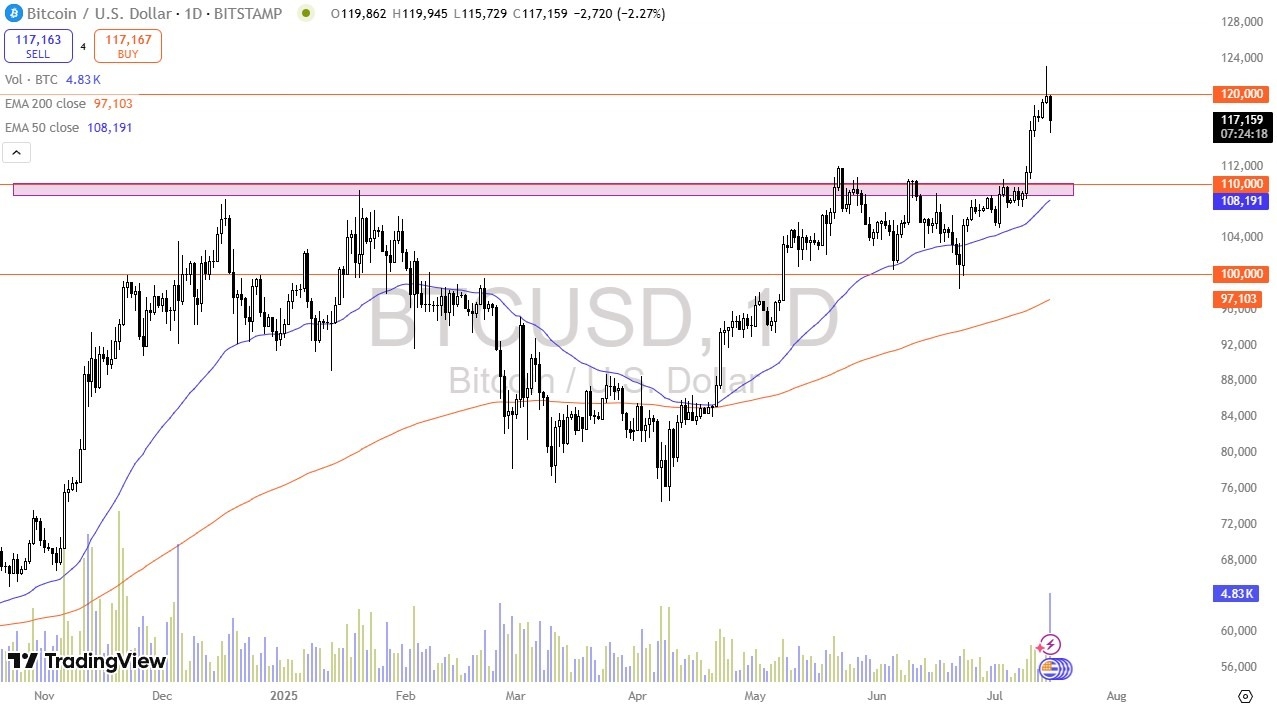

- The bitcoin market has seen a lot of selling during the trading session on Tuesday, which does make a certain amount of sense considering that we had gotten a little bit ahead of ourselves.

- It then ended up forming a massive shooting star for the Monday session that pierced the $120,000 level, only to see sellers come in and push the market down below there.

Buying the Dips

Top Forex Brokers

I think at this point in time most people are looking to buy the dips, and this is the first chance they’ve had to do it for about a week. Even if we were to break down below the bottom of the candlestick for the Tuesday session, I suspect there are plenty of buyers underneath that would be willing to get involved near the $115,000 level, perhaps even the $110,000 level, an area that previously had been significant resistance, and now is starting to attract the attention of the 50 Day EMA indicator, which a lot of people will be more willing to look at as dynamic support if we do get a pullback.

Alternatively, if we simply bounce from here, and at the end of the day it looks like we are at least trying to do exactly that, a break above the candlestick from the Monday session could open up even more strength and momentum, sending Bitcoin looking to the $125,000 level, followed by the $130,000 level. Ultimately, I do think that happens, but we have to see whether or not we get a sustainable bounce that people can believe in. It would not surprise me at all to see a little bit further downward pressure, but I think the market breaking down below the $110,000 level seems to be very unlikely in this environment. After all, Bitcoin is extraordinarily bullish, and has been most of the year with the exception of a couple of months where we worked off some of the excess froth.

Ready to trade Bitcoin forecasts & predictions? We’ve shortlisted the best MT4 crypto brokers in the industry for you.