Cardano (ADA) is trading around $0.63 today, showing signs of life after a quiet stretch of sideways movement. The crypto has gained roughly 5% in the last 24 hours and rebounded from recent lows as buyers step back in.

Price Levels in Focus

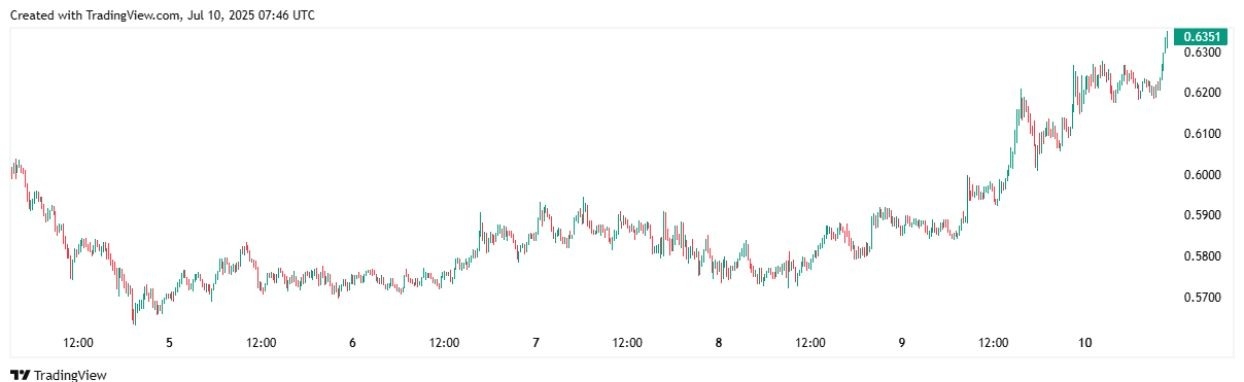

ADA Price Chart | Source: TradingView

Right now, ADA is sitting below $0.64, a level that has capped several breakout attempts over the past month. A decisive close above this barrier would flip the short-term outlook to bullish and open the door for a move toward $0.70.

If buyers can sustain momentum beyond that, the next major target is $0.75, where the 200-day moving average comes into play.

That level could act as a ceiling unless broader market sentiment turns decisively positive.

On the flip side, immediate support sits at $0.61. This level has been held multiple times since late June, acting as a clear line in the sand for bulls. A break below $0.61 could send ADA back toward $0.56, where more substantial support from prior buying interest is expected.

Technical Indicators Flash Early Signs of Strength

The technical picture for Cardano is starting to lean positive, but the signals are still developing. The Relative Strength Index (RSI) is sitting just above 55, a neutral position that leaves room for further upside without flashing overbought warnings.

Meanwhile, the MACD has crossed into bullish territory, with the histogram flipping to positive. This crossover suggests growing momentum, but the move has yet to show the kind of strong follow-through that typically powers larger rallies.

Price action is also pressing up against the 50-day moving average. If the price breaks above this average and holds, it could attract new buyers looking for confirmation of trend reversal.

On-Chain Activity Shows Slow but Steady Improvement

Cardano’s on-chain data is showing gradual improvement. Daily active addresses have ticked higher, which suggests that user engagement is picking up after a quiet spell. Transaction volumes across Cardano-based decentralized applications are also climbing.

Whale activity has quietly shifted as well. After months of steady selling, larger holders have resumed accumulation.

This is not yet happening at the kind of aggressive pace that typically precedes explosive rallies, but it adds a layer of support beneath the price.

Derivatives markets show a modest rise in open interest, with some short positions being squeezed out during the latest price push. This supports the idea that momentum may continue in the short term, provided there is follow-through.

Upcoming Cardano Summit Could Be a Price Catalyst

The next big test for Cardano may come from its own ecosystem. The Cardano Foundation is set to release updates on Hydra, its long-awaited scaling solution, at an upcoming summit. Positive news here could serve as the spark for a sustained move higher.

Broader market conditions also matter. If Bitcoin continues to hold near recent highs, sentiment across altcoins is likely to remain stable. Any macro risk-off event, however, could quickly reverse the current gains.

What Traders Should Watch

For traders, the setup is clear. A clean break and daily close above $0.64 could serve as an entry signal, with upside targets at $0.70 and $0.75. A confirmed move beyond $0.75 would shift the longer-term picture back in favor of bulls.

On the downside, a failure to hold $0.61 could trigger a pullback to $0.56 or lower, at which point risk management becomes essential.

This is still a market in search of conviction. While the signs of a potential breakout are building, volume and follow-through will be key. Without them, ADA risks remaining stuck in its current range.

Ready to trade our technical analysis of Ethereum? Here’s our list of the best MT4 crypto brokers worth reviewing.

Top Forex Brokers