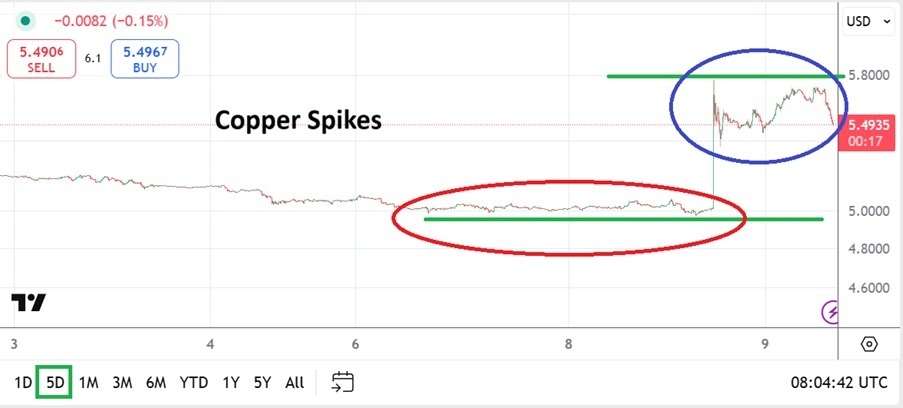

Copper spiked to highs yesterday touching the 5.7800 vicinity as President Trump delivered the gift of fear into the commodity, this by proclaiming he is considering a duty charge of nearly 50% on all imported copper into the U.S.

Most commodity traders do not have to be warned, trading in certain resources can be more than a little volatile. Copper has long been one of the famed commodities which is able to provide not only sudden fireworks, but an occasional roller coaster ride. Yesterday Copper future contracts were languishing calmly near the 4.9800 ratio, when President Trump suddenly threatened to hit imports of Copper into the U.S with a 50% duty charge.

Top Forex Brokers

The price of Copper immediately screamed higher. Day traders and large players who had long positions (buying) of Copper were no doubt elated with the rocket ride upwards. The price of the commodity touched the 5.7800 vicinity yesterday and it is still hovering near 5.5244 as of this writing with lightning quick changes via bids and asks. Traders who were on the wrong side of the copper movement yesterday are likely looking at their trading accounts today and cursing.

Surge Higer and Speculative Notions Based on Noise

In late March of this year Copper was trading near the 5.2500 ratio after a similar amount of noise from President Trump regarding imports of the commodity, and questions about inventory and production capabilities not only in the U.S but globally. Copper will be fast near-term and traders considering pursuit need to use risk management, actually they needed to be using risk taking tactics also yesterday.

Copper will continue to produce wicked price action based on White House rhetoric and fueled additionally by constant whispers in the industrial metals sector. In the month of June, Copper largely started trading from the 4.7500 ratio but by the end of the past month was touching the 5.1000 level with normal price action and slight reversals. Yesterday’s elevator ride must be looked at cautiously, because there is a chance that if President Trump lowers his rhetoric to a calm tone and backs away from this threats that the price of the commodity will prove to be overbought currently.

Loud Noises and Fear in the Copper Market

However, Copper traders need to understand that yesterday’s sudden move higher, while violent is a rather well established trait of trading commodities. Except, that with President Trump in the White House and able to unleash a sudden soundbite that scares the daylights out of industrial producers and suppliers of Copper that there is an extra element of jet fuel ready to ignite at any time.

Tariff discussions will continue into the 1st of August and core metals like Copper will continue to occasionally get attention.

Copper does look overbought at this time, but betting on the commodity to find a ‘safe place’ away from President Trump’s gaze might prove difficult.

Risk premium may stay part of the price action in Copper, keeping it elevated.

Yesterday’s highs may be looked at as extreme resistance, and price action in February and March via six month charts will be needed to gain insights regarding volatility capabilities.

Copper Short-Term Outlook:

Current Resistance: 5.5600

Current Support: 5.4900

High Target: 5.6100

Low Target: 5.4300

Ready to trade our Forex daily forecast? We’ve shortlisted the best forex broker list for you to check out.