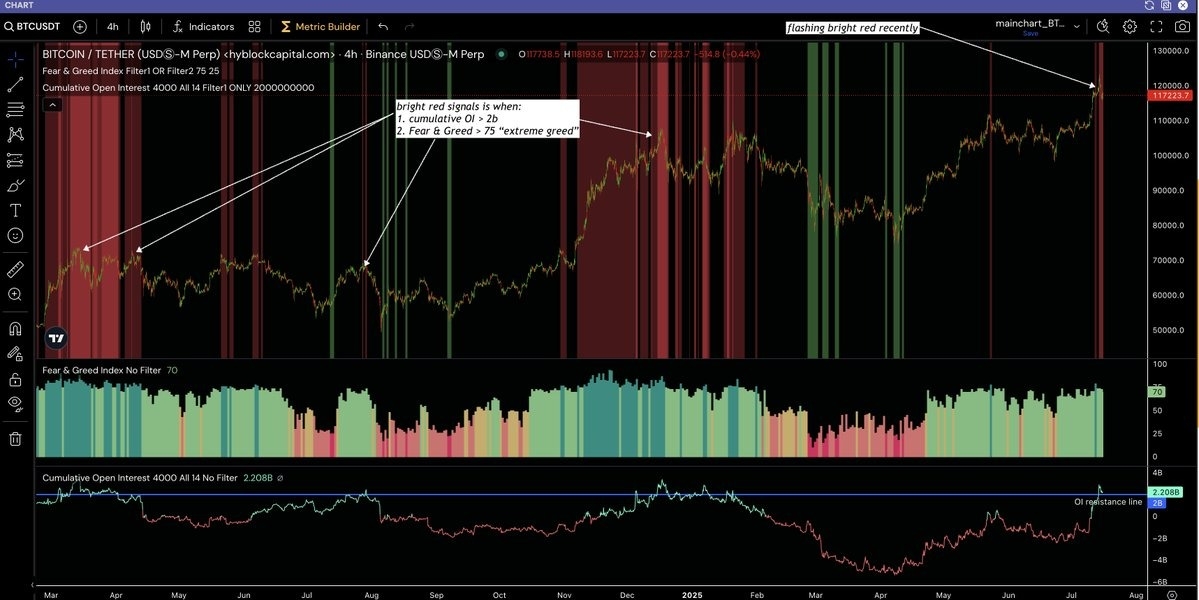

Trading platform Hyblock Capital posted the following chart on X, noting that Bitcoin “Open Interest (OI) is approaching frothy levels again.”

BTC/USD 4-Hour Chart. Source: Hyblock Capital

“Historically, when this happens *and* Fear & Greed Index is in 'Extreme Greed' territories --> we get local tops and corrections,” they added. “Those bright red highlights when both conditions occur. Historically, these play out over much longer timeframes, so don't go rushing into a trade right away.”

That said, most analysts agree that we have not yet reached the top of this market. According to Daan Crypto Trades, “As long as trades well above the Bull Market Support Band, the higher timeframe trend looks strong.”

$BTC Has seen an incredibly consistent and steady trend this cycle.

— Daan Crypto Trades (@DaanCrypto) July 16, 2025

As long as it trades well above the Bull Market Support Band, the higher timeframe trend looks strong.

That does not mean we can't see short/mid term consolidations and corrections. But never lose sight of the… pic.twitter.com/pr1orMXdGl

Ether Shows Building Momentum

Amid Bitcoin’s rally to a new all-time high, Ethereum has also shown increasing strength, up nearly 150% from its April 9 low of $1,380 and trading above $3,330.

ETH/USD 1-Day Chart. Source: TradingView

The rally comes as Ethereum nears its 10th anniversary, and on the heels of its latest update, the Pectra upgrade. As the network continues to mature, blockchain company Consensys says it's evolving beyond a smart contract platform into a foundational layer for verifiable, programmable trust in financial systems and beyond – entering what it calls a “trustware era.”

For evidence, they point to Ethereum’s growing share of tokenized assets, stablecoins, and DeFi applications as early indicators of this shift, predicting that demand for Ether could rise sharply in the coming years.

Rising demand for Ether is seen in ETH futures OI, which hit a record high of $46.58 billion on Wednesday, indicating increased market participation and more capital entering the market and flowing into ETH futures contracts.

Ether futures Aggregate Open Interest, USD. Source: CoinGlass

Analysts across X are growing increasingly bullish on ETH, with price predictions ranging from $5,000 to $25,000.

According to crypto trader Ether Wizz, Ether is showing a similar set up to Bitcoin’s 2020-2021 trajectory, suggesting a rally is imminent.

“The next major resistance level for ETH is around $4K and some consolidation is expected after that,” Ether Wizz said. “Once that's over, $ETH will 2x-3x within 3-4 months,” suggesting it will hit a minimum of $6,500.

Market analyst Mister Crypto highlighted similarities with Ether’s 2017 chart, noting that, “If history repeats, a massive rally is imminent here!”

$ETH is setting up just like it did in the 2017 cycle.

— Mister Crypto (@misterrcrypto) July 16, 2025

If history repeats, a massive rally is imminent here! pic.twitter.com/DDb9BLTGE4

And popular crypto analyst Kaleo is in full-on beast bull mode, suggesting that everyone is underestimating the coming rally and giving ETH a price target of $25,000.

$ETH / #Ethereum

— K A L E O (@CryptoKaleo) July 16, 2025

This is a reminder to raise your targets.

$8K ETH is FUD.

$25K+ ETH is a magnet. pic.twitter.com/r7kDGYuzXT

At the time of writing, Ether trades at $3,348, representing a 20.45% increase on the 7-day chart.

Top Forex Brokers

Ready to trade our analyses of Bitcoin and Ethereum? Here’s our list of the best MT4 crypto brokers worth reviewing.