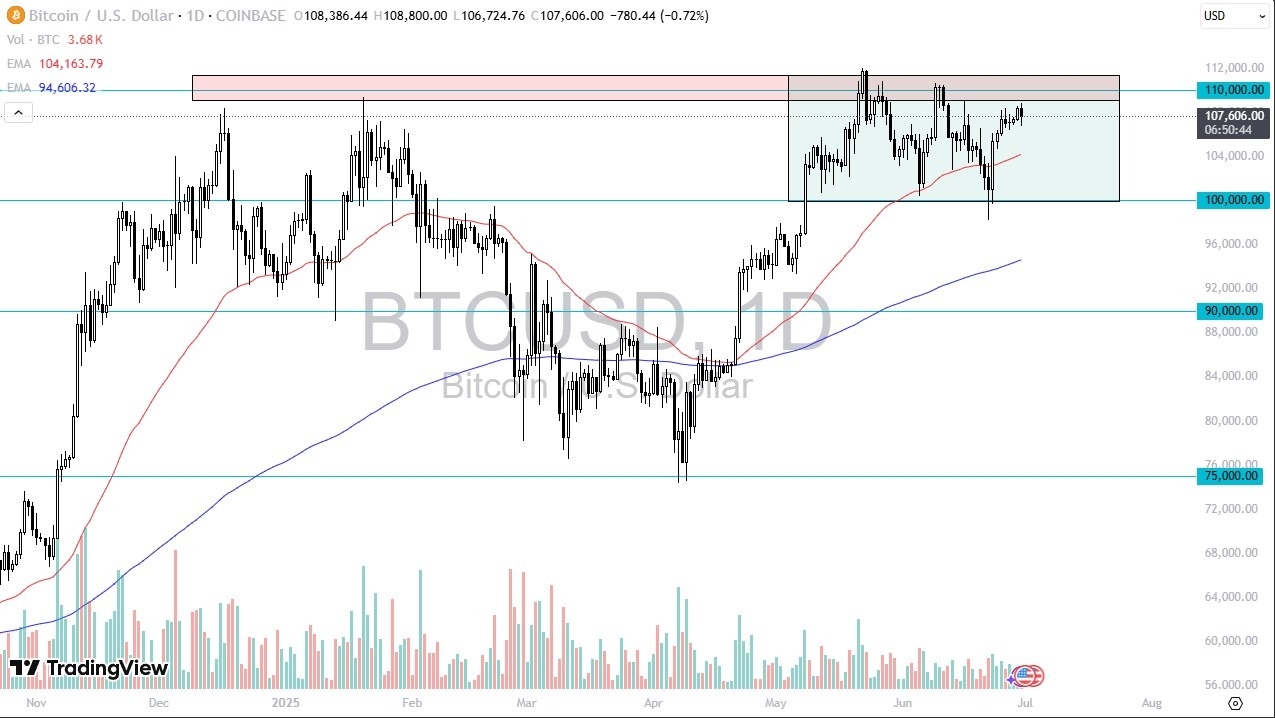

- Bitcoin is clearly bullish over the longer term, but really at this point in time, I think what we need to pay the most attention to is the $110,000 level that I think extends to the $112,000 level.

- If we can break above that, then I think we could go looking at the $120,000 level given enough time.

Short-term pullbacks, I think at this point probably continue to attract a certain amount of attention as well. And of course, we have the 50 day EMA hanging around the 104,000 level that could offer support. Anything below opens up the possibility of a move down to the $100,000 level, but right now I don't think that is as likely as a potential breakout to the upside.

Top Forex Brokers

The “Measured Move.”

Ultimately, the measured move, like over the last two months or so, opens up the possibility of a move to the $120,000 level, possibly even a little higher than that. So, I do not like the idea of shorting this market. I do believe that when we do break out, we genuinely will go much higher, and I also think it will drag the rest of crypto right along with it. The US dollar is shrinking a bit, but at the end of the day, it’s not exactly falling apart. So that's not helping Bitcoin either. It seems to be very specific areas where you see a lot of US dollar weakness.

So that may not be as big of a driver as people may have wanted. Now we have a situation where we're just hanging out and trying to figure out what the next catalyst is. That's the problem with Bitcoin. It will make massive moves and then put you to sleep for months on end. So I think at this point in time, short-term pullbacks probably offer accumulation potential.

Ready to trade Bitcoin forecasts & predictions? We’ve shortlisted the best MT4 crypto brokers in the industry for you.