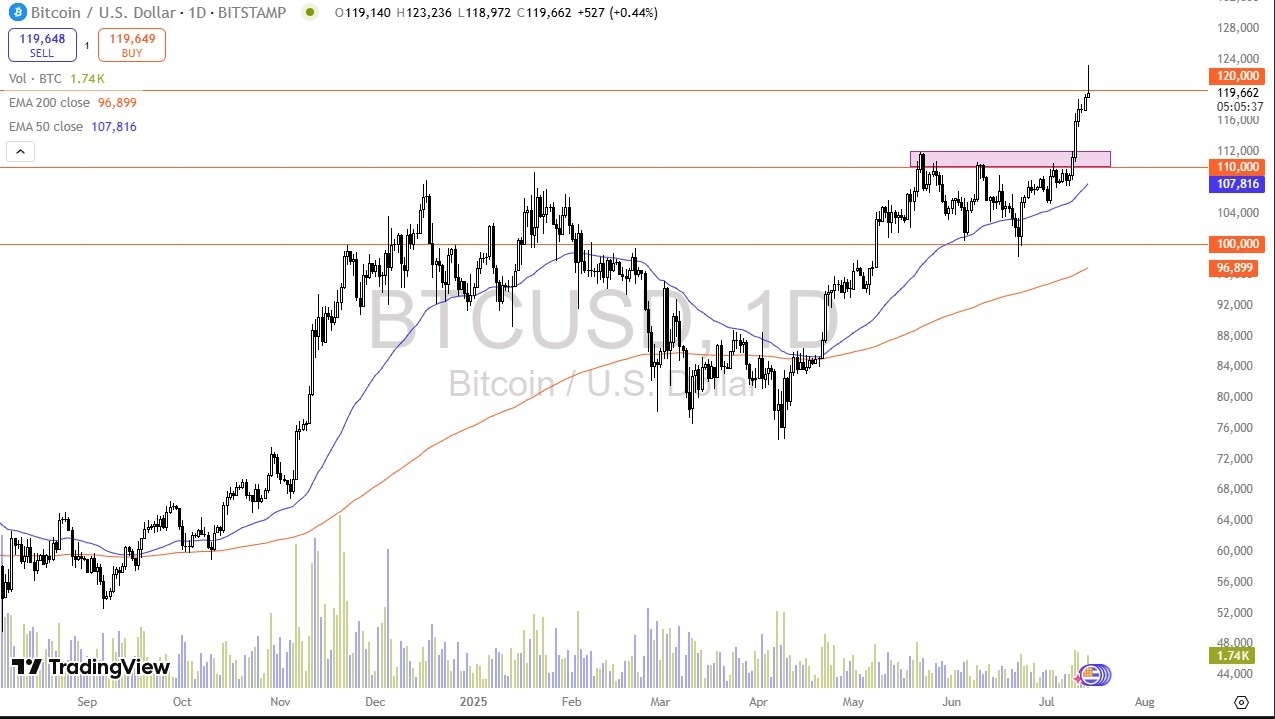

- The Bitcoin market initially rallied pretty significantly during the trading session here on Monday but has given back the gains above the $120,000 level.

- This has formed a very ugly shooting star and the question at this point in time, we'll to see whether or not we can continue.

- I think a short-term pullback is a nice buying opportunity to reach towards the previous explosion to the upside.

And that being said, I don't look at this as a market that I would want to get short. And I believe that there will be a lot of support near the $112,000 level followed by the $110,000 level. The 50 day EMA is reaching toward the $110,000 level. And therefore, I think you've got a situation where any $10,000 pullback for me at least, is an opportunity that has to be taken advantage of. If we can break above the top of the shooting star from the trading session here on Monday, then it opens up a move to the $125,000 level, possibly even $130,000. But I think we've gotten a little bit ahead of ourselves. So, a short-term pullback, I think, does a lot of good for Bitcoin.

The $110,000 Level Will Continue to Be Important

I think the market had been arguing about the efficacy of the $110,000 level as resistance for a while. And now that we have broken out, broken above there, then a short-term pullback, I think, will have people interested in buying Bitcoin. And with that being the case, I think you've got a situation where eventually you will see a drop and then a bounce.

On that bounce, that's when I enter Bitcoin to take advantage of the longer term uptrend that is most clearly still here. Again, if we break above the top of the shooting star, then it opens up the possibility of a move to $130,000. But I prefer pullback. I think it's more sustainable at this point for buyers.

Ready to trade Bitcoin forecasts & predictions? We’ve shortlisted the best MT4 crypto brokers in the industry for you.